Concept explainers

Renslen, Inc., a truck manufacturing conglomerate, has recently purchased two divisions: Meyers Service Company and Wellington Products, Inc. Meyers provides maintenance service on large truck cabs for 10-wheeler trucks, and Wellington produces air brakes for the 10-wheeler trucks.

The employees at Meyers take pride in their work, as Meyers is proclaimed to offer the best maintenance service in the trucking industry. The management of Meyers, as a group, has received additional compensation from a 10 percent bonus pool based on income before income taxes and bonus. Renslen plans to continue to compensate the Meyers management team on this basis as it is the same incentive plan used for all other Renslen divisions, except for the Wellington division.

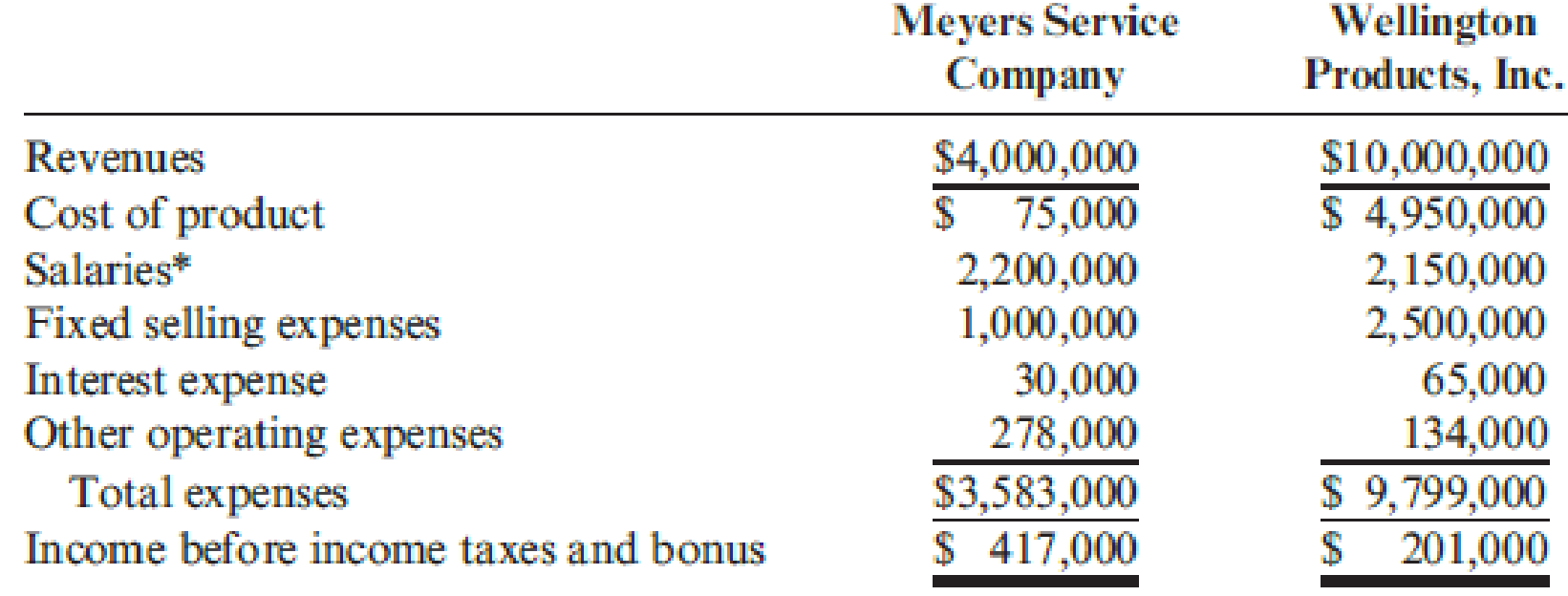

Wellington offers a high-quality product to the trucking industry and is the premium choice even when compared to foreign competition. The management team at Wellington strives for zero defects and minimal scrap costs; current scrap levels are at 2 percent. The incentive compensation plan for Wellington management has been a 1 percent bonus based on gross margin. Renslen plans to continue to compensate the Wellington management team on this basis. The following condensed income statements are for both divisions for the fiscal year ended May 31, 20x1:

Renslen, Inc. Divisional Income Statements For the Year Ended May 31, 20x1

*Each division has $1,000,000 of management salary expense that is eligible for the bonus pool.

Renslen has invited the management teams of all its divisions to an off-site management workshop in July where the bonus checks will be presented. Renslen is concerned that the different bonus plans at the two divisions may cause some heated discussion.

Required:

- 1. Determine the 20x1 bonus pool available for the management team at:

- a. Meyers Service Company

- b. Wellington Products, Inc.

- 2. Identify at least two advantages and disadvantages to Renslen, Inc., of the bonus pool incentive plan at:

- a. Meyers Service Company

- b. Wellington Products, Inc.

- 3. Having two different types of incentive plans for two operating divisions of the same corporation can create problems.

- a. Discuss the behavioral problems that could arise within management for Meyers Service Company and Wellington Products, Inc., by having different types of incentive plans.

- b. Present arguments that Renslen, Inc., can give to the management teams of both Meyers and Wellington to justify having two different incentive plans.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

- The standard materials cost to produce 1 unit of Product Z is 5 pounds of material at a standard price of $38 per pound. In manufacturing 7,500 units, 36,800 pounds of material were used at a cost of $39 per pound. What is the total direct materials cost variance? A. $8,600 favorable B. $37,800 favorable C. $29,200 unfavorable D. $10,200 unfavorable E. $37,800 unfavorablearrow_forwardCompute the direct material price variance for June.arrow_forwardWhat is your firm's cash conversion cycle ?arrow_forward

- Anderson Inc. has decided to use the high-low method to estimate total costs and determine the fixed and variable cost components. The data for various levels of production are as follows: When 6,500 units were produced, the total cost was $420,000. When 2,500 units were produced, the total cost was $250,000. (a) Determine the variable cost per unit and the total fixed cost. Variable cost per unit: Total fixed cost: (b) Estimate the total cost for producing 3,200 units. Total cost for 3,200 units:arrow_forwardwhich of the following correct option account questionsarrow_forwardHenderson Manufacturing produces a product with the following standard costs: Direct materials: 3.5 liters per unit at $9.00 per liter Direct labor: 0.6 hours per unit at $18.50 per hour Variable overhead: 0.6 hours per unit at $6.50 per hour The company produced 3,800 units in June, using 13,600 liters of direct material and 2,320 direct labor hours. During the month, the company purchased 14,000 liters of direct material at $9.20 per liter. The actual direct labor rate was $18.80 per hour, and the actual variable overhead rate was $6.50 per hour. The company applies variable overhead on the basis of direct labor hours. The direct materials purchase variance is computed at the time of purchase. Compute the materials quantity variance for June.arrow_forward

- Calculate gross profit and the gross profit ratio for the year.arrow_forwardViolet has received a special order for 150 units of its product. The product normally sells for $2,500 and has the following manufacturing costs: • Direct materials: $700 • Direct labor: $360 • Variable manufacturing overhead: $460 • Fixed manufacturing overhead: $720 • Total unit cost: $2,240 Assume that Violet has sufficient capacity to fill the order without impacting normal production and sales. What minimum price should Violet charge to achieve a $25,500 incremental profit? A. $1,600 B. $1,860 C. $1,720 D. $1,580arrow_forwardYour boss at LK Enterprises asks you to compute the company's cash conversion cycle. Looking at the financial statements, you see that the average inventory for the year was $135,500, accounts receivable were $102,400, and accounts payable were at $121,700. You also see that the company had sales of $356,000 and that cost of goods sold was $298,500. What is your firm's cash conversion cycle? Round to the nearest day.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning