Concept explainers

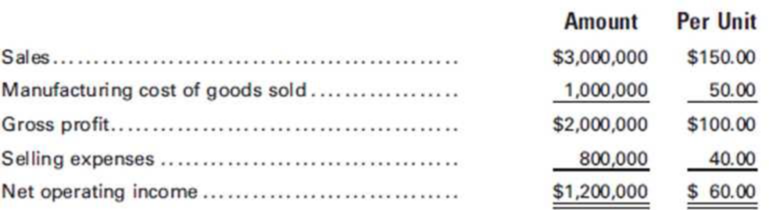

Deuce Sporting Goods manufactures a high-end model tennis racket. The company’s

Fixed costs included in the forecasted income statement are $400,000 in

A new client placed a special order with Deuce, offering to buy 1,000 tennis rackets for $100.00 each. The company will incur no additional selling expenses if it accepts the special order. Assuming that Deuce has sufficient capacity to manufacture 1,000 more tennis rackets, by what amount would differential income increase (decrease) as a result of accepting the special order? (Hint: First compute the variable cost per unit relevant to this decision.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

PRINCIPLES OF COST ACCOUNTING

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardCan you solve this financial accounting problem using appropriate financial principles?arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

- I am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forwardPlease provide the correct answer to this financial accounting problem using valid calculations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Siemens Technology produces ergonomic keyboards for $75.00 per unit. The variable cost per unit is $27.00. Each keyboard requires 4 direct labor hours and 6 machine hours to produce. Which of the following is the correct contribution margin per machine hour? a) $8.00 b) $12.00 c) $19.00 d) $48.00 e) None of these.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning