Effects of Changes in Sales, Expenses, and Assets on ROI

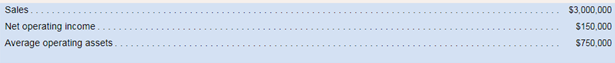

CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below:

Required:

Consider each question below independently. Carry out all computations to two decimal places.

1. Compute the company's

2. The entrepreneur who founded the company is convinced that sales will increase next year by 50% and that net operating income will increase by 200%, with no increase in average operating assets. What would be the company's ROI?

3. The chief financial officer of the company believes a more realistic scenario would be a 10,000,000 increase in sales, requiring a $250,000 increase in average operating assets, with a resulting $200,000 increase in net operating income. What would be the company's ROI in this scenario?

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Loose Leaf For Introduction To Managerial Accounting

- Cost per unit under absorption costingarrow_forwardWhat amount of goodwill is recorded for this financial accounting question?arrow_forwardA company manufactures custom furniture and uses a process costing system. During the month of September, the company started production on 550 units and completed 440 units. The remaining 100 units were 57% complete in terms of materials and 43% complete in terms of labor and overhead. The total cost incurred during the month for materials was $33,200, and the cost for labor and overhead was $24,800. Using the weighted-average method, what is the equivalent unit cost for materials and conversion costs (labor and overhead)?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning