Evaluate divisional performance (Learning Objective 3)

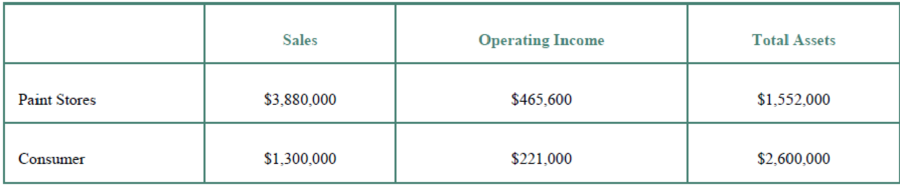

Sacramento Paints is a national paint manufacturer and retailer. The company is segmented into five divisions: Paint Stores (branded retail locations), Consumer (paint sold through stores like Sears, Home Depot, and Lowe’s), Automotive (sales to auto manufacturers), International, and Administration. The following is selected hypothetical divisional information for its two largest divisions: Paint Stores and Consumer (in thousands of dollars).

Assume that management has specified a 21% target

Requirements

Round all calculations to four decimal places.

- 1. Calculate each division’s

ROI . - 2. Calculate each division’s sales margin. Interpret your results.

- 3. Calculate each division’s capital turnover. Interpret your results.

- 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results.

- 5. Calculate each division’s RI. Interpret your results and offer recommendations for any division with negative RI.

- 6. Total asset data were provided in this problem. If you were to gather this information from an annual report, how would you measure total assets? Describe your measurement choices and some of the pros and cons of those choices.

- 7. Describe some of the factors that management considers when setting its minimum target rate of return.

- 8. Explain why some firms prefer to use RI rather than ROI for performance measurement.

- 9. Explain why budget versus actual performance reports are insufficient for evaluating the performance of investment centers.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting, Student Value Edition (5th Edition)

Additional Business Textbook Solutions

FUNDAMENTALS OF CORPORATE FINANCE

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Principles of Microeconomics (MindTap Course List)

Intermediate Accounting (2nd Edition)

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Horngren's Accounting (12th Edition)

- Please solve this question answer financial Accounting questionarrow_forwardHelparrow_forwardConsider the information below regarding the cost of goods sold for Company L. Calculate the amount of Ending inventory. Beginning inventory $ 162 Purchases 1,456 Net purchases 1,402 Cost of goods purchased 1,658 Cost of goods available for sale 1,820 Cost of goods sold 1,658arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning