1.

Arrange the asset, liability and equity titles in a table.

1.

Explanation of Solution

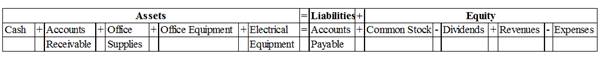

The arrangement of asset, liability and equity titles is as follows:

Figure (1)

2.

Create the table showing the effects of each transaction using

2.

Explanation of Solution

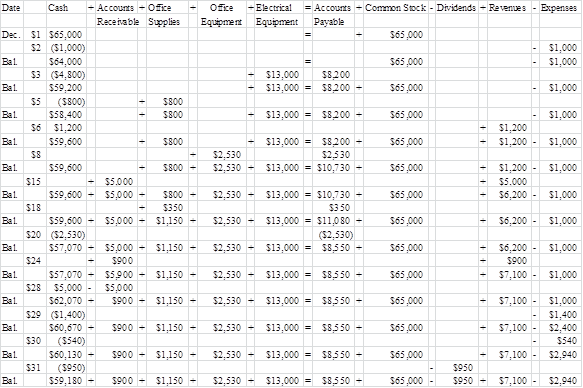

The effects of each transaction on the accounts of accounting equation are given bellow:

Figure (2)

3.

Prepare the income statement, statement of

3.

Explanation of Solution

Income statement: Income statement is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Statement of retained earnings: Statement of retained earnings is an equity statement which shows the changes in the

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities. Operating activities include cash inflows and outflows from business operations. Investing activities includes cash inflows and

Prepare income statement:

| Company S | ||

| Income Statement | ||

| For Month Ended December 31 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | ||

| Electrical fees earned | 7,100 | |

| Expenses | ||

| Rent expense | 1,000 | |

| Salaries expense | 1,400 | |

| Utilities expense | 540 | |

| Total expenses | 2,940 | |

| Net income | 4,160 | |

Table (1)

Prepare statement of retained earnings:

| Company S | |

| Statement of Retained Earnings | |

| For Month Ended December 31 | |

| Particulars | Amount ($) |

| Retained earnings, December 1 | 0 |

| Add: | 4,160 |

| Net income | 4,160 |

| Less: | |

| Dividends | 950 |

| Retained earnings, December 31 | 3,210 |

Table (2)

Prepare balance sheet:

| Company S | |||

| Balance Sheet | |||

| For the year ended December 31,2017 | |||

| Assets | Amount ($) | Liabilities | Amount ($) |

| Cash | 59,180 | Accounts payable | 8,550 |

| 900 | Equity | ||

| Office supplies | 1,150 | Common stock | 65,000 |

| Office equipment | 2,530 | Retained earnings | 3,210 |

| Electrical equipment | 13,000 | Total equity | 68,210 |

| Total assets | 76,760 | Total liabilities and equity | 76,760 |

Table (3)

Prepare statement of cash flows:

| Company S | ||

| Statement of Cash Flows | ||

| For Month Ended December 31 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from operating activities | ||

| Cash received from customers (1) | 6,200 | |

| Cash paid for rent | (1,000) | |

| Cash paid for supplies | (800) | |

| Cash paid for utilities | (540) | |

| Cash paid to employees | (1,400) | |

| Net cash provided by operating activities | 2,460 | |

| Cash flows from investing activities | ||

| Cash paid for office equipment | (2,530) | |

| Cash paid for electrical equipment | (4,800) | |

| Net cash used by investing activities | (7,330) | |

| Cash flows from financing activities | ||

| Cash investment from shareholder | 65,000 | |

| Cash dividend to shareholder | (950) | |

| Net cash provided by financing activities | 64,050 | |

| Net increase in cash | 59,180 | |

| Cash balance, December 1 | 0 | |

| Cash balance, December 31 | 59,180 | |

Table (4)

Working note:

Calculate the cash received from customers:

4.

Explain the effect of change on total assets, total liabilities and total equity.

4.

Explanation of Solution

If the investment of cash on December 1 is $49,000 instead of $65,000 and if the difference of $16,000 was borrowed from bank by the Company, then following is the effect of this change:

(a) Total assets remain the same.

(b) Total liabilities will be $16,000 greater.

(c) Total equity will be $16,000 lower (due to less investment of owner).

Want to see more full solutions like this?

Chapter 1 Solutions

FINANCIAL ACCOUNTING ACCT 2301 >IC<

- in the first day of a company’s fiscal year, it has paid for and installed a machine for servicing vehicle engines at one of its outlets. The machine costs $40,000. Its annual cash operating costs total $30,000. The machine will have a four-year useful life and a zero terminal disposal value. After the machine has been used for only one day, a consultant offers a different machine that promises to do the same job at annual cash operating costs of $18,000. The new machine will cost $48,000 cash, installed. The original machine is unique and can be sold outright for $20,000, minus $4,000 removal cost. The new machine, like the old one, will have a four-year useful life and zero terminal disposal value. Revenues, all in cash, will be $300,000 annually, and other cash costs will be $220,000 annually, regardless of this decision. . Is there any conflict between the decision model and the incentives of the manager who hasjust purchased the original (old) machine and is considering replacing…arrow_forwardFinancial Accountingarrow_forwardHorizon Industries paid $320 in dividends and $450 in interest this past year. Common stock increased by $180, and retained earnings increased by $280. What is the net income for the year? a) $320 b) $450 c) $500 d) $600 e) $730arrow_forward

- During its first year, Cypress Manufacturing, Inc., showed a $40 per unit profit under absorption costing but would have reported a total profit of $15,600 less under variable costing. If production exceeded sales by 650 units and an average contribution margin of 75% was maintained, what is apparent? a) Fixed cost per unit? b) Sales price per unit?arrow_forwardCan you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forwardGeneral accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education