1.

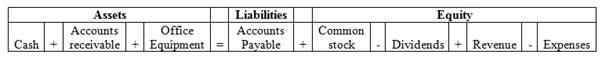

Arrange the asset, liability and equity titles in a table.

1.

Explanation of Solution

Figure (1)

2.

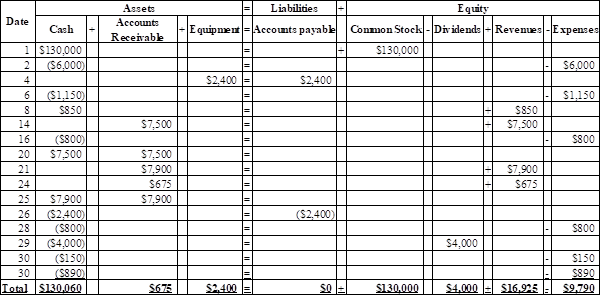

Show the effects of the transactions on the accounts of the

2.

Explanation of Solution

The effects of each transaction on the accounts of accounting equation are given bellow:

Figure (2)

3.

Prepare the income statement, the statement of

3.

Explanation of Solution

Income statement: Income statement is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Statement of retained earnings: Statement of retained earnings is an equity statement which shows the changes in the

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities. Operating activities include

Prepare income statement:

| Company N | ||

| Income Statement | ||

| For Month Ended June 30 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | ||

| Consulting services revenue | 16,925 | |

| Expenses | ||

| Rent expense | 6,000 | |

| Salaries expense | 1,600 | |

| Advertising expense | 1,150 | |

| Utilities expense | 890 | |

| Telephone expense | 150 | |

| Total expenses | 9,790 | |

| Net income | 7,135 | |

Table (1)

Prepare statement of retained earnings:

| Company N | |

| Statement of Retained Earnings | |

| For Month Ended June 30 | |

| Particulars | Amount ($) |

| Retained earnings, 1 | 0 |

| Add: | |

| Net income | 7,135 |

| Less: | |

| Dividends | 4,000 |

| Retained earnings, June 30 | 3,135 |

Table (2)

Prepare balance sheet:

| Company N | |||

| Balance Sheet | |||

| For the month ended June 30 | |||

| Assets | Amount ($) | Liabilities | Amount ($) |

| Cash | 130,060 | Accounts payable | 0 |

| Office equipment | 675 | Equity | |

| Common stock | 130,000 | ||

| Retained earnings | 3,135 | ||

| Total equity | 133,135 | ||

| Total assets | $133,135 | Total liabilities and equity | 133,135 |

Table (3)

Prepare statement of cash flows:

| Company N | ||

| Statement of Cash Flows | ||

| For Month Ended June 30 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from operating activities | ||

| Cash received from customers (1) | 16,250 | |

| Cash paid for rent | (6,000) | |

| Cash paid for advertising | (1,150) | |

| Cash paid for telephone | (150) | |

| Cash paid for utilities | (890) | |

| Cash paid to employees | (1,600) | |

| Net cash provided by operating activities | 6,460 | |

| Cash flows from investing activities | ||

| Cash paid for equipment | (2,400) | |

| Net cash used by investing activities | (2,400) | |

| Cash flows from financing activities | ||

| Cash investments from stockholder | 130,000 | |

| Cash dividends to stockholder | (4,000) | |

| Net cash provided by financing activities | 126,000 | |

| Net increase in cash | 130,060 | |

| Cash balance, June 1 | 0 | |

| Cash balance, June 30 | 130,060 | |

Table (4)

Working note:

Calculate the cash received from customers:

Want to see more full solutions like this?

Chapter 1 Solutions

FINANCIAL ACCOUNTING ACCT 2301 >IC<

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help with this financial accounting question using standard accounting techniques.arrow_forward

- I need help with this general accounting question using standard accounting techniques.arrow_forwardI am trying to find the accurate solution to this financial accounting problem with the correct explanation.arrow_forwardPlease help me solve this financial accounting question using the right financial principles.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education