Concept explainers

1.

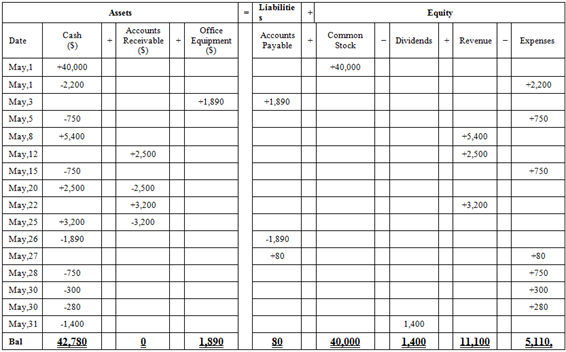

To identify: The effect of given transactions on the

1.

Explanation of Solution

Table (1)

Hence, the cash balance is $42,780, office equipment is $1,890, accounts payable is $80, common stock is $40,000, dividend is $1,400, revenue is $11,100 and expenses is $5,110.

2.

To prepare: The income statement, statement of

2.

Explanation of Solution

Prepare income statement.

| G. Company | ||

| Income Statement | ||

| For the month ended May 31,20XX | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Service Revenue | 11,100 | |

| Total Revenue | 11,100 | |

| Expenses: | ||

| Advertising Expenses | 80 | |

| Cleaning Expenses | 750 | |

| Rent Expenses | 2200 | |

| Salary Expenses | 1,500 | |

| Telephone Expenses | 300 | |

| Utilities Expenses | 280 | |

| Total Expense | 5,110 | |

| Net income | 5,990 | |

Table(2)

Hence, net income of .G Company as on May 31, 20XX is $5,990.

Prepare statement of retained earnings.

| G. Company | |

| Retained Earnings Statement | |

| For the month ended May 31,20XX | |

| Particulars | Amount ($) |

| Opening balance | 0 |

| Net income | 5,990 |

| Total | 5,990 |

| Dividends | (1,400) |

| Retained earnings | 4,590 |

Table(3)

Hence, the retained earnings of G Company as on May 31, 20XX are $4,590.

Prepare balance sheet.

| G. Company | ||

| Balance Sheet | ||

| As on May 31, 20XX | ||

| Particulars |

| Amount ($) |

| Assets | ||

| Cash | 42,780 | |

| Equipment | 1,890 | |

| Total assets |

| 44,670 |

| Liabilities and | ||

| Liabilities | ||

| Accounts payable | 80 | |

| Stockholder’s equity | ||

| Common stock | 40,000 | |

| Retained earnings | 4,590 | |

| Total stockholders’ equity |

| 44,590 |

| Total Liabilities and Stockholder’s equity |

| 44,670 |

Table(4)

Hence, the total of the balance sheet of the G Company as on May 31, 20XX is of $44,670.

3.

To prepare: The statement of

3.

Explanation of Solution

Prepare the cash flow statement.

| G. Company | ||

| Statement of Cash Flows | ||

| Month Ended May 31, 20XX | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flow from operating activities | ||

| Receipts: | ||

| Collections from customers |

| 11,100 |

| Payments: |

| |

| Cleaning Expenses | (750) | |

| Rent Expenses | (2200) | |

| Salary Expenses | (1,500) | |

| Telephone Expenses | (300) | |

| Utilities | (280) | (5,030) |

| Net cash from operating activities |

| 6,070 |

| Cash flow from investing activities |

| |

| Purchase of equipment | (1,890) | |

| Net cash from investing activities |

| (1,890) |

| Cash flow from financing activities |

| |

| Issued common stock | 40,000 | |

| Less: Payment of cash dividends | (1,400) | |

| Net cash from financing activities |

| 38,600 |

| Net increase in cash |

| 42,780 |

| Cash balance, May 1,20XX |

| 0 |

| Cash balance, May 31,20XX |

| 42,780 |

Table(5)

Hence, the cash balance of the G Company as on May 31, 20XX is $42,780.

Want to see more full solutions like this?

Chapter 1 Solutions

GEN COMBO LOOSELEAF FINANCIAL AND MANAGERIAL ACCOUNTING; CONNECT ACCESS CARD

- Selected comparative financial statements of Korbin Company follow. Sales KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 $ 512,008 $ 392,240 2019 $ 272,200 Cost of goods sold 308,229 245,542 174,208 Gross profit 203,779 146,698 97,992 Selling expenses 72,705 54,129 35,930 Administrative expenses 46,081 34,517 22,593 Total expenses 118,786 88,646 58,523 Income before taxes .84,993 58,052 39,469 Income tax expense 15,809 11,901 8,012 Net income $ 69,184 $ 46,151 $ 31,457 KORBIN COMPANY Comparative Balance Sheets Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings December 31 2021 2020 2019 $ 54,370 0 $ 36,390 600 $ 48,645 3,870 99,436 90,776 53,339 Total liabilities and equity $ 153,806 $ 127,766 $ 105,854 $ 22,456 $ 19,037 $ 18,524 68,000 68,000 50,000 8,500 8,500 5,556 54,850 32,229 31,774 $ 153,806 $ 127,766 $ 105,854arrow_forwardprovide correct answer mearrow_forwardgeneral accountingarrow_forward

- E3-17 (Algo) Calculating Equivalent Units, Unit Costs, and Cost Assigned (Weighted-Average Method) [LO 3-2] Vista Vacuum Company has the following production Information for the month of March. All materials are added at the beginning of the manufacturing process. Units . • Beginning Inventory of 3,500 units that are 100 percent complete for materials and 28 percent complete for conversion. 14,600 units started during the period. Ending Inventory of 4,200 units that are 14 percent complete for conversion. Manufacturing Costs Beginning Inventory was $20,500 ($10,100 materials and $10,400 conversion costs). Costs added during the month were $28,400 for materials and $51,500 for conversion ($26.700 labor and $24,800 applied overhead). Assume the company uses Weighted-Average Method. Required: 1. Calculate the number of equivalent units of production for materials and conversion for March. 2. Calculate the cost per equivalent unit for materials and conversion for March. 3. Determine the…arrow_forwardNonearrow_forwardAccounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education