Exercise 1-6 Effect of transactions on general ledger accounts

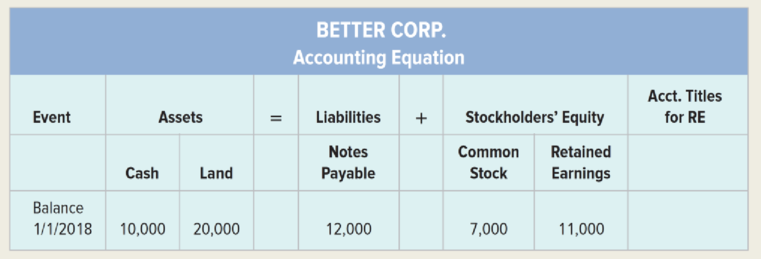

At the beginning of 2018, Better Corp.’s accounting records had the following general ledger accounts and balances:

Better Corp. completed the following transactions during 2018:

1. Purchased land for $5,000 cash.

2. Acquired $25,000 cash from the issue of common stock.

3. Received $75,000 cash for providing services to customers.

4. Paid cash operating expenses of $42,000.

5. Borrowed $10,000 cash from the bank.

6. Paid a $5,000 cash dividend to the stockholders.

7. Determined that the market value of the land purchased in event 1 is $35,000.

Required

a. Record the transactions in the appropriate general ledger accounts. Record the amounts of revenue, expense, and dividends in the

b. As of December 31, 2018, determine the total amount of assets, liabilities, and stockholders’ equity and present this information in the form of an

c. What is the amount of total assets, liabilities, and stockholders’ equity as of January 1, 2019?

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Survey Of Accounting

- I am looking for a reliable way to solve this financial accounting problem using accurate principles.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardCan you solve this financial accounting problem using appropriate financial principles?arrow_forward

- I am looking for help with this financial accounting question using proper accounting standards.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardI am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forward

- Accounting?arrow_forwardWipro Plastics uses the weighted-average method in its process costing system. Department A had 4,000 units in beginning work-in-process (60% complete for conversion costs), started 16,000 new units during the period, and transferred 18,000 completed units to Department B. If the ending work-in-process in Department A was 2,000 units (30% complete for conversion costs), what are the equivalent units for conversion costs for the period?arrow_forwardOn January 1, 2018, Sycamore International reports net assets of $1,245,000, although machinery (with an eight-year life) having a book value of $720,000 is worth $840,000 and an unrecorded trademark is valued at $75,600. Teton Group pays $1,140,000 on that date for a 90 percent ownership in Sycamore. If the trademark is to be written off over a 15-year period, at what amount should it be reported on the consolidated statements on December 31, 2020?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning