Concept explainers

a.

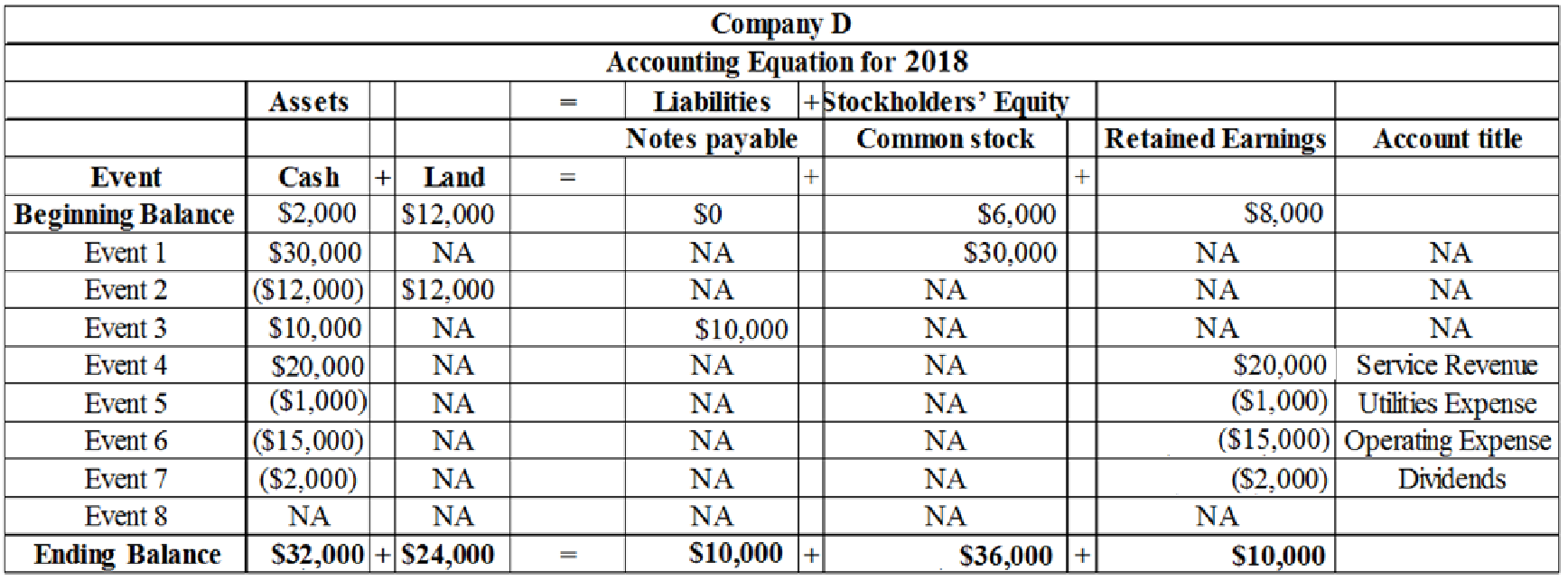

Record the eight events in the

a.

Explanation of Solution

The eight events are recorded using

Table (1)

b.

Prepare an income statement, statement of changes in equity, year-end

b.

Explanation of Solution

Income statement: Income statement is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Income statement for the Year 2018 is prepared as follows:

| Company D | |

| Income Statement | |

| For the Year Ended December 31, 2018 | |

| Particulars | Amount ($) |

| Service Revenue | $20,000 |

| Utilities Expense | (1,000) |

| Operating Expense | ($15,000) |

| Net Income | 4,000 |

Table (2)

Statement of changes in stockholders' equity: Statement of changes in stockholders' equity records the changes in the

Statement of changes in equity for the Year 2018 is prepared is as follows:

| Company D | ||

| Statement of Changes in Stockholders’ Equity | ||

| For the Year Ended December 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Beginning Common Stock | 6,000 | |

| Add: Common Stock Issued | 30,000 | |

| Ending Common Stock | 36,000 | |

| Beginning | 8,000 | |

| Add: Net Income | 4,000 | |

| Less: Dividends | (2,000) | |

| Ending Retained Earnings | 10,000 | |

| Total Stockholders’ Equity | $46,000 | |

Table (3)

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Balance sheet for the Year 2018 is prepared as follows:

| Company D | ||

| Balance Sheet | ||

| As of December 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets: | ||

| Cash | 32,000 | |

| Land | 24,000 | |

| Total Assets | $56,000 | |

| Liabilities: | ||

| Notes Payable | 10,000 | |

| Total Liabilities | 10,000 | |

| Stockholders’ Equity: | ||

| Common Stock | 36,000 | |

| Retained Earnings | 10,000 | |

| Total Stockholders’ Equity | 46,000 | |

| Total Liabilities and Stockholders’ Equity | $56,000 | |

Table (4)

Statement of cash flows: Statement of cash flows is one among the financial statement of a Company statement that shows aggregate data of all

Statement of cash flows for the Year 2018 is prepared as follows:

| Company D | ||

| Statement of Cash Flows | ||

| For the Year Ended December 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash Flows From Operating Activities: | ||

| Cash Receipts from Customers | 20,000 | |

| Cash Payment for Utilities Expense | (1,000) | |

| Cash Payments for Other Operating Expense | (15,000) | |

| Net Cash Flow from Operating Activities | 4,000 | |

| Cash Flows From Investing Activities: | ||

| Cash Paid to Purchase Land | (12,000) | |

| Net Cash Flow from Investing Activities | (12,000) | |

| Cash Flows From Financing Activities: | ||

| Cash Receipts from Stock Issue | 30,000 | |

| Cash Receipts from Loan | 10,000 | |

| Cash Payments for Dividends | (2,000) | |

| Net Cash Flow from Financing Activities | 38,000 | |

| Net Increase in Cash | 30,000 | |

| Add: Beginning Cash Balance | 2,000 | |

| Ending Cash Balance | $32,000 | |

Table (5)

c.

Ascertain the percentage of assets provided by the retained earnings and find out the amount of cash in the retained earnings account.

c.

Explanation of Solution

Retained earnings: Retained earnings are the portion of earnings kept by the business for the purpose of reinvestments, payment of debts, or for future growth.

Calculate the percentage of assets provided by retained earnings:

Retained earnings are used to purchase assets or to pay liabilities and therefore, the amount of cash in the retained earnings accounts cannot be determined.

Therefore, the percentage of assets provided by retained earnings is 17.9%.

Want to see more full solutions like this?

Chapter 1 Solutions

Survey Of Accounting

- Blockbuster Co is building a new state of the art cineplex at a cost of $3,500,000.They received a capital investment of $1,500,000. The remainder of funds will haveto be borrowed so they decided to issue bonds. They have issued 10.5%, 5-yearbonds. These bonds were issued on January 1st, 2020, and pay semi-annual intereston July 1st and January 1st. The bonds yield 10%. The year end is December 31st Calculate the proceeds from the sale of the bond. Clearly show theamount of the premium or discount and state two reasons which supportthe premium or discount calculatedarrow_forwardGeneral accounting questionarrow_forwardNeed help with this question solution general accountingarrow_forward

- Blockbuster Co is building a new state of the art cineplex at a cost of $3,500,000.They received a capital investment of $1,500,000. The remainder of funds will haveto be borrowed so they decided to issue bonds. They have issued 10.5%, 5-yearbonds. These bonds were issued on January 1st, 2020, and pay semi-annual intereston July 1st and January 1st. The bonds yield 10%. The year end is December 31starrow_forwardHi expert please give me answer general accounting questionarrow_forwardGeneral Accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning