Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 4E

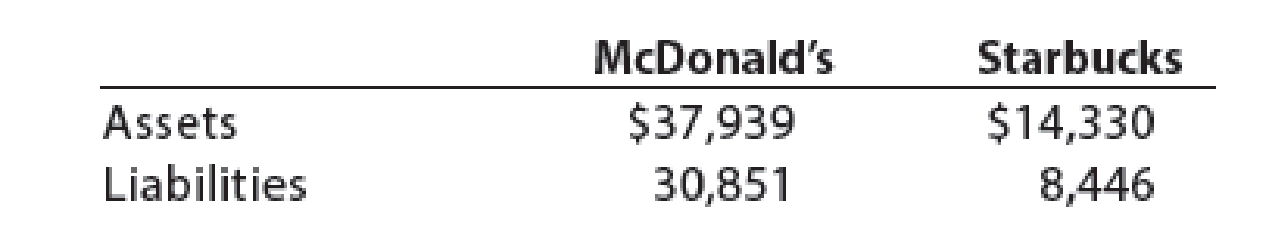

The total assets and total liabilities (in millions) of McDonald’s Corporation (MCD) and Star-bucks Corporation (SBUX) follow:

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The monthly cost (in dollars) of a data plan for Mercury Communications is a linear function of the total data usage (in gigabytes). The monthly cost for 25 gigabytes of data is $45.50 and the monthly cost for 40 gigabytes is $58.00. What is the monthly cost for 28 gigabytes of data? Help

How many hours worked during the year?

Financial Accounting

Chapter 1 Solutions

Financial And Managerial Accounting

Ch. 1 - Prob. 1DQCh. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - Josh Reilly is the owner of Dispatch Delivery...Ch. 1 - On July 12, Reliable Repair Service extended an...Ch. 1 - Prob. 6DQCh. 1 - Describe the difference between an account...Ch. 1 - A business had revenues of 679,000 and operating...Ch. 1 - A business had revenues of 640,000 and operating...Ch. 1 - The financial statements are interrelated. (A)...

Ch. 1 - Prob. 1BECh. 1 - Accounting equation Be-The-One is a motivational...Ch. 1 - Transactions Interstate Delivery Service is owned...Ch. 1 - Income statement The revenues and expenses of...Ch. 1 - Statement of stockholders equity Using the income...Ch. 1 - Balance sheet Using the following data for...Ch. 1 - Statement of cash flows A summary of cash flows...Ch. 1 - Ratio of liabilities to stockholders equity The...Ch. 1 - Prob. 1ECh. 1 - Prob. 2ECh. 1 - Prob. 3ECh. 1 - Accounting equation The total assets and total...Ch. 1 - Prob. 5ECh. 1 - Accounting equation Determine the missing amount...Ch. 1 - Accounting equation Inspirational Inc. is a...Ch. 1 - Asset, liability, and stockholders equity items...Ch. 1 - Effect of transactions on accounting equation What...Ch. 1 - Effect of transactions on accounting equation A. A...Ch. 1 - Effect of transactions on stockholders equity...Ch. 1 - Transactions The following selected transactions...Ch. 1 - Nature of transactions Teri West operates her own...Ch. 1 - Net income and dividends The income statement for...Ch. 1 - Net income and stockholders equity for four...Ch. 1 - Balance sheet items From the following list of...Ch. 1 - Income statement items Based on the data presented...Ch. 1 - Statement of stockholders equity Financial...Ch. 1 - Income statement Imaging Services was organized on...Ch. 1 - Prob. 20ECh. 1 - Balance sheets, net income Financial information...Ch. 1 - Financial statements Each of the following items...Ch. 1 - Statement of cash flows Indicate whether each of...Ch. 1 - Statement of cash flows A summary of cash flows...Ch. 1 - Financial statements We-Sell Realty was organized...Ch. 1 - Transactions On April 1 of the current year,...Ch. 1 - Financial statements The assets and liabilities of...Ch. 1 - Financial statements Seth Feye established...Ch. 1 - Transactions; financial statements On August 1,...Ch. 1 - Transactions; financial statements DLite Dry...Ch. 1 - Missing amounts from financial statements The...Ch. 1 - Transactions Amy Austin established an insurance...Ch. 1 - PR 1-2 B Financial statements The assets and...Ch. 1 - Financial statements 1. Net income: 10,900 Jose...Ch. 1 - Transactions; financial statements 2. Net income:...Ch. 1 - Transactions; financial statements Bevs Dry...Ch. 1 - Missing amounts from financial statements The...Ch. 1 - Peyton Smith enjoys listening to all types of...Ch. 1 - Prob. 1MADCh. 1 - Analyze The Home Depot for three years The Home...Ch. 1 - Analyze Lowes for three years Lowes Companies,...Ch. 1 - Compare The Home Depot and Lowes Using your...Ch. 1 - Compare Papa Johns and Yum! Brands The following...Ch. 1 - Prob. 1TIFCh. 1 - Prob. 2TIFCh. 1 - Prob. 4TIFCh. 1 - Prob. 5TIFCh. 1 - Prob. 6TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Do fast answer of this accounting questionsarrow_forwardRepsola is a drilling company that operates an offshore Oilfield in Feeland. Five years ago, Feeland had a major oil discovery and granted licenses to drill oil to reputable, experienced drilling companies. The licensing agreement requires the company to remove the oil rig at the end of production and restore the seabed. Ninety percent of the eventual costs of undertaking the work relate to the removal of the oil rig and restoration of damage caused by building it and ten percent arise through the extraction of the oil. At the Statement of Financial Position (SOFP) date (December 31 2025), the rig has been constructed but no oil has been extractedOn January 1st 2023, Repsola obtained the license to construct an oil rig at a cost of $500 million. Two years later the oil rig was completed. The rig is expected to be removed in 20 years from the date of acquisition. The estimated eventual cost is 100 million. The company’s cost of capital is 10% and its year end is December 31st. Repsola…arrow_forwardSolve this Accounting problemarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License