Missing amounts from financial statements

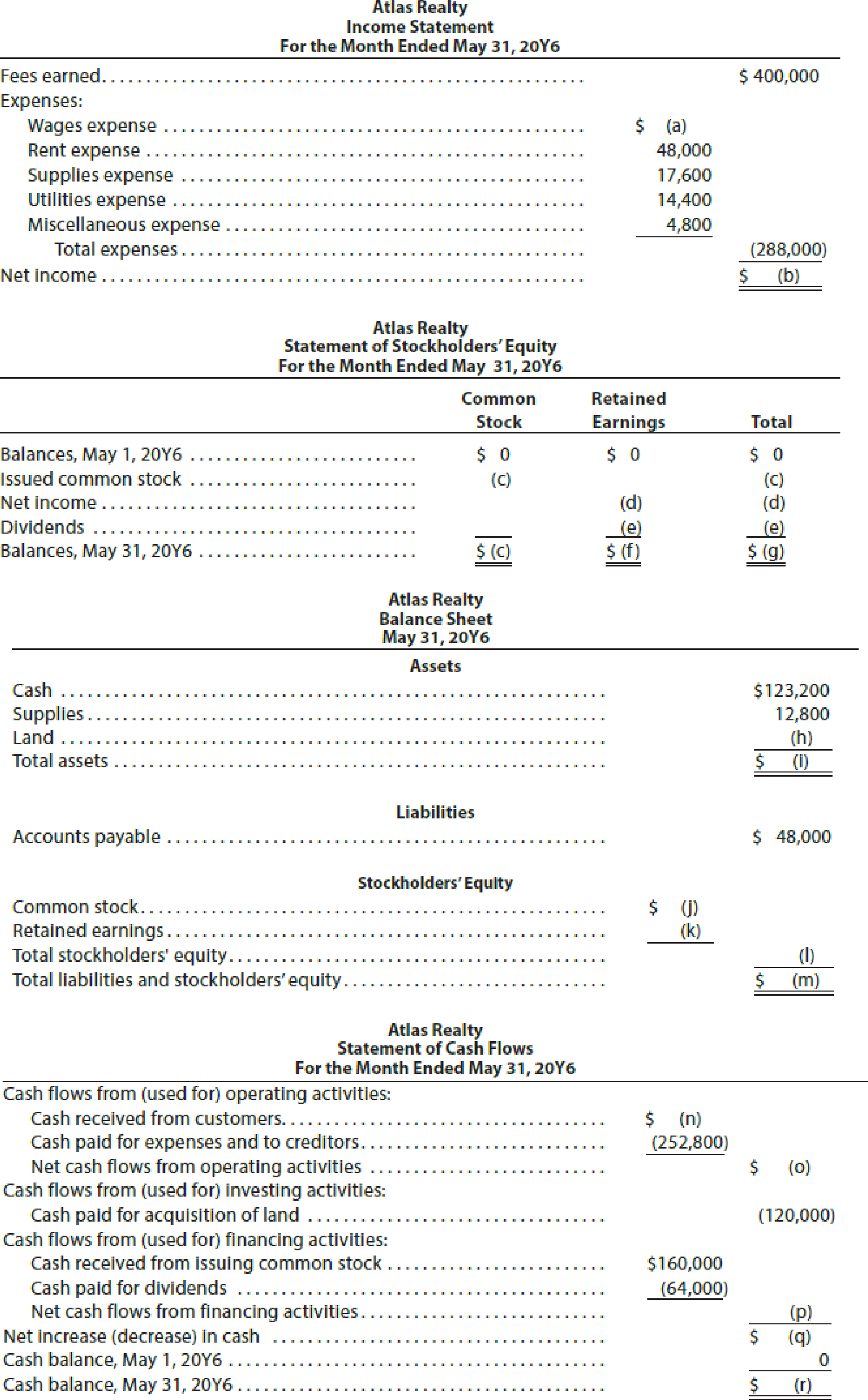

The financial statements at the end of Atlas Realty’s first month of operations follow:

Instructions

By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (r).

Calculate the amount of (a) through (r), analyzing the financial statements.

Explanation of Solution

Financial statements: Financial statements are condensed summary of transactions communicated in the form of reports for the purpose of decision making.

Calculate the amount of (a) through (r), analyzing the financial statements:

The financial statements of Company AR or month ended May 31, 20Y6, are given below:

| Company AR | ||

| Income Statement | ||

| For the month ended May 31, 20Y6 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | ||

| Fees earned | $400,000 | |

| Expenses | ||

| Wages expense | (a) $203,200 | |

| Rent expense | $48,000 | |

| Supplies expense | $17,600 | |

| Utilities expense | $14,400 | |

| Miscellaneous expense | $4,800 | |

| Total expenses | $288,000 | |

| Net income | (b) $112,000 | |

Table (1)

Hence the net income of Company AR for month ended May 31, 20Y6, is $112,000.

| Company AR | |||

| Statement of Stockholder's Equity | |||

| For the month ended May 31, 20Y6 | |||

| Particulars | Common Stock | Retained Earnings | Total |

| Balances, May 1, 20Y6 | $0 | $0 | $0 |

| Issued common stock | (c) $160,000 | (c) $160,000 | |

| Net income | (d) $112,000 | (d) $112,000 | |

| Dividends | (e) ($64,000) | (e) ($64,000) | |

| Balances, May 31, 20Y6 | (c) $ 160,000 | (f) $ 48,000 | (g) $ 208,000 |

Table (2)

Hence the stockholder's equity of Company AR for month ended May 31, 20Y6, is $208,000.

| Company AR | ||

| Balance Sheet | ||

| As on May 31, 20Y6 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Current Assets | ||

| Cash | $123,200 | |

| Supplies | $12,800 | |

| Land | (h) $120,000 | |

| Total current assets | (i) $256,000 | |

| Liabilities and Stockholders’ Equity | ||

| Liabilities | ||

| Accounts payable | $48,000 | |

| Stockholder's equity | ||

| Common Stock | (j) $160,000 | |

| Retained earnings | (k) $48,000 | |

| Total stockholders’ equity | (l) 208,000 | |

| Total liabilities and stockholders’ equity | (m) $256,000 | |

Table (3)

Hence the financial statement of Company AR shows the same asset and total liabilities and stockholder's equity balance of $256,000 for month ended May 31, 20Y6.

| Company AR | ||

| Statement of Cash Flows | ||

| For the month ended May 31, 20Y6 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Cash receipts from customers | (n) $400,000 | |

| Cash payments for expenses and creditors | $252,800 | |

| Net cash flow used for operating activities | (o) $147,200 | |

| Cash flows from investing activities: | ||

| Cash payment for purchase of land | $120,000 | |

| Cash flows from financing activities: | ||

| Cash receipt of owner’s investment | $160,000 | |

| Cash Withdrawals | $64,000 | |

| Net cash flow from financing activities | (p) $96,000 | |

| Net Increase (decrease) in cash | (q) $123,200 | |

| Cash balance, May 1, 20Y6 | $0 | |

| Cash balance, May 31, 20Y6 | (r) $123,200 | |

Table (4)

Hence the cash balance of Company AR on May 31, 20Y6, is $123,200.

Working Notes:

- a) Wages expense:

Calculate the wages expense.

Wages expense during the month of May is $203,200.

- b) Net income:

Calculate the net income.

Net income during the month of May is $112,000.

- c) Common Stock:

Common Stock of $160,000, shown in the statement of cash flow is transferred to balance sheet.

- d) Net income for May:

Net income is provided in the income statement is transferred to the statement of stockholder’s equity. Net income during the month of May is $112,000.

- e) Dividends:

Dividends of $64,000, provided in the statement of cash flow are transferred to the statement of retained earnings.

- f) Retained earnings, May 31, 20Y6:

Calculate increase in the retained earnings of Company AR.

The retained earnings on May 31, 20Y6 are $48,000.

- g) Stockholder's equity:

The Stockholder's equity of Company AR is $208,000.

- h) Land:

Land of $120,000, shown in the statement of cash flow is transferred to the balance sheet.

- i) Total Assets:

Calculate the total assets.

The sum of total assets is $256,000.

- j) Common Stock:

Common Stock of $160,000, shown in the statement of cash flow is transferred to balance sheet.

- k) Retained earnings:

Retained earnings of $48,000, calculated in the statement of retained earnings are transferred to the balance sheet.

- l) Total stockholders’ equity:

Calculate the total stockholder’s equity.

Total stockholder's equity is $208,000.

- m) Total liabilities and stockholders’ equity:

Calculate the total liabilities and stockholder’s equity.

The total liabilities and stockholder's equity is $256,000.

- n) Cash receipts from customers:

This includes all the income generated and received in the form of cash in the month of May, is $400,000 and it is transferred from income statement.

- o) Net cash flow used for operating activities:

Calculate the cash flow used for operating activities.

The cash flow used for operating activities in the month of May, is $147,200.

- p) Net cash flow from financing activities:

Calculate the net cash flow from financing activities.

The cash flow from financing activities in the month of May is $96,000.

- q) Net Increase in cash:

The net increase in cash balance is $123,200 and it is transferred from balance sheet.

- r) Cash balance, May 31, 20Y6:

Net Increase in cash, May 31, 20Y6 cash balance is $123,200 and it is transferred from balance sheet.

Want to see more full solutions like this?

Chapter 1 Solutions

Financial And Managerial Accounting

- I need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub