Concept explainers

Using the data Problem 1-2A and the inventory for Leone Company below, complete the requirements below. Assume income tax expenses is $233,725 for the year.

Required

- Prepare the company’s 2015 schedule of cost of goods manufactured.

- Prepare the company’s 2015 income statement that reports separate categories for (a) selling expenses and (b) general administrative expenses.

Analysis Component

Concept introduction:

Cost of goods manufactured Cost of goods manufactured, also known as cost of goods completed calculates the total value of inventory that was produced during the period and is ready for sale. It is the total amount of expenses incurred to turn work in process into finished goods. It includes total manufacturing costs including all direct materials, direct labor, factory overheads to the beginning work in process inventory and subtracting ending work in process inventory which can be seen below:

Requirement 1:

To calculate:

Schedule of Cost of goods manufactured for 2015.

Answer to Problem 3PSA

Cost of goods manufactured = $19, 35, 650

Explanation of Solution

To calculate cost of goods manufactured, following formula would be used:

To calculate Direct materials used, following formula would be used:

In the given problem, following information is given:

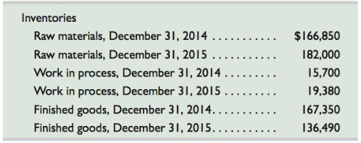

Beginning raw material = $1, 66, 850

Raw material purchases = $9, 25, 000

Ending raw material = $1, 82, 000

Further, following information is given in regard to Factory overheads:

Depreciation expense- Factory equipment = $33, 550

Factory supervision = $1, 02, 600

Factory supplies used = $7, 350

Factory utilities = $33, 000

Indirect labor = $56, 875

Miscellaneous production cost = $8, 425

Rent expense- Factory building = $76, 800

Maintenance expense- Factory building = $35, 400

Also, direct labor is given as $6, 75, 480, Beginning work in process inventory as $15, 700 and Ending work in process inventory as $19, 380 in the given problem. Therefore, schedule of cost of goods manufactured as asked in the given problem is given below:

Schedule of cost of goods manufactured of Company (Amount in $):

| Particulars | (Amount in $) | (Amount in $) |

| Direct materials used | 9, 09, 850 | |

| Add: Direct labor | 6, 75, 480 | |

| Add: Factory overheads | 3, 54, 000 | |

| Total manufacturing costs | 19, 39, 330 | |

| Add: Beginning work in process inventory | 15, 700 | |

| Less: Ending work in process inventory | (19, 380) | |

| Cost of goods manufactured | 19, 35, 650 |

Thus, cost of goods manufactured = $19, 35, 650.

Concept introduction:

Income statement Income statement, also known as Statement of revenue and expense measures company’s financial performance over an accounting period (say for a year, a quarter). In this statement, total expenses are deducted from total revenues to arrive at net income or loss for the period.

Selling expenses These are the expenses incurred for making sales. These include direct and indirect cost associated with selling a product.

General and administrative expenses These are basically the overheads of the company. These are the costs a company incurs to keep its business operational.

Requirement 2:

Income statement reporting separate categories for (a) selling expenses and (b) general and administrative expenses.

Answer to Problem 3PSA

Net income after income tax = $17, 14, 005

Explanation of Solution

To prepare the income statement categorizing selling or general and administrative expenses, firstly cost of goods sold would be calculated using the below- mentioned formula:

We have already computed cost of goods manufactured as $19, 35, 650 in the previous requirement. Beginning finished goods inventory as $1, 67, 350 and ending finished goods inventory as $1, 36, 490. Thus,

Further, Sales are given as $44, 62, 500. Gross profit would be calculated as follows:

Following would be covered under selling expenses:

Advertising expense = $28, 750

Depreciation expense- Selling equipment = $8, 600

Sales salaries expense = $3, 92, 560

Rent expense- Selling space = $26, 100

General and administrative expenses would include the following:

Depreciation expense- Office equipment = $7, 250

Office salaries expense = $63, 000

Rent expense- Office space = $22, 000

Also, income tax expense is given as $2, 33, 725 in the given problem. Net income after income tax would be calculates as under:

Schedule of Income statement as asked in the given problem for 2015 is shown below:

Income statement of Company (Amount in $):

| Particulars | Amount | Amount |

| Sales | 44, 62, 500 | |

| Less: Cost of goods sold | ||

| Cost of goods manufactured | 19, 35, 650 | |

| Add: Beginning finished goods inventory | 1, 67, 350 | |

| Goods available for sale | 21, 03, 000 | |

| Less: Ending finished goods inventory | (1, 36, 490) | |

| Cost of goods sold | (19, 66, 510) | |

| Gross profit | 24, 95, 990 | |

| Less: Selling expenses | ||

| Advertising expense | 28.750 | |

| Depreciation expense- Selling equipment | 8, 600 | |

| Sales salaries expense | 3, 92, 560 | |

| Rent expense- Selling space | 26, 100 | |

| Total selling expenses | (4, 56, 010) | |

| Less: General and administrative expenses | ||

| Depreciation expense- Office equipment | 7, 250 | |

| Office salaries expense | 63, 000 | |

| Rent expense- Office space | 22, 000 | |

| Total general and administrative expenses | (92, 250) | |

| Net income before income tax expense | 19, 47, 730 | |

| Less: Income tax expense | (2, 33, 725) | |

| Net income after income tax | 17, 14, 005 |

Thus, Net income after income tax is coming out to be $17, 14, 005.

Concept introduction:

Inventory turnover Inventory turnover, also known as merchandise turnover calculates the number of times a company sells or replaces its stock of goods during a period.

This is an efficiency ratio that shows how effectively inventory is managed by comparing cost of goods sold with average inventory for a period. It is calculated by dividing the cost of goods sold with average inventory.

Raw material turnover is calculated by dividing the raw materials used with average raw materials used, i.e.

Day’s sales in inventory measures liquidity of inventory and is calculated in the following manner:

Day’s sales in inventory for raw material inventory would be calculated as follows:

Requirement 3:

To calculate:

- Inventory turnover defined as cost of goods sold divided by average inventory

- Day’s sales in inventory defined as 365 times ending inventory divided by cost of goods sold for both raw materials inventory and finished goods inventory

- Reasons for differences between these ratios for the two types of inventories

Answer to Problem 3PSA

- Inventory turnover defined as cost of goods sold divided by average inventory For finished goods inventory = 12.9 times

- Days sales in inventory defined as 365 times ending inventory divided by cost of goods sold for both raw materials inventory and finished goods inventory For finished goods inventory = 25.3 days

- Reasons for differences between these ratios for the two types of inventories

For raw materials inventory = 5.2 times

For raw materials inventory = 73 days

The lower raw materials inventory ratio may be due to the reason that company is holding large quantity of inventory to support operations than it may need.

Further, the company is having higher inventory ratio of finished goods which may be due to unexpected increased sales or it may be due to the negligence of company for procurement of its finished goods and in administering them.

Explanation of Solution

- Inventory turnover defined as cost of goods sold divided by average inventory

- Inventory turnover is calculated by dividing the cost of goods sold with average inventory, i.e.

Average inventory can be computed using the following formula:

In the given problem, Beginning finished goods inventory as $1, 67, 350 and ending finished goods inventory as $1, 36, 490. Thus,

Further, Cost of goods has been calculated as $19, 66, 510. Therefore, Inventory turnover would be:

Hence, inventory turnover = 12.9 times.

- Raw material turnover is calculated by dividing the raw materials used with average raw materials used, i.e.

Average inventory can be computed using the following formula:

In the given problem, Beginning raw material inventory as $1, 66, 850 and ending raw material inventory as $1, 82, 000. Thus,

Further, Direct materials used has been calculated as $9.09.850. Therefore, inventory turnover would be calculated as follows:

Hence, inventory turnover is coming out to be 5.2 times.

(b) Day’s sales in inventory defined as 365 times ending inventory divided by cost of goods sold for both raw materials inventory and finished goods inventory:

- Day’s sales in inventory measures liquidity of inventory and is calculated in the following manner:

In the given problem, Ending finished goods inventory as $1, 36, 490 and Cost of goods has been calculated as $19, 66, 510. Thus,

Hence, Day’s sale in inventory is coming to be 25.3 days.

- Day’s sales for raw material inventory would be calculated as follows:

Ending raw materials inventory is given as $1, 82, 000 and Direct materials used has been calculated as $9.09.850. Thus,

Hence, Day’s sale for raw material inventory is coming out to be 73 days.

(c) Reasons for differences between these ratios for the two types of inventories:

The turnover ratios as well as Day’s sales in inventory for both raw materials and finished goods has been shown below in the tabular form:

| Particulars | Raw materials | Finished goods |

| Inventory Turnover ratios | 5.2 | 12.9 |

| Day’s sales in inventory | 73 | 25.3 |

From the above table, it can be seen that turnover ratio of raw materials inventory is lower than finished goods inventory ratio. The lower raw materials inventory ratio may be due to the reason that company is holding large quantity of inventory to support operations than it may need. Therefore, it has too much of its capital tied up in raw materials that will take long time to sell or make profits.

Further, the company is having higher inventory ratio of finished goods which may be due to unexpected increased sales or it may be due to the negligence of company for procurement of its finished goods and in administering them.

Want to see more full solutions like this?

Chapter 1 Solutions

Managerial Accounting

- What are two double entries the following transaction? Account Receivable. Account payable. Rent Expenses. Cell phone bill, cable, light bill, gas, and monthly income of $4,000.00 what will be your net income after all expenses are paid. Please figure out your own price for each expense.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- I need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning