a.

Prepare an income statement and the cost waste for Product H that are prepared in advance.

a.

Answer to Problem 25PSB

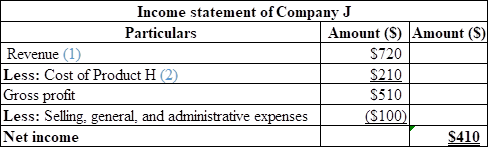

Calculation of income statement based on sales of 160 Product H per day is as follows:

Table (1)

Calculation of cost of waste Product H is as follows:

Hence, the cost of waste Product H is $42.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Working notes:

Calculate the revenue:

Hence, the revenue is $720.

…… (1)

Calculate the total cost of Product H:

Hence, the cost of Product H is $210.

…… (2)

b.

Prepare an income statement and determine the amount of profit that is lost from the incapability of serving the 40 additional customers.

b.

Answer to Problem 25PSB

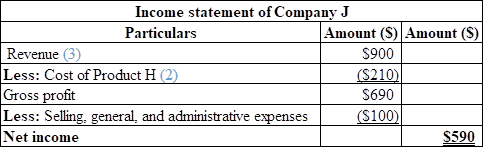

Calculation of income statement of Company J if the company as prepare 200 Product H is as follows:

Table (2)

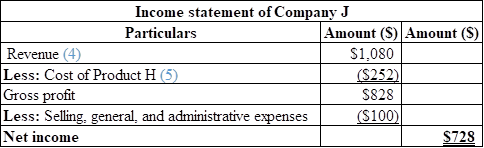

Calculation of income statement of the Company J if the company as prepare 240 Product H in advance is as follows:

Table (3)

Calculation of lost profit is as follows:

Hence, the lost profit from rejecting additional customers is $138.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Working notes:

Calculate the revenue for 200 customers:

Hence, the revenue is $900.

…… (3)

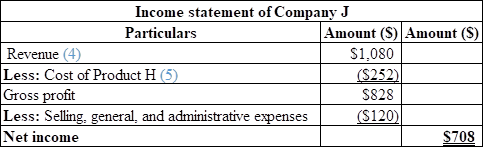

Calculate the revenue for 240 customers:

Hence, the revenue is $1,080.

…… (4)

Calculate the total cost of Product H in case of 240 customers:

Hence, the cost of Product H textbooks is $252.

…… (5)

c.

Prepare an income statement under the process of just in time system for 160 Product H, compare the income statement with requirement a., and comment how this system would affect the profitability.

c.

Answer to Problem 25PSB

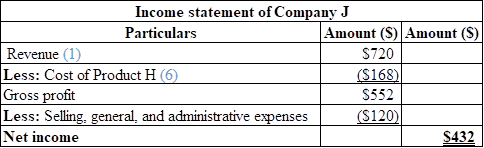

Calculation of income statement of the Company J under just in time system for 160 Product H is as follows:

Table (4)

Comparison and comment on the income statement is as follows:

The expenses on the cost of Product H will come down by using just in time inventory system than traditional inventory system used in requirement (a). Reduction of Product H will increase employee payroll cost. As an effect, there will be increase in net income by $22.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Just in time:

Just in time is a management strategy used by the organizations to decrease waste and increase the efficiency by receiving goods that are required for production. That decreases the inventory cost.

Working notes:

Calculate the total cost of Product H in case of 240 hamburgers:

Hence, the cost of Product H is $168.

…… (6)

d.

Prepare an income statement under the process of just in time system for 240 Product H are sold, compare the income statement with requirement b., and comment how this system would affect the profitability.

d.

Answer to Problem 25PSB

Calculation of income statement of the Company J under just in time system for selling 240 Product H is as follows:

Table (5)

Comparison and comment on the income statement is as follows:

The extra customer order can be accepted because the just in time inventory system increases the employee pay roll cost. Thus, the net income will increase by $118 than the traditional inventory system.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Just in time:

Just in time is a management strategy used by the organizations to decrease waste and increase the efficiency by receiving goods that are required for production. That decreases the inventory cost.

e.

Discuss the probable effects of the just in time inventory system on the level of customer satisfaction.

e.

Explanation of Solution

Just in time:

Just in time is a management strategy used by the organizations to decrease waste and increase the efficiency by receiving goods that are required for production. That decreases the inventory cost.

The probable effect of just in time inventory system on the level of customer satisfaction is as follows:

The just in time inventory system helps in preparing the fresh Product H and can prepare according to the customers taste and preferences that increases the level of customer satisfaction. Increase in customer satisfaction will increase purchase and revenues. That in returns leads to higher profits.

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamental Managerial Accounting Concepts with Access

- 82. What role does assurance boundary definition play in attestation? a) Standard limits work always b) Boundaries never matter c) All areas need equal coverage d) Engagement scope limits determine verification responsibilitiesarrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardGiven solution for General accounting question not use aiarrow_forward

- How many units were started and completed with respect to direct materials during the month?arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education