a.

The

a.

Answer to Problem 23PSB

Option 1

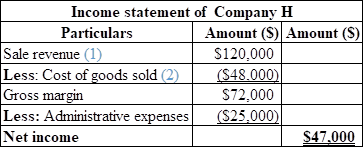

Calculation of income statement of Company H is as follows:

Table (1)

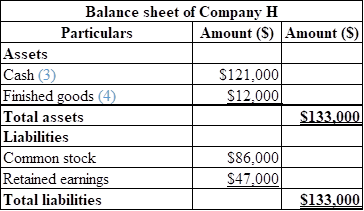

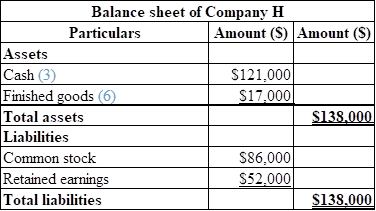

Calculation of balance sheet of Company H is as follows:

Table (2)

Option 2

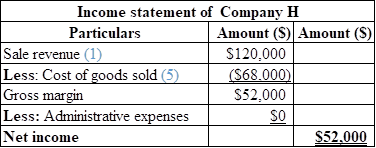

Calculation of income statement of Company H is as follows:

Table (3)

Calculation of balance sheet of Company H is as follows:

Table (4)

Explanation of Solution

Income statement:

It is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

It is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

Calculate the sale revenue:

Hence, the sales revenue is $120,000.

…… (1)

Calculate the cost per unit:

Hence, the cost per unit is $6.

Calculate the cost of goods sold:

Hence, the cost of goods sold is $48,000.

…… (2)

Calculate the total cash:

Hence, the total cash is $121,000.

…… (3)

Calculate the total finished goods:

Hence, the finished goods is $12,000.

…… (4)

Calculate the cost per unit:

Hence, the cost per unit is $8.5.

Calculate the cost of goods sold:

Hence, the cost of goods sold is $68,000.

…… (5)

Calculate the total finished goods:

Hence, the finished goods is $17,000.

…… (6)

b.

Recognize the option in the financial statement that gives a favourable image to the creditors and investors.

b.

Answer to Problem 23PSB

Option 2 is the financial statement that gives favourable impression to creditors and investors with greater net income of $52,000.

Explanation of Solution

Income statement:

It is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

It is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

The option that gives the favorable image to the creditors and investors is as follows:

Option 2 gives the in the financial statement that gives the favorable image to the creditors and investors because the net income in option 2 is greater than the net income in option 1.

c.

Calculate the amount of bonus under each option and recognize the option that provides the higher bonus.

c.

Answer to Problem 23PSB

Option 2 provides the president with the higher bonus with $5,200.

Explanation of Solution

Income statement:

It is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Calculation of bonus under option 1 is as follows:

Hence, the bonus received by president under option 1 is $4,700.

Calculation of bonus under option 2 is as follows:

Hence, the bonus received by president under option is $5,200.

d.

Calculate the amount of tax expenses under each option and recognize which option pays lesser tax.

d.

Answer to Problem 23PSB

Option 1 minimizes the cost of income tax expenses for the company by $16,450.

Explanation of Solution

Calculation of income tax under option 1 is as follows:

Hence, the income tax expenses under option 1 is $16,450.

Calculation of income tax under option 2 is as follows:

Hence, the bonus received by president under option 2 is $18,200

e.

Comment on the conflict between the company president and the owner based on the requirement c and requirement d and define an incentive compensation plan that would avoid the conflict.

e.

Explanation of Solution

The conflicts between the owner and the president is as follows:

Option 2 provides the president with the higher bonus with $5,200. Option 1 minimizes the cost of income tax expenses for the company by $16,450. These are the two conflicts between the owner and the president.

The reasons to avoid these conflicts is as follows:

- The bonus plans of the company can be tied up with the company stock price instead of net income.

Market efficiency increases, as a result the performance of the company increases that creates a value to the company stock price.

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamental Managerial Accounting Concepts with Access

- Can you explain the correct approach to solve this general accounting question?arrow_forwardFinancial Accounting Question please answerarrow_forwardA firm has net working capital of $510, net fixed assets of $2,750, sales of $7,200, and current liabilities of $950. How many dollars worth of sales are generated from every $1 in total assets?arrow_forward

- Hi expert please given correct answer with accounting questionarrow_forwardGeneral accounting questionarrow_forwardHemsworth Electronics company has a beginning finished goods inventory of $24,500, raw material purchases of $35,600, cost of goods manufactured of $42,800, and an ending finished goods inventory of $27,300. The cost of goods sold for this company is?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education