Concept explainers

a.

The total product cost and average cost per unit

Given information:

- Raw material $26,000.

- Wages for production workers $21,000.

- Manufacturing equipment’s is $49,000, its salvage value is $4,000 and an expected life is 5years.

- The completed production of Company I is 8,000 units.

a.

Explanation of Solution

Product cost:

It is the cost incurred by the company during the process of manufacturing the product.

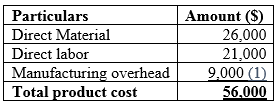

Calculation of total product cost for the year 2014 is as follows:

Table (1)

Hence, the total cost of the product for the year 2014 is $56,000.

Calculation average cost per unit for the year 2014 is as follows:

Hence, the average cost per unit for the year 2014 is $7.

Working notes:

Calculation of manufacturing

Hence, the manufacturing overheads are $9,000.

…… (1)

b.

The cost of goods sold that appears in 2014 income statement.

Given information:

- The total number of units sold by Company I is 7,200 units.

b.

Explanation of Solution

Cost of goods sold

Cost of goods sold is the accumulation of all the direct costs incurred in the process of producing a product. It excludes indirect expenses.

Calculation of total cost of goods sold for the year 2014 is as follows:

Hence, the total cost of goods sold is $50,400.

c.

The cost of ending inventory that appears on 31st December 2014

Given information:

- The total number of units sold by Company I is 7,200 units.

- The completed production of Company I is 8,000 units.

c.

Explanation of Solution

Inventory:

It is the term for products ready for sale and raw materials used in making the final product.

Calculation of ending inventory for the year 2014 is as follows:

Hence, the ending inventory for the year 2014 is $5,600.

d.

The total amount of net income for the year 2014

Given information:

- Raw material $26,000.

- Manufacturing equipment’s is $49,000, its salvage value is $4,000 and an expected life is 5years.

- The total number of units sold by Company I is 7,200 units at cost of $15 per unit.

- The completed production of Company I is 8,000 units.

- Common stock of the Company I is $78,000.

- Purchased furniture for office at $21,000 and an expected life is 7years.

- The Company pays $12,000 as salary and $21,000 as wages for production purpose.

d.

Explanation of Solution

Financial statement:

The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

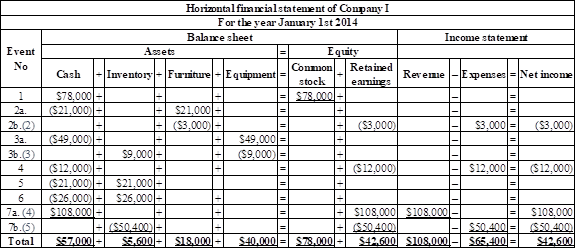

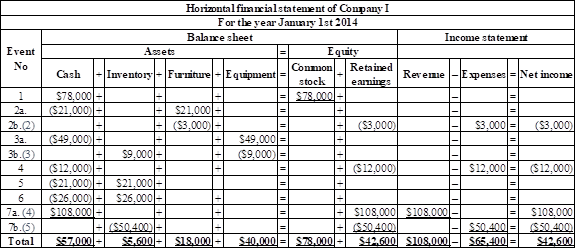

Calculation of net income of the Company I for the year 2014 is as follows:

Table (2)

Hence, the net income of the Company for the year 2014 is $42,600.

Working note:

Calculation of

Hence, the depreciation value of furniture is $3,000.

…… (2)

Calculation of depreciation value for manufacturing equipment’s:

Hence, the depreciation value of manufacturing equipment’s is $9,000.

…… (3)

Calculation of total units sold at the rate of $15 per unit.

The total units sold by the Company I is 108,000.

…… (4)

Calculation of total inventory at the average cost per unit.

The total inventory at the average cost is $50,400.

…… (5)

e.

The total amount of

Given information:

- Raw material $26,000.

- Manufacturing equipment’s is $49,000, its salvage value is $4,000 and an expected life is 5years.

- The total number of units sold by Company I is 7,200 units at cost of $15 per unit.

- The completed production of Company I is 8,000 units.

- Common stock of the Company I is $78,000.

- Purchased furniture for office at $21,000 and an expected life is 7years.

- The Company pays $12,000 as salary and $21,000 as wages for production purpose.

e.

Explanation of Solution

Financial statement:

The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Calculation of retained earnings of the Company I for the year 2014 is as follows:

Table (3)

Hence, the retained earnings of the Company for the year 2014 are $42,600.

f.

The total assets that appears on the balance sheet

Given information:

- Raw material $26,000.

- Manufacturing equipment’s is $49,000, its salvage value is $4,000 and an expected life is 5years.

- The total number of units sold by Company I is 7,200 units at cost of $15 per unit.

- The completed production of Company I is 8,000 units.

- Common stock of the Company I is $78,000.

- Purchased furniture for office at $21,000 and an expected life is 7years.

- The Company pays $12,000 as salary and $21,000 as wages for production purpose.

f.

Explanation of Solution

Financial statement:

The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

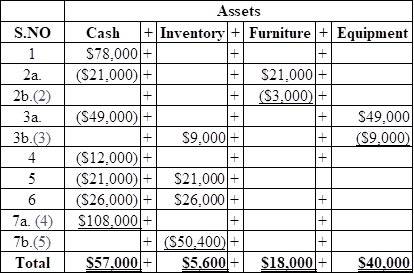

Table showing calculation of assets:

Table (4)

Calculation of total assets is as follows:

Hence, the total amount of assets of the Company for the year 2014 is $120,600.

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamental Managerial Accounting Concepts with Access

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardEcho Corporation had accounts receivable of $95,000 at January 1, 2023. At December 31, 2023, accounts receivable was $75,000. Sales for 2023 totaled $650,000. Compute Echo Corporation's 2023 cash receipts from customers.arrow_forwardProvide answerarrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNonearrow_forwardO'Keeffe Corporation's trial balance shows Accounts Receivable with a debit balance of $350,000. The company estimates that 3% of receivables will be uncollectible. If the Allowance for Doubtful Accounts has a credit balance of $4,200 before adjustment, what is the required adjusting entry for bad debt expense?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education