Bundle: Survey of Accounting, Loose-Leaf Version, 8th + CengageNOWv2, 1 term Printed Access Card

8th Edition

ISBN: 9781337379885

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1.4.2MBA

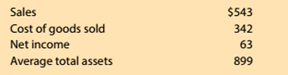

Return on assets

The following data (in millions) were adapted from recent financial statements of Tootsie Roll Industries Inc. (TR):

The percent a company adds to its cost of sales to determine selling price is called a markup. What is Tootsie Roll’s markup percent? Round to one decimal place.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The ROA for 2020 was?

PROVIDE ANSWER: On June 30, 2009, Straight Movers had $243,000 in current assets and $211,000 in current liabilities. On August 1, 2009, Straight received $50,000 from an issue of promissory notes that will mature in 2012. The notes pay interest on February 1 at an annual rate of 6 percent. Straights' fiscal year ends on December 31. What is the interest expense for December 31?

You have reported a net income solution this accounting questions

Chapter 1 Solutions

Bundle: Survey of Accounting, Loose-Leaf Version, 8th + CengageNOWv2, 1 term Printed Access Card

Ch. 1 - Prob. 1SEQCh. 1 - The resources owned by a business are called: A....Ch. 1 - A listing of a business entity’s assets,...Ch. 1 - If total assets are $20,000 and total liabilities...Ch. 1 - Prob. 5SEQCh. 1 - Prob. 1CDQCh. 1 - Prob. 2CDQCh. 1 - Prob. 3CDQCh. 1 - Prob. 4CDQCh. 1 - Prob. 5CDQ

Ch. 1 - Prob. 6CDQCh. 1 - Prob. 7CDQCh. 1 - Prob. 8CDQCh. 1 - Prob. 9CDQCh. 1 - Prob. 10CDQCh. 1 - Briefly describe the nature of the information...Ch. 1 - Prob. 12CDQCh. 1 - What particular item of financial or operating...Ch. 1 - Prob. 14CDQCh. 1 - On October 1, Wok Repair Service extended an offer...Ch. 1 - Prob. 16CDQCh. 1 - Prob. 1.1ECh. 1 - Prob. 1.2ECh. 1 - accounting equation The total assets and total...Ch. 1 - accounting equation The total assets and total...Ch. 1 - accounting equation Determine the missing amount...Ch. 1 - accounting equation Determine the missing amounts...Ch. 1 - Net income and dividends The income statement of a...Ch. 1 - Net income and stockholders’ equity for four...Ch. 1 - Accounting equation and Income statement Staples,...Ch. 1 - Prob. 1.10ECh. 1 - Income statement items Based on the data presented...Ch. 1 - Financial statement items Identify each of the...Ch. 1 - Statement of stockholders’ equity Financial...Ch. 1 - Income statement Maynard Services was organized on...Ch. 1 - Prob. 1.15ECh. 1 - Balance sheets, net income Financial information...Ch. 1 - Financial statements Each of the following items...Ch. 1 - Statement of cash flows Indicate whether each of...Ch. 1 - Prob. 1.19ECh. 1 - Statement of cash flows Looney Inc. was organized...Ch. 1 - Prob. 1.21ECh. 1 - Financial statement items Amazon.com, Inc., (AMZN)...Ch. 1 - Income statement Based on the Amazon.com, Inc.,...Ch. 1 - Financial statement items Though the McDonald’s...Ch. 1 - Financial statements Outlaw Realty, organized...Ch. 1 - Accounting concepts Match each of the following...Ch. 1 - Prob. 1.27ECh. 1 - Income statement, retained earnings statement, and...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Prob. 1.2.1PCh. 1 - Missing amounts from financial statements Obj.4...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Statement of cash flows The following cash data...Ch. 1 - Financial statements, including statement of cash...Ch. 1 - Financial statements, including statement of cash...Ch. 1 - Financial statements, including statement of cash...Ch. 1 - Financial statements, including statement of cash...Ch. 1 - Quantitative metrics Interpublic Group of...Ch. 1 - Prob. 1.1.2MBACh. 1 - Quantitative metrics JetBlue Airways Corporation...Ch. 1 - Prob. 1.2.2MBACh. 1 - Return on assets The financial statements of The...Ch. 1 - Prob. 1.3.2MBACh. 1 - Prob. 1.3.3MBACh. 1 - Prob. 1.3.4MBACh. 1 - Return on assets The financial statements of The...Ch. 1 - Return on assets The financial statements of The...Ch. 1 - Return on assets The financial statements of The...Ch. 1 - Return on assets The following data (in millions)...Ch. 1 - Return on assets The following data (in millions)...Ch. 1 - Return on assets The following data (in millions)...Ch. 1 - Prob. 1.4.4MBACh. 1 - Return on assets The following data (in millions)...Ch. 1 - Return on assets Pfizer Inc. (PFE) discovers,...Ch. 1 - Return on assets Pfizer Inc. (PFE) discovers,...Ch. 1 - Prob. 1.5.3MBACh. 1 - Prob. 1.6.1MBACh. 1 - Return on assets ExxonMobil Corporation (XOM)...Ch. 1 - Return on assets ExxonMobil Corporation (XOM)...Ch. 1 - Return on assets Tiffany & Co. (TIF) designs and...Ch. 1 - Return on assets Tiffany & Co. (TIF) designs and...Ch. 1 - Prob. 1.1CCh. 1 - Ethics and professional conduct in business...Ch. 1 - Prob. 1.2.2CCh. 1 - How businesses make money Assume that you are the...Ch. 1 - How businesses make money Assume that you are the...Ch. 1 - How businesses make money Assume that you are the...Ch. 1 - Prob. 1.4CCh. 1 - The accounting equation Review financial...Ch. 1 - Prob. 1.6C

Additional Business Textbook Solutions

Find more solutions based on key concepts

Risk Premiums and Discount Rates. Top hedge fund manager Sally Buffit believes that a stock with the same marke...

FUNDAMENTALS OF CORPORATE FINANCE

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

CHAPTER CASE

S&S Air’s Mortgage

Mark Sexton and Todd Story, the owners of S&S Air, Inc., were impressed by the ...

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License