Concept explainers

Missing amounts from financial statements Obj.4

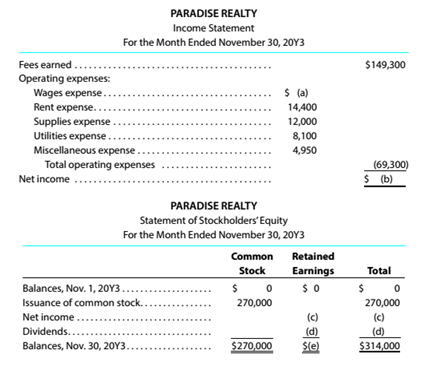

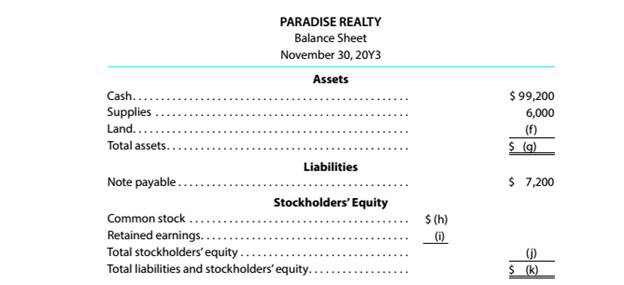

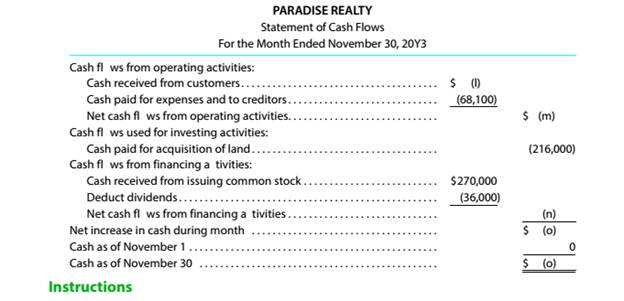

The financial statements at the end of Paradise Reaky’s first month of operations are shown

2. By analyzing the interrelationships among the financial statements, determine the proper amounts for (a) through (o).

Introduction:

Financial Statements:

It is a set of records of all financial activities of a business entity prepared by the management that shows the ability of the business entity in utilizing the funds entrusted by the stockholders and lenders.

To calculate:

The wages expense and net income in income statement of company X, dividend and retained earnings closing balance in statement of stockholder's equity, balances of land, stock holder's equity and total liabilities and stockholder's equity as shown in balance sheet of company X. Also, to calculate cash received from customers, net cash flow from operating activities, net cash flow from financing activities, net increase in cash during month ended November 30, 20Y3 and cash as on November 30, 20Y3 as shown in statement of cash flows.

Answer to Problem 1.2.2P

Income Statement of company X

- Wages expense - $29850

- Net Income - $80000

- Net Income- $80000

- Dividends- $36000

- Retained Earnings total = $44000

- Land- $216000

- Total assets- $321200

- Common stock- $270000

- Retained earnings- $44000

- Total stockholder's equity- $314000

- Total liabilities and stockholder's equity- $321200

- Cash received from customers- $149300

- Net cash flow from operating activities- $81200

- Net cash flow from financing activities- $234000

- Net increase in cash during the month - $99200

Statement of stockholders' equity

Balance Sheet

Statement of cash flows

cash as on November 30, 20Y3

Explanation of Solution

Calculation of missing amounts in financial statements of company X:

Income Statement of company X

Statement of stockholder's equity of company X

Balance Sheet:

Statement of Cash flows

Want to see more full solutions like this?

Chapter 1 Solutions

Bundle: Survey of Accounting, Loose-Leaf Version, 8th + CengageNOWv2, 1 term Printed Access Card

Additional Business Textbook Solutions

Business Essentials (12th Edition) (What's New in Intro to Business)

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardWhat is the impact of inventory valuation method (FIFO vs. LIFO) on net income during inflation?no aiarrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forward

- What is the impact of inventory valuation method (FIFO vs. LIFO) on net income during inflation? Need helparrow_forwardWhat are index funds, and why are they popular among long-term investors in finance? need helparrow_forwardJoe and Ethan form JH Corporation. Joe transfers equipment (basis of $210,000 and fair market value of $180,000) while Ethan transfers land (basis of $15,000 and fair market value of $150,000) and $30,000 of cash. Each receives 50% of JH’s stock. As a result of these transfers: a. Joe has a recognized loss of $30,000, and Ethan has a recognized gain of $135,000. b. Neither Joe nor Ethan has any recognized gain or loss.c. Joe has no recognized loss, but Ethan has a recognized gain of $30,000. d. JH Corporation will have a basis in the land of $45,000.e. None of the above.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning