Business Combination

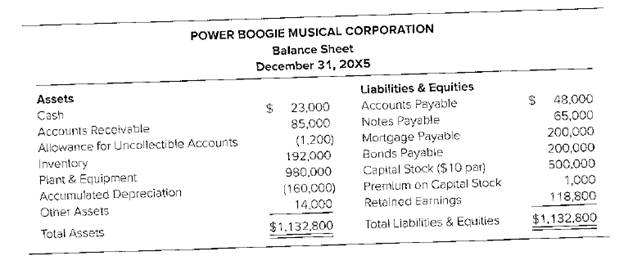

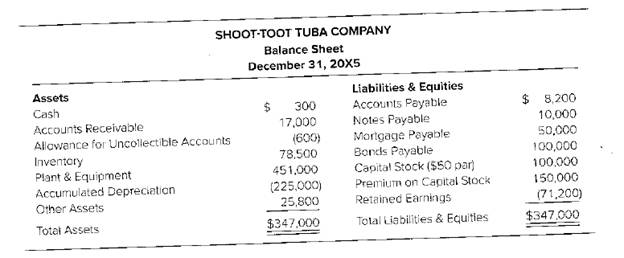

Following are the

In preparation for a possible business combination, a team of experts from Power BoogieMusical made a thorough examination and audit of Shoot-Toot Tuba. They found that Shoot-Toot’s assets and liabilities were correctly stated except that they estimated uncollectibleaccounts at $1,400. The experts also estimated the market value of the inventory at $35,000and the market value of the plant and equipment at $500,000. The business combination tookplace on January 1, 20X6, and on that date Power Boogie’s Musical acquired all the assets andliabilities of Shoot-Toot Tuba. On that date, Power Boogie’s common stock was selling for$55 per share.

Required

Record the combination on Power Boogie’s books assuming that Power Boogie issued 9,000 of its

$10 par common shares in exchange for Shoot-Toot’s assets and liabilities.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Advanced Financial Accounting

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage