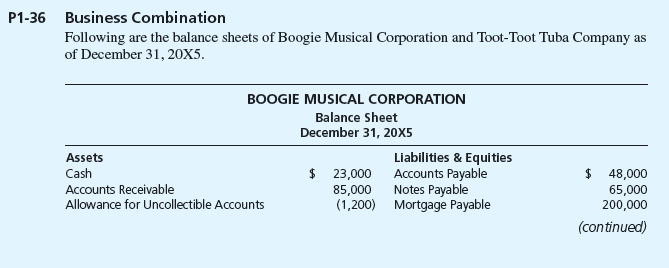

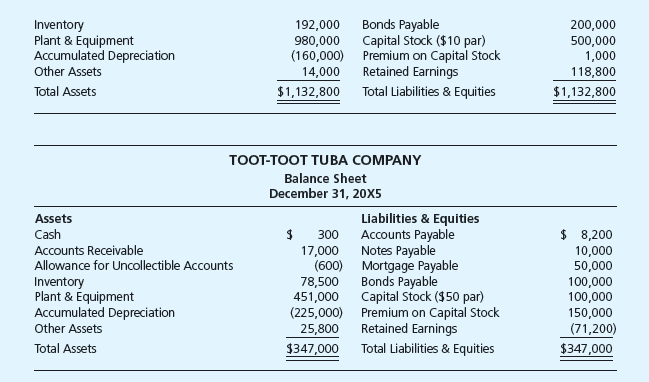

Business Combination

Following are the

In preparation for a possible business combination, a team of experts from Boogie Musical made a thorough examination and audit of Toot-Toot Tuba. They found that Toot-Toot’s assets and liabilities were correctly stated except that they estimated uncollectible accounts at $1.400. The experts also estimated the market value of the inventory at $35.000 and the market value of the plant and equipment at $500.000. The business combination took place on January 1, 20X6, and on that date Boogie Musical acquired all the assets and liabilities of Toot-Toot Tuba. On that date. Boogie’s common stock was selling for $55 per share.

Required

Record the combination on Boogie’s books assuming that Boogie issued 9.000 of its $10 par common shares in exchange for Toot-Toot’s assets and liabilities.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning