EBK ADVANCED FINANCIAL ACCOUNTING

11th Edition

ISBN: 8220102796096

Author: Christensen

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1.13E

Acquisition Using Debentures

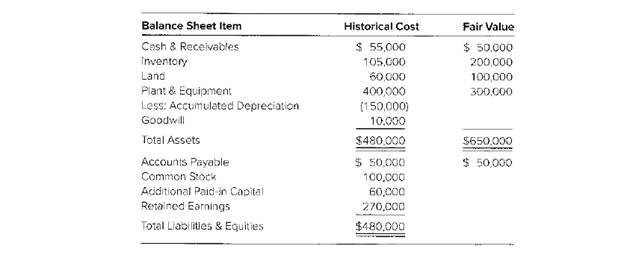

Planter Corporation used debentures with a par value of $625,000 to acquire 100 percent of Sorden Company’s net assets on January 1, 20X2. On that date, the fair

Required

Required

Give the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please explain the solution to this general accounting problem with accurate explanations.

Can you help me solve this general accounting problem with the correct methodology?

I am looking for the correct answer to this general accounting question with appropriate explanations.

Chapter 1 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

Ch. 1 - What types of circumstances would encourage...Ch. 1 - How would the decision to dispose of a segment of...Ch. 1 - Prob. 1.3QCh. 1 - Prob. 1.4QCh. 1 - Prob. 1.5QCh. 1 - Prob. 1.6QCh. 1 - Prob. 1.8QCh. 1 - Prob. 1.9QCh. 1 - Prob. 1.10QCh. 1 - Prob. 1.11Q

Ch. 1 - Prob. 1.12QCh. 1 - Prob. 1.13QCh. 1 - Prob. 1.14QCh. 1 - Prob. 1.15QCh. 1 - Within the measurement period following a business...Ch. 1 - Prob. 1.17QCh. 1 - Prob. 1.1CCh. 1 - Prob. 1.3CCh. 1 - Prob. 1.4CCh. 1 - Risks Associated with Acquisitions Not all...Ch. 1 - Prob. 1.8CCh. 1 - Prob. 1.1.1ECh. 1 - Prob. 1.1.2ECh. 1 - Prob. 1.1.3ECh. 1 - Multiple-Choice Questions on Complex Organizations...Ch. 1 - Prob. 1.1.5ECh. 1 - Prob. 1.2.1ECh. 1 - Prob. 1.2.2ECh. 1 - Multiple-Choice Questions on Recording Business...Ch. 1 - Prob. 1.2.4ECh. 1 - Multiple-Choice Questions on Recording Business...Ch. 1 - Multiple-Choice Questions on Reported Balances...Ch. 1 - Multiple-Choice Questions on Reported Balances...Ch. 1 - Prob. 1.3.3ECh. 1 - Prob. 1.3.4ECh. 1 - Prob. 1.4.1ECh. 1 - Prob. 1.4.2ECh. 1 - Prob. 1.4.3ECh. 1 - Prob. 1.4.4ECh. 1 - Prob. 1.4.5ECh. 1 - Prob. 1.5ECh. 1 - Prob. 1.6ECh. 1 - Prob. 1.7ECh. 1 - Prob. 1.8ECh. 1 - Prob. 1.9ECh. 1 - Prob. 1.10ECh. 1 - Prob. 1.11ECh. 1 - Goodwill Recognition Spur Corporation reported the...Ch. 1 - Acquisition Using Debentures Planter Corporation...Ch. 1 - Bargain Purchase Using the data resented in E1-13,...Ch. 1 - Prob. 1.15ECh. 1 - Prob. 1.16ECh. 1 - Prob. 1.17ECh. 1 - Prob. 1.18ECh. 1 - Prob. 1.19ECh. 1 - Prob. 1.20ECh. 1 - Prob. 1.21ECh. 1 - Prob. 1.22ECh. 1 - Prob. 1.23ECh. 1 - Prob. 1.24PCh. 1 - Prob. 1.25PCh. 1 - Prob. 1.26PCh. 1 - Prob. 1.27PCh. 1 - Prob. 1.28PCh. 1 - Prob. 1.29PCh. 1 - Prob. 1.30PCh. 1 - Prob. 1.31PCh. 1 - Prob. 1.32PCh. 1 - Prob. 1.33PCh. 1 - Prob. 1.34PCh. 1 - Prob. 1.35PCh. 1 - Business Combination Following are the balance...Ch. 1 - Prob. 1.37PCh. 1 - Prob. 1.38PCh. 1 - Prob. 1.39PCh. 1 - Prob. 1.40P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License