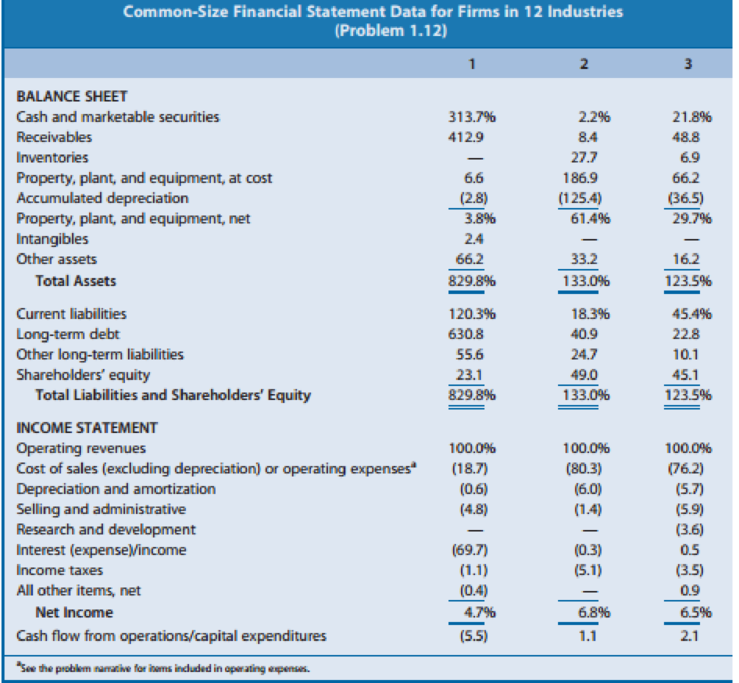

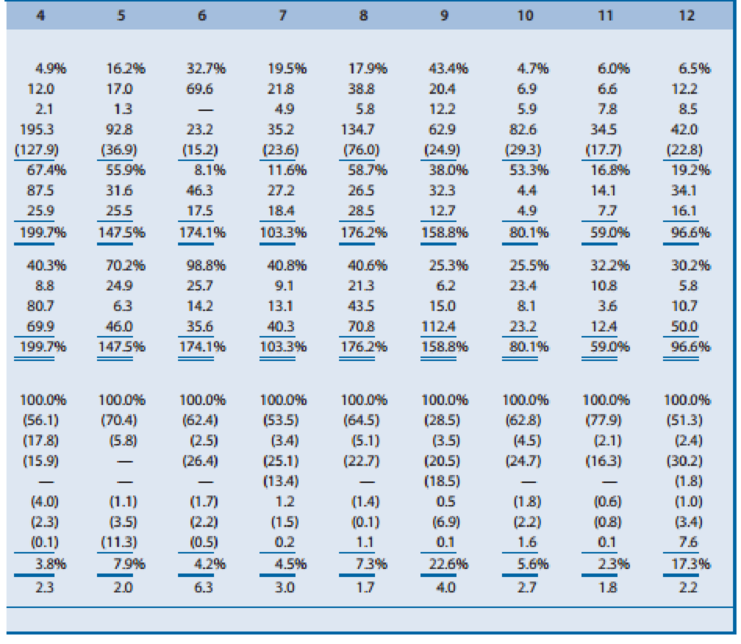

Effect of Industry Characteristics on Financial Statement Relations: A Global Perspective. Effective financial statement analysis requires an understanding of a firm’s economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.24 (pages 66–67) presents common-size condensed

- A. Accor (France): World’s largest hotel group, operating hotels under the names of Sofitel, Novotel, Motel 6, and others. Accor has grown in recent years by acquiring established hotel chains.

- B. Carrefour (France): Operates grocery supermarkets and hypermarkets in Europe, Latin America, and Asia.

- C. Deutsche Telekom (Germany): Europe’s largest provider of wired and wireless telecommunication services. The telecommunications industry has experienced increased deregulation in recent years.

- D. E.ON AG (Germany): One of the major public utility companies in Europe and the world’s largest privately owned energy service provider.

- E. Fortis (Netherlands): Offers insurance and banking services. Operating revenues include insurance premiums received, investment income, and interest revenue on loans. Operating expenses include amounts actually paid or amounts it expects to pay in the future on insurance coverage outstanding during the year.

- F. Interpublic Group (U.S.): Creates advertising copy for clients. Interpublic purchases advertising time and space from various media and sells it to clients. Operating revenues represent the commissions or fees earned for creating advertising copy and selling media time and space. Operating expenses include employee compensation.

- G. Marks & Spencer (U.K.): Operates department stores in England and other retail stores in Europe and the United States. Offers its own credit card for customers’ purchases.

- H. Nestlé (Switzerland): World’s largest food processor, offering prepared foods, coffees, milk-based products, and mineral waters.

- I. Roche Holding (Switzerland): Creates, manufactures, and distributes a wide variety of prescription drugs.

- J. Sumitomo Metal (Japan): Manufacturer and seller of steel sheets and plates and other construction materials.

- K. Sun Microsystems (U.S.): Designs, manufactures, and sells workstations and servers used to maintain integrated computer networks. Sun outsources the manufacture of many of its computer components.

- L. Toyota Motor (Japan): Manufactures automobiles and offers financing services to its customers.

REQUIRED

Use the ratios to match the companies in Exhibit 1.24 with the firms listed above.

Trending nowThis is a popular solution!

Chapter 1 Solutions

EBK FINANCIAL REPORTING, FINANCIAL STAT

- If data is unclear or blurr then comment i will write it. please don't use AI i will unhelpfularrow_forwardYou are considering an option to purchase or rent a single residential property. You can rent it for $5,000 per month and the owner would be responsible for maintenance, property insurance, and property taxes. Alternatively, you can purchase this property for $204,500 and finance it with an 80 percent mortgage loan at 4 percent interest that will fully amortize over a 30-year period. The loan can be prepaid at any time with no penalty. You have done research in the market area and found that (1) properties have historically appreciated at an annual rate of 2 percent per year, and rents on similar properties have also increased at 2 percent annually; (2) maintenance and insurance are currently $1,545.00 each per year and they have been increasing at a rate of 3 percent per year; (3) you are in a 24 percent marginal tax rate and plan to occupy the property as your principal residence for at least four years; (4) the capital gains exclusion would apply when you sell the property; (5)…arrow_forwardIf data is unclear or blurr then comment i will write it.arrow_forward

- I need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.arrow_forwardcorrect an If image is blurr or data is unclear then plz comment i will write values or upload a new image. i will give unhelpful if you will use incorrect data.arrow_forwardWhat are the five management assertions that serve as basis for financial statements audit programs?arrow_forward

- PROBLEM 2 On July 1, 2022, LTU Contracting, Inc. purchased a new Peiner SK575 Tower Crane for a total cost of $875,000. The crane has an estimated useful life of five (5) years. For financial reporting (book) purposes, the company utilizes straight line depreciation. For tax purposes, the equipment is depreciated over five years utilizing the 200% declining balance method. A. Prepare a table that computes the book and tax depreciation for each year of the useful life and determine the difference in book value between each method at the end of each year. B. On July 1st, 2025, the company is considering selling the crane for $500,000. Compute what the gain or loss would have been at that time for both book and tax purposes.arrow_forwardBrightwoodę Furniture provides the following financial data for a given enod: Sales Aount ($) Per Unit ($) 150,000 13 Less Variable E - L96,000 13 Contribwaon Margin c 1C Less Fixed Expenses $5,000 et Income 125,000 a. What is the company's CM ratio? b. If quarterly sales increase by $5,200 and there is no change in fixed expenses, by how much would you expect quarterly net operating income to increase?arrow_forwardPlease give correct answer dont use chatgpt . if image is blurr or any data is unclear then please comment i will write values , dont give answer without sure that data in image is showing properly.arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College