Concept explainers

Financial statement items

Though the McDonald’s (MCD) menu of hamburgers, cheeseburgers, the Big Mac, Quarter Pounder, Filet-O-Fish, and Chicken McNugges is easily recognized. McDonalds finan cial statements may not be as familiar. The following items sere adapted from a recent annual report of McDonalds Corporation:

1. Accounts payable

2. Accrued Interest payable

3. Cash

4. Cash provided by operations

S. Common Stock

6. Food and packaging costs used in operations

7. Income tax expense

8. Interest expense

9. Inventories

10. Long-term debt payable

11. Net income

Net increase in cash

Notes payable

Notes receivable

Occupancy and rent expense

Payroll expense

Prepaid expenses not yet used in operations

Property and equipment

19.

20. Sales

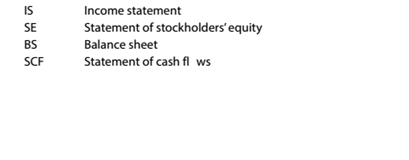

Identify the financial statement on which each of the preceding items would appear. An item may appear on more than one statement. Use the following notations:

Trending nowThis is a popular solution!

Chapter 1 Solutions

Survey of Accounting (Accounting I)

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Marketing: An Introduction (13th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- You are the owner of Veiled Wonders, a firm that makes window treatments. Some merchandise is custom-made to customer specifications, and some are mass-produced in standardized measurements. There are production workers who work primarily on standardized blinds and some employees who work on custom products on an as-needed basis. How should you structure the pay methods for these production workers?arrow_forwardGeneral Accounting questionarrow_forwardWilson Corporation acquires Greatbatch Company for $80 million cash in a merger. The balance sheets of both companies at the date of acquisition are as follows: Balance Sheet (in millions) Wilson Greatbatch Current assets $96 $8 Property and equipment 800 144 Intangibles 32 4.8 Total assets $928 $156.8 Current liabilities $40 $3.2 Long-term debt 640 104 Capital stock 80 19.2 Retained earnings 192 24 Accumulated other comprehensive income (loss) (24) 6.4 Total liabilities and equity $928 $156.8 Greatbatch's property and equipment is overvalued by $48 million, its reported intangibles are undervalued by $32 million, and it has unreported intangibles, in the form of customer databases and marketing agreements, valued at $11.2 million. Required Prepare Wilson's balance sheet immediately following the merger. Use a negative sign with your answer for AOCI if the balance is a loss.arrow_forward

- Compare and contrast experiences you have had with your own and other people’s monochromic time orientation and polychronic time orientation and how you can account for any differences in time orientation in your workplace communications in the future.arrow_forwardI need this question answer general Accountingarrow_forwardFinancial accounting questionarrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage