Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1.13E

Statement of

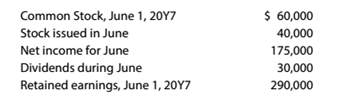

Financial information related to Webber Company for the month ended June 30, 20Y7, is as follows:

Prepare a statement of stockholders’ equity for the month ended June 30, 20Y7.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the value of its total assets on these financial accounting question?

none

What is the value of its total assets on these financial accounting question?

Chapter 1 Solutions

Survey of Accounting (Accounting I)

Ch. 1 - Prob. 1SEQCh. 1 - The resources owned by a business are called: A....Ch. 1 - A listing of a business entity’s assets,...Ch. 1 - If total assets are $20,000 and total liabilities...Ch. 1 - Prob. 5SEQCh. 1 - Prob. 1CDQCh. 1 - Prob. 2CDQCh. 1 - Prob. 3CDQCh. 1 - Prob. 4CDQCh. 1 - Prob. 5CDQ

Ch. 1 - Prob. 6CDQCh. 1 - Prob. 7CDQCh. 1 - Prob. 8CDQCh. 1 - Prob. 9CDQCh. 1 - Prob. 10CDQCh. 1 - Briefly describe the nature of the information...Ch. 1 - Prob. 12CDQCh. 1 - What particular item of financial or operating...Ch. 1 - Prob. 14CDQCh. 1 - On October 1, Wok Repair Service extended an offer...Ch. 1 - Prob. 16CDQCh. 1 - Prob. 1.1ECh. 1 - Prob. 1.2ECh. 1 - accounting equation The total assets and total...Ch. 1 - accounting equation The total assets and total...Ch. 1 - accounting equation Determine the missing amount...Ch. 1 - accounting equation Determine the missing amounts...Ch. 1 - Net income and dividends The income statement of a...Ch. 1 - Net income and stockholders’ equity for four...Ch. 1 - Accounting equation and Income statement Staples,...Ch. 1 - Prob. 1.10ECh. 1 - Income statement items Based on the data presented...Ch. 1 - Financial statement items Identify each of the...Ch. 1 - Statement of stockholders’ equity Financial...Ch. 1 - Income statement Maynard Services was organized on...Ch. 1 - Prob. 1.15ECh. 1 - Balance sheets, net income Financial information...Ch. 1 - Financial statements Each of the following items...Ch. 1 - Statement of cash flows Indicate whether each of...Ch. 1 - Prob. 1.19ECh. 1 - Statement of cash flows Looney Inc. was organized...Ch. 1 - Prob. 1.21ECh. 1 - Financial statement items Amazon.com, Inc., (AMZN)...Ch. 1 - Income statement Based on the Amazon.com, Inc.,...Ch. 1 - Financial statement items Though the McDonald’s...Ch. 1 - Financial statements Outlaw Realty, organized...Ch. 1 - Accounting concepts Match each of the following...Ch. 1 - Prob. 1.27ECh. 1 - Income statement, retained earnings statement, and...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Prob. 1.2.1PCh. 1 - Missing amounts from financial statements Obj.4...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Statement of cash flows The following cash data...Ch. 1 - Financial statements, including statement of cash...Ch. 1 - Financial statements, including statement of cash...Ch. 1 - Financial statements, including statement of cash...Ch. 1 - Financial statements, including statement of cash...Ch. 1 - Quantitative metrics Interpublic Group of...Ch. 1 - Prob. 1.1.2MBACh. 1 - Quantitative metrics JetBlue Airways Corporation...Ch. 1 - Prob. 1.2.2MBACh. 1 - Return on assets The financial statements of The...Ch. 1 - Prob. 1.3.2MBACh. 1 - Prob. 1.3.3MBACh. 1 - Prob. 1.3.4MBACh. 1 - Return on assets The financial statements of The...Ch. 1 - Return on assets The financial statements of The...Ch. 1 - Return on assets The financial statements of The...Ch. 1 - Return on assets The following data (in millions)...Ch. 1 - Return on assets The following data (in millions)...Ch. 1 - Return on assets The following data (in millions)...Ch. 1 - Prob. 1.4.4MBACh. 1 - Return on assets The following data (in millions)...Ch. 1 - Return on assets Pfizer Inc. (PFE) discovers,...Ch. 1 - Return on assets Pfizer Inc. (PFE) discovers,...Ch. 1 - Prob. 1.5.3MBACh. 1 - Prob. 1.6.1MBACh. 1 - Return on assets ExxonMobil Corporation (XOM)...Ch. 1 - Return on assets ExxonMobil Corporation (XOM)...Ch. 1 - Return on assets Tiffany & Co. (TIF) designs and...Ch. 1 - Return on assets Tiffany & Co. (TIF) designs and...Ch. 1 - Prob. 1.1CCh. 1 - Ethics and professional conduct in business...Ch. 1 - Prob. 1.2.2CCh. 1 - How businesses make money Assume that you are the...Ch. 1 - How businesses make money Assume that you are the...Ch. 1 - How businesses make money Assume that you are the...Ch. 1 - Prob. 1.4CCh. 1 - The accounting equation Review financial...Ch. 1 - Prob. 1.6C

Additional Business Textbook Solutions

Find more solutions based on key concepts

Which of the following is a primary activity in the value chain?

purchasing

accounting

post-sales service

human...

Accounting Information Systems (14th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

Whether callable bonds have a higher or lower yield than otherwise identical bonds without a call feature. Intr...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

Describe and evaluate what Pfizer is doing with its PfizerWorks.

Management (14th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License