The Riverton Company, a ski resort, recently announced a $931,970 expansion to lodging properties, lifts, and terrain. Assume that this investment is estimated to produce $214,000 in equal annual cash flows for each of the first six years of the project life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine the expected internal rate of return of this project for six years, using the present value of an annuity of $1 table above. If required, round your final answer to the nearest whole percent. fill in the blank 1 % b. Identify the uncertainties that could reduce the internal rate of return of this project?

-

internal Rate of Return Method for a Service CompanyThe Riverton Company, a ski resort, recently announced a $931,970 expansion to lodging properties, lifts, and terrain. Assume that this investment is estimated to produce $214,000 in equal annual

cash flows for each of the first six years of the project life.Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine the expected internal rate of return of this project for six years, using the present value of an annuity of $1 table above. If required, round your final answer to the nearest whole percent.

fill in the blank 1 %b. Identify the uncertainties that could reduce the internal rate of return of this project?

a.

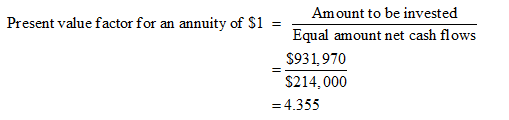

When the annual cash flows are equal, the internal rate of return can determine as follows:

Locate the number of years (6 years) of expected useful life of the investment in the year column, and find the present value factor (4.355) computed in above. In the row 10, present value factor of 4.355 is located, and rate of return is 10%.

Step by step

Solved in 2 steps with 1 images