Required: 1. Prepare a sales budget for January. 2.prepare a production budget for Jan. 3. prepare a direct materials purchased budget for Jan. 4. Prepare a direct labour cost for Jan. 5. Prepare a factory overhead cost budget for Jan. Prepare a selling and administrative expense budget for Jan.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

The budget director of Birds of a Feather Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the

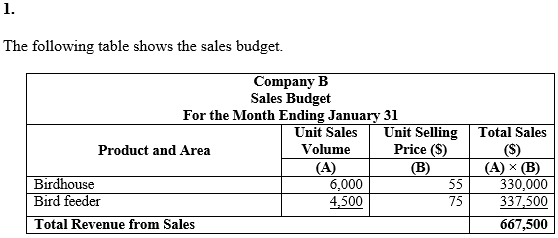

- Estimated sales for January:

Birdhouse 6,000 units at $55 per unit Bird feeder 4,500 units at $75 per unit - Estimated inventories at January 1:

Direct materials: Wood 220 ft. Plastic 250 lb. Finished products: Birdhouse 300 units at $23 per unit Bird feeder 240 units at $34 per unit - Desired inventories at January 31:

Direct materials: Wood 180 ft. Plastic 210 lb. Finished products: Birdhouse 340 units at $23 per unit Bird feeder 200 units at $34 per unit - Direct materials used in production:

In manufacture of BirdHouse: Wood 0.80 ft. per unit of product Plastic 0.50 lb. per unit of product In manufacture of Bird Feeder: Wood 1.20 ft. per unit of product Plastic 0.75 lb. per unit of product - Anticipated cost of purchases and beginning and ending inventory of direct materials:

Wood $8.00 per ft. Plastic $1.20 per lb. - Direct labor requirements:

Birdhouse: Fabrication Department 0.20 hr. at $15 per hr. Assembly Department 0.30 hr. at $12 per hr. Bird Feeder: Fabrication Department 0.40 hr. at $15 per hr. Assembly Department 0.35 hr. at $12 per hr. - Estimated factory

overhead costs for January:Indirect factory wages $80,000 Depreciation of plant and equipment 25,000 Power and light 8,000 Insurance and property tax 2,000 - Estimated operating expenses for January:

Sales salaries expense $90,000 Advertising expense 20,000 Office salaries expense 18,000 Depreciation expense—office equipment 800 Telephone expense—selling 500 Telephone expense—administrative 200 Travel expense—selling 5,000 Office supplies expense 250 Miscellaneous administrative expense 450 - Estimated other income and expense for January:

Interest revenue $300 Interest expense 224 - Estimated tax rate: 30%

Required:

1. Prepare a sales budget for January.

2.prepare a production budget for Jan.

3. prepare a direct materials purchased budget for Jan.

4. Prepare a direct labour cost for Jan.

5. Prepare a

Prepare a selling and administrative expense budget for Jan.

“Hey, since there are multiple sub-parts posted, we will answer first three sub-parts. If you want any specific sub-part to be answered then please submit that only or specify the sub-part number in your message.”

Budgeting is a process to prepare the financial statement by the manager to estimate the organization’s future actions. It is also helpful to satisfy the everyday activities.

Step by step

Solved in 3 steps with 4 images