Sales Contribution Margin Income Statement For the Year Ended December 31, 20Y8 Variable costs: Manufacturing expense Selling expense Administrative expense Contribution margin Fixed costs: Manufacturing expense Selling expense Administrative expense Operating income Income Statement - Biblio Files Sales Variable costs: Biblio Files Company Contribution Margin Income Statement For the Year Ended December 31, 20Y8 Manufacturing expense Selling expense Administrative expense Contribution margin Fixed costs: Manufacturing expense Selling expense Administrative expense $254,400 21,200 63,600 Operating income $5,000 4,000 12,200 $169,600 16,960 67,840 $88,000 8,000 10,000 $424,000 (339,200) $84,800 (21,200) $63,600 $424,000 (254,400) $169,600 (106,000) $63,600

-

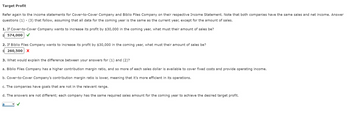

Target Profit

Refer again to the income statements for Cover-to-Cover Company and Biblio Files Company on their respective Income Statement. Note that both companies have the same sales and net income. Answer questions (1) - (3) that follow, assuming that all data for the coming year is the same as the current year, except for the amount of sales.

1. If Cover-to-Cover Company wants to increase its profit by $30,000 in the coming year, what must their amount of sales be?

$fill in the blank 76bbeef61075022_12. If Biblio Files Company wants to increase its profit by $30,000 in the coming year, what must their amount of sales be?

$fill in the blank 76bbeef61075022_23. What would explain the difference between your answers for (1) and (2)?

a. Biblio Files Company has a higher contribution margin ratio, and so more of each sales dollar is available to cover fixed costs and provide operating income.

b. Cover-to-Cover Company’s contribution margin ratio is lower, meaning that it’s more efficient in its operations.

c. The companies have goals that are not in the relevant range.

d. The answers are not different; each company has the same required sales amount for the coming year to achieve the desired target profit.

Answers: a, b, c, d

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Target Profit - Question 2 is incorrect. Please see attached image