Net sales Less: Operating costs, except depreciation and amortization Less: Depreciation and amortization expenses Operating income (or EBIT) Less: Interest expense Pre-tax income (or EBT) Less: Taxes (25%) Earnings after taxes Less: Preferred stock dividends Earnings available to common shareholders Less: Common stock dividends Contribution to retained earnings. Green Caterpillar Garden Supplies Inc. Income Statement for Year Ending December 31 Year 1 $10,000,000 8,000,000 400,000 $1,600,000 160,000 1,440,000 360,000 $1,080,000 300,000 780,000 486,000 $294,000 Year 2 (Forecasted) $ 400,000 $ TOU $ $436,312

Net sales Less: Operating costs, except depreciation and amortization Less: Depreciation and amortization expenses Operating income (or EBIT) Less: Interest expense Pre-tax income (or EBT) Less: Taxes (25%) Earnings after taxes Less: Preferred stock dividends Earnings available to common shareholders Less: Common stock dividends Contribution to retained earnings. Green Caterpillar Garden Supplies Inc. Income Statement for Year Ending December 31 Year 1 $10,000,000 8,000,000 400,000 $1,600,000 160,000 1,440,000 360,000 $1,080,000 300,000 780,000 486,000 $294,000 Year 2 (Forecasted) $ 400,000 $ TOU $ $436,312

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Net sales

Less: Operating costs, except depreciation and amortization

Less: Depreciation and amortization expenses

Operating income (or EBIT)

Less: Interest expense

Pre-tax income (or EBT)

Less: Taxes (25%)

Earnings after taxes

Less: Preferred stock dividends

Earnings available to common shareholders

Less: Common stock dividends

Contribution to retained earnings

Green Caterpillar Garden Supplies Inc.

Income Statement for Year Ending December 31

Year 1

$10,000,000

8,000,000

400,000

$1,600,000

160,000

1,440,000

360,000

$1,080,000

300,000

780,000

486,000

$294,000

Year 2 (Forecasted)

$

400,000

$

$

$436,312

Transcribed Image Text:The income statement, also known as the profit and loss (P&L) statement, provides a snapshot of the financial performance of a company during a

specified period of time. It reports a firm's gross income, expenses, net income, and the income that is available for distribution to its preferred and

common shareholders.

The income statement is prepared using the generally accepted accounting principles (GAAP) that match the firm's revenues and expenses to the

period in which they were incurred, not necessarily when cash was received or paid. Investors and analysts use the information given in the income

statement and other financial statements and reports to evaluate the company's financial performance and condition.

Consider the following scenario:

Green Caterpillar Garden Supplies Inc.'s income statement reports data for its first year of operation. The firm's CEO would like sales to increase by

25% next year.

1. Green Caterpillar is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before

interest and taxes (EBIT).

2. The company's operating costs (excluding depreciation and amortization) remain at 80% of net sales, and its depreciation and

amortization expenses remain constant from year to year.

3. The company's tax rate remains constant at 25% of its pre-tax income or earnings before taxes (EBT).

4. In Year 2, Green Caterpillar expects to pay $300,000 and $602,438 of preferred and common stock dividends, respectively.

Complete the Year 2 income statement data for Green Caterpillar, then answer the questions that follow. Be sure to round each dollar value to the

nearest whole dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

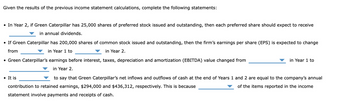

Transcribed Image Text:Given the results of the previous income statement calculations, complete the following statements:

• In Year 2, if Green Caterpillar has 25,000 shares of preferred stock issued and outstanding, then each preferred share should expect to receive

in annual dividends.

• If Green Caterpillar has 200,000 shares of common stock issued and outstanding, then the firm's earnings per share (EPS) is expected to change

from

in Year 1 to

in Year 2.

• Green Caterpillar's earnings before interest, taxes, depreciation and amortization (EBITDA) value changed from

in Year 2.

in Year 1 to

. It is

to say that Green Caterpillar's net inflows and outflows of cash at the end of Years 1 and 2 are equal to the company's annual

contribution to retained earnings, $294,000 and $436,312, respectively. This is because

of the items reported in the income

statement involve payments and receipts of cash.

Solution

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education