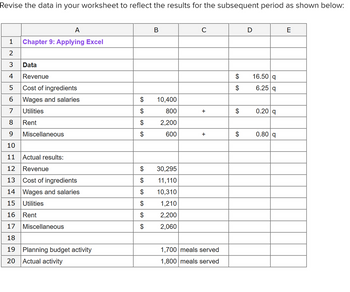

Chapter 9: Applying Excel Data Revenue Cost of ingredients Wages and salaries Utilities Rent Miscellaneous Actual results: Revenue Cost of ingredients Wages and salaries Utilities Rent Miscellaneous Planning budget activity Actual activity Meals served Revenue Expenses: Cost of ingredients Wages and salaries Utilities Rent $10,400 $800 $2,200 $600 Miscellaneous Total expenses Net operating income $27,920 $11,110 $10,130 $1,080 $2,200 $2,240 Enter a formula into each of the cells marked with a ? below Review Problem: Variance Analysis Using a Flexible Budget Construct a flexible budget performance report 1,800 meals served 1,700 meals served + ? + Revenue and Actual Spending Results Variances ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? $16.50 q $6.25 q $0.20 q $0.80 q Flexible Budget ? ? ? UNNN... ? ? ? ? ? ? Activity Variances ? ? ? ? ? ? ? ? Planning Budget ? ? ? ? ? ? ? ? ?

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

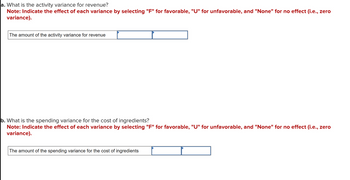

![c. What is the spending variance for wages and salaries?

**Note:** Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).

[Text box] The amount of the spending variance for wages and salaries [Dropdown box]

d. What is the spending variance for total expenses?

**Note:** Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).

[Text box] The amount of the spending variance for total expenses [Dropdown box]](https://content.bartleby.com/qna-images/question/84be77e3-7e2a-48d9-923c-45508700aa71/9b8331f4-8668-43c0-9127-62ccf79a4be2/oque0w_thumbnail.png)