Bentley Enterprises uses process costing to control costs in the manufacture of Dust Sensors for the mining Industry. The following Information pertains to operations for November. (CMA adapted) work in process, November 1st started in production during November work in process, November 30th The beginning Inventory was 60% complete as to materials and 20% complete as to conversion costs. The ending Inventory was 90% complete as to materials and 40% complete as to conversion cost Costs pertaining to November are as follows: Beginning Inventory: direct materials, $58,560; direct labor, $22,320, manufacturing overhead, $17.240. Costs incurred during the month: direct materials, $487,800; direct labor, $235,280; manufacturing overhead, $443,960 Multiple Choice What are the total costs in the ending Work-In-Process Inventory assuming Bentley uses first-in, first-out (FIFO) process costing? Note: Round costs per equivalent unit to two decimal places. O O $192.900 O $190,350 O Units $190,320 18,000 104,000 28,000 $198.820 Q Search < Prev 3 or 10 Nerty> LDC L (DELL

Bentley Enterprises uses process costing to control costs in the manufacture of Dust Sensors for the mining Industry. The following Information pertains to operations for November. (CMA adapted) work in process, November 1st started in production during November work in process, November 30th The beginning Inventory was 60% complete as to materials and 20% complete as to conversion costs. The ending Inventory was 90% complete as to materials and 40% complete as to conversion cost Costs pertaining to November are as follows: Beginning Inventory: direct materials, $58,560; direct labor, $22,320, manufacturing overhead, $17.240. Costs incurred during the month: direct materials, $487,800; direct labor, $235,280; manufacturing overhead, $443,960 Multiple Choice What are the total costs in the ending Work-In-Process Inventory assuming Bentley uses first-in, first-out (FIFO) process costing? Note: Round costs per equivalent unit to two decimal places. O O $192.900 O $190,350 O Units $190,320 18,000 104,000 28,000 $198.820 Q Search < Prev 3 or 10 Nerty> LDC L (DELL

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:80007 ACG3343 2023 X M Question 3- Chapter X

d

-8 Quiz i

https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F...

work in process, November 1st

started in production during November

Work in process, November 30th

Bentley Enterprises uses process costing to control costs in the manufacture of Dust Sensors for the mining Industry. The following Information pertains to operations for November. (CMA adapted)

F1

Multiple Choice

OOOO

The beginning Inventory was 60% complete as to materials and 20% complete as to conversion costs. The ending Inventory was 90% complete as to materials and 40% complete as to conversion costs.

Costs pertaining to November are as follows:

Beginning Inventory: direct materials, $58,560; direct labor, $22,320; manufacturing overhead, $17,240.

Costs incurred during the month: direct materials, $487,800; direct labor, $235,280; manufacturing overhead, $443,960.

What are the total costs in the ending Work-In-Process Inventory assuming Bentley uses first-In, first-out (FIFO) process costing?

Note: Round costs per equivalent unit to two decimal places.

$190,350

$192,900

$188,328

$188.820

J

2

F2

F3

#3

F4

Exercises

Units

18,000

104,000

28,000

$

4

Q Search

DE

xb Home | bartleby

F5

%

5

F6

Seved

< Prev 3 or 10

A

G

MA L DCL

F7

8

x M Question 3 - Chapter X b Success Confin

Q A ☆

30

&

7

Next >

F8

*

6

F9

prt sc

(DELL)

F10

(

S

home

F11

1

end

F12

Expert Solution

Step 1: Introduction of process costing and equivalent unit

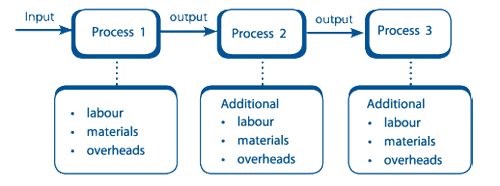

Process Costing :

Operation costing method employed to determine the value of a product at each process or stage of the production process, applicable where goods produced from a series of continuous operations or procedures. Process costing is employed by businesses that manufacture goods and where production is in repetitive inflow.

Equivalent Units

Equivalent Units: These are the units which are partially completed, to arriving at the correct cost we may calculate the equivalent units.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education