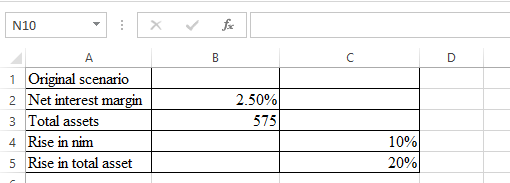

Banque du Langenberg holds $575 million interest producing assets earning a net interest margin (NIM) of 2.50%. The inital net interest income is thus $14.375 million. The bank's President pursues a strategy of holding longer dated, higher risk assets while also increasing leverage and as a result the net interest margin expands by 25 basis points (or 10% on 2.50%) and the | total asset base increases by 20%. What is the new net interest income? Original scenario Net interest margin Total assets (millions) Rise in nim Rise in total assets Original New scenario Scenario Net interest margin 0.00% 0.00% Total assets $0 $0 Rise in nim 0.0% Rise in total assets 0.0% Net interest income $0.000 $0.000

Banque du Langenberg holds $575 million interest producing assets earning a net interest margin (NIM) of 2.50%. The inital net interest income is thus $14.375 million. The bank's President pursues a strategy of holding longer dated, higher risk assets while also increasing leverage and as a result the net interest margin expands by 25 basis points (or 10% on 2.50%) and the | total asset base increases by 20%. What is the new net interest income? Original scenario Net interest margin Total assets (millions) Rise in nim Rise in total assets Original New scenario Scenario Net interest margin 0.00% 0.00% Total assets $0 $0 Rise in nim 0.0% Rise in total assets 0.0% Net interest income $0.000 $0.000

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:**Analysis of Banque du Langenberg's Interest Income Strategy**

Banque du Langenberg holds $575 million in interest-producing assets with an initial net interest margin (NIM) of 2.50%, resulting in a net interest income of $14.375 million.

**Strategic Changes:**

- The bank’s President proposes a strategy involving the acquisition of longer-dated and higher-risk assets.

- This is anticipated to increase the NIM by 25 basis points (a 10% increase from the original 2.50%).

- Additionally, the total asset base is expected to grow by 20%.

**Table Analysis:**

The table outlines two scenarios:

1. **Original Scenario:**

- Net interest margin and total assets are left unspecified beyond the given context ($14.375 million on $575 million at 2.50% NIM).

2. **New Scenario:**

- With the strategic changes, key calculations would include:

- New NIM: 2.50% + 0.25% = 2.75%

- New Total Assets: $575 million + 20% increase = $690 million

- New Net Interest Income: 2.75% of $690 million

Currently, these calculations are left blank in the table but are crucial for understanding the financial impact of the proposed strategy.

Expert Solution

Step 1

Computation:

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education