As the owner of a successful business, you have just purchased an additional type of property insurance coverage known as business interruption insurance. This insurance protects the profits that a company would have earned had there been no problem. Business interruption insurance covers damages caused by all types of perils, such as fires, tornadoes, hurricanes, lightning, or any other disaster except floods and earthquakes. This insurance pays for "economic" losses incurred when business operations suddenly cease. These include loss of income due to the interruption and additional expenses (e.g., leases; relocation to temporary facilities; overtime to keep up with production demands; recompiling of business, financial, and legal records; and even the salaries of key employees). Your coverage provides insurance reimbursement for 80% of any losses. Your company pays the other 20%. The annual premium is 4% of the income and extra expenses that you insure. (a)If you have purchased coverage amounting to $40,000 per month, what is the amount of your annual premium (in $)? $ (b)If a tornado put your company out of business for 4 1 2 months, what would be the amount of the insurance reimbursement for your economic loss (in $)? $

As the owner of a successful business, you have just purchased an additional type of property insurance coverage known as business interruption insurance. This insurance protects the profits that a company would have earned had there been no problem. Business interruption insurance covers damages caused by all types of perils, such as fires, tornadoes, hurricanes, lightning, or any other disaster except floods and earthquakes. This insurance pays for "economic" losses incurred when business operations suddenly cease. These include loss of income due to the interruption and additional expenses (e.g., leases; relocation to temporary facilities; overtime to keep up with production demands; recompiling of business, financial, and legal records; and even the salaries of key employees). Your coverage provides insurance reimbursement for 80% of any losses. Your company pays the other 20%. The annual premium is 4% of the income and extra expenses that you insure. (a)If you have purchased coverage amounting to $40,000 per month, what is the amount of your annual premium (in $)? $ (b)If a tornado put your company out of business for 4 1 2 months, what would be the amount of the insurance reimbursement for your economic loss (in $)? $

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

100%

As the owner of a successful business, you have just purchased an additional type of property insurance coverage known as business interruption insurance. This insurance protects the profits that a company would have earned had there been no problem. Business interruption insurance covers damages caused by all types of perils, such as fires, tornadoes, hurricanes, lightning, or any other disaster except floods and earthquakes.

This insurance pays for "economic" losses incurred when business operations suddenly cease. These include loss of income due to the interruption and additional expenses (e.g., leases; relocation to temporary facilities; overtime to keep up with production demands; recompiling of business, financial, and legal records; and even the salaries of key employees).

Your coverage provides insurance reimbursement for 80% of any losses. Your company pays the other 20%. The annual premium is 4% of the income and extra expenses that you insure.

(a)If you have purchased coverage amounting to $40,000 per month, what is the amount of your annual premium (in $)?

$

(b)If a tornado put your company out of business for

4

months, what would be the amount of the insurance reimbursement for your economic loss (in $)?| 1 |

| 2 |

$

Expert Solution

Step 1

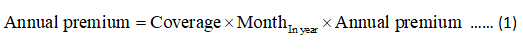

Annual premium can be calculated by using the following formula.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education