2. As the supervisor of a facilities engineering department, you consider mobile cranes to be critical equipment. The purchase of a new medium-sized, truck-mounted crane is being evaluated. The economic estimates for the two best alternatives are shown in the following table. Capital investment Annual expenses" Useful life (years) Market value (at end of life) Alternatives A B $272,000 $346,000 28,800 19,300 6 $25,000 $40,000 "Excludes the cost of an operator, which is the same for both alternatives. You have selected the longest useful life (nine years) for the study period and would lease a crane

2. As the supervisor of a facilities engineering department, you consider mobile cranes to be critical equipment. The purchase of a new medium-sized, truck-mounted crane is being evaluated. The economic estimates for the two best alternatives are shown in the following table. Capital investment Annual expenses" Useful life (years) Market value (at end of life) Alternatives A B $272,000 $346,000 28,800 19,300 6 $25,000 $40,000 "Excludes the cost of an operator, which is the same for both alternatives. You have selected the longest useful life (nine years) for the study period and would lease a crane

Introductory Circuit Analysis (13th Edition)

13th Edition

ISBN:9780133923605

Author:Robert L. Boylestad

Publisher:Robert L. Boylestad

Chapter1: Introduction

Section: Chapter Questions

Problem 1P: Visit your local library (at school or home) and describe the extent to which it provides literature...

Related questions

Question

I need help with this problem. Steps of what's going on would be helpful. Please and thank you!

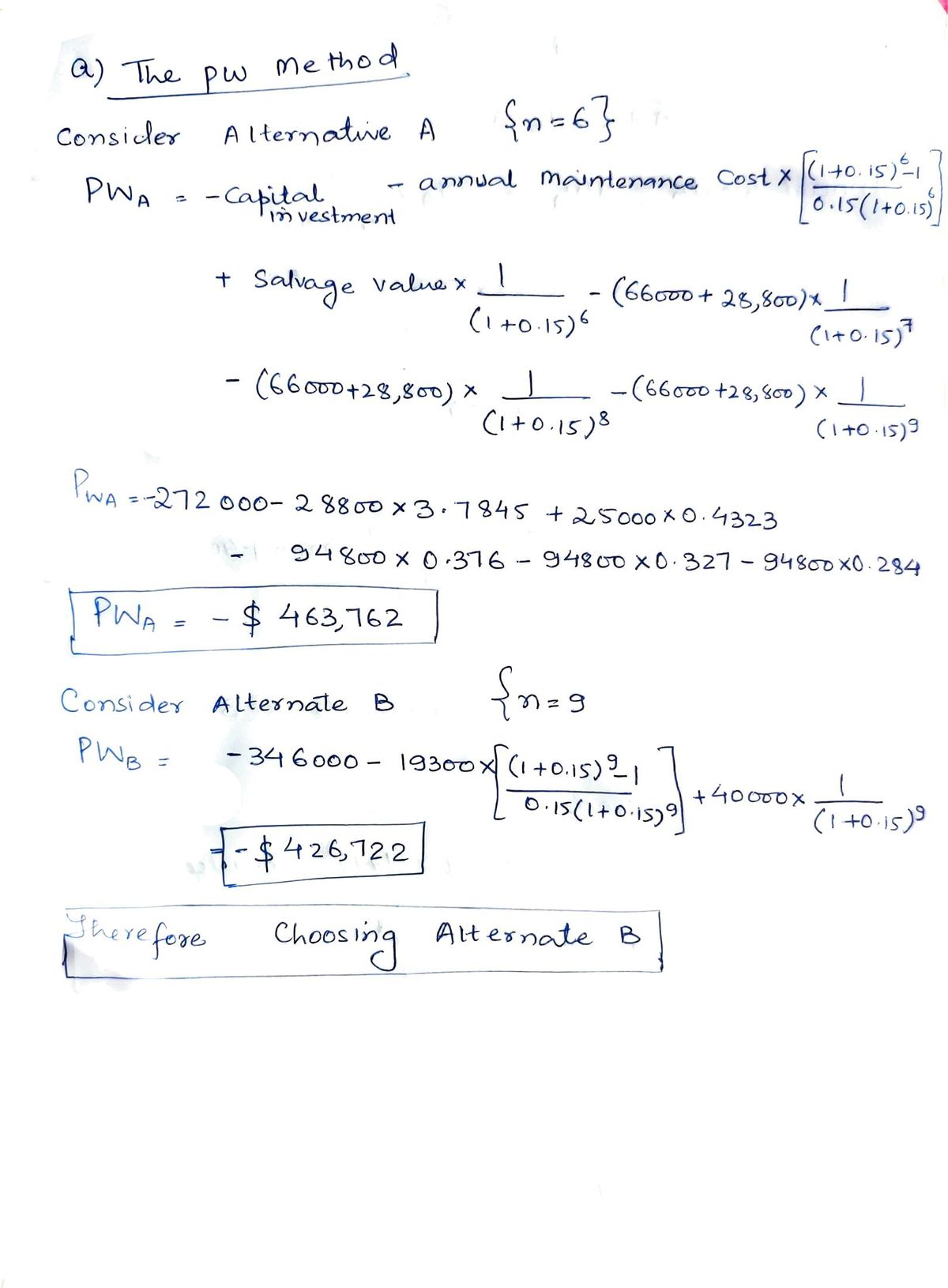

Transcribed Image Text:### Equipment Evaluation: Economic Analysis of Mobile Crane Alternatives

#### Background:

As the supervisor of a facilities engineering department, selecting the right mobile crane is crucial. This analysis involves comparing two truck-mounted crane alternatives, A and B, based on economic estimates.

#### Economic Estimates:

| Alternatives | A | B |

|---------------|---------|---------|

| Capital Investment | $272,000 | $346,000 |

| Annual Expenses† | $28,800 | $19,300 |

| Useful Life (years) | 6 | 9 |

| Market Value (end of life) | $25,000 | $40,000 |

† Note: Annual expenses exclude the cost of an operator, which remains constant across both alternatives.

#### Scenario Analysis:

- The study period uses the longest useful life, i.e., nine years.

- For Alternative A, leasing a crane for the final three years is considered.

- Estimated annual leasing cost in this scenario is $66,000 (plus $28,800 annual expenses for each year).

- The Minimum Attractive Rate of Return (MARR) is 15% per year.

#### Problem Tasks:

1. **Present Worth (PW) Method Analysis:** Determine if selection differs from other methods.

2. **Internal Rate of Return (IRR) Method Analysis:** Analyze to confirm the selection.

3. **External Rate of Return (ERR) Method Analysis:** Verify consistent selection.

4. **Cost Analysis for Crane A:** Evaluate if leasing Crane A for nine years remains optimal, considering all costs against MARR = 15%.

These analytical approaches help ensure the most economically viable decision is made for the department’s operational efficiency.

Expert Solution

Step 1

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, electrical-engineering and related others by exploring similar questions and additional content below.Recommended textbooks for you

Introductory Circuit Analysis (13th Edition)

Electrical Engineering

ISBN:

9780133923605

Author:

Robert L. Boylestad

Publisher:

PEARSON

Delmar's Standard Textbook Of Electricity

Electrical Engineering

ISBN:

9781337900348

Author:

Stephen L. Herman

Publisher:

Cengage Learning

Programmable Logic Controllers

Electrical Engineering

ISBN:

9780073373843

Author:

Frank D. Petruzella

Publisher:

McGraw-Hill Education

Introductory Circuit Analysis (13th Edition)

Electrical Engineering

ISBN:

9780133923605

Author:

Robert L. Boylestad

Publisher:

PEARSON

Delmar's Standard Textbook Of Electricity

Electrical Engineering

ISBN:

9781337900348

Author:

Stephen L. Herman

Publisher:

Cengage Learning

Programmable Logic Controllers

Electrical Engineering

ISBN:

9780073373843

Author:

Frank D. Petruzella

Publisher:

McGraw-Hill Education

Fundamentals of Electric Circuits

Electrical Engineering

ISBN:

9780078028229

Author:

Charles K Alexander, Matthew Sadiku

Publisher:

McGraw-Hill Education

Electric Circuits. (11th Edition)

Electrical Engineering

ISBN:

9780134746968

Author:

James W. Nilsson, Susan Riedel

Publisher:

PEARSON

Engineering Electromagnetics

Electrical Engineering

ISBN:

9780078028151

Author:

Hayt, William H. (william Hart), Jr, BUCK, John A.

Publisher:

Mcgraw-hill Education,