Concept explainers

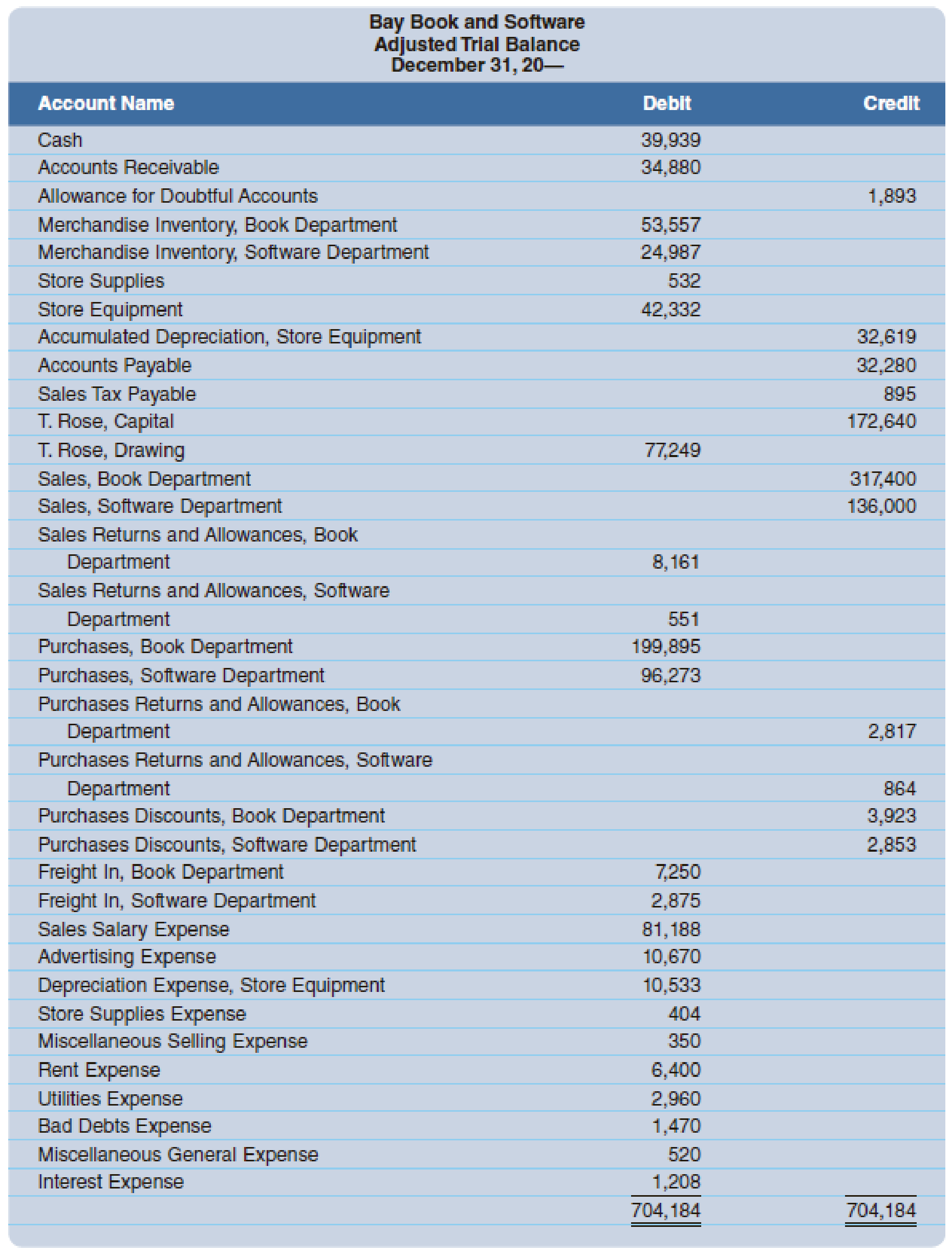

Bay Book and Software has two sales departments: Book and Software. After recording and posting all adjustments, including the adjustments for merchandise inventory, the accountant prepared the adjusted

Merchandise inventories at the beginning of the year were as follows: Book Department, $53,410; Software Department, $23,839. The bases (and sources of figures) for apportioning expenses to the two departments are as follows (rounded to the nearest dollar):

- Sales Salary Expense (payroll register): Book Department, $45,559; Software Department, $35,629

- Advertising Expense (newspaper column inches): Book Department, 550 inches; Software Department, 450 inches

- Depreciation Expense, Store Equipment (property and equipment ledger): Book Department, $7,851; Software Department, $2,682

- Store Supplies Expense (requisitions): Book Department, $205; Software Department, $199

- Miscellaneous Selling Expense (volume of gross sales): Book Department, $240; Software Department, $110

- Rent Expense and Utilities Expense (floor space): Book Department, 9,000 square feet; Software Department, 7,000 square feet

Bad Debts Expense (volume of gross sales): Book Department, $1,029; Software Department, $441- Miscellaneous General Expense (volume of gross sales): Book Department, $364; Software Department, $156

Required

Prepare an income statement by department to show income from operations, as well as a nondepartmentalized income statement (using the Total columns) to show net income for the entire company.

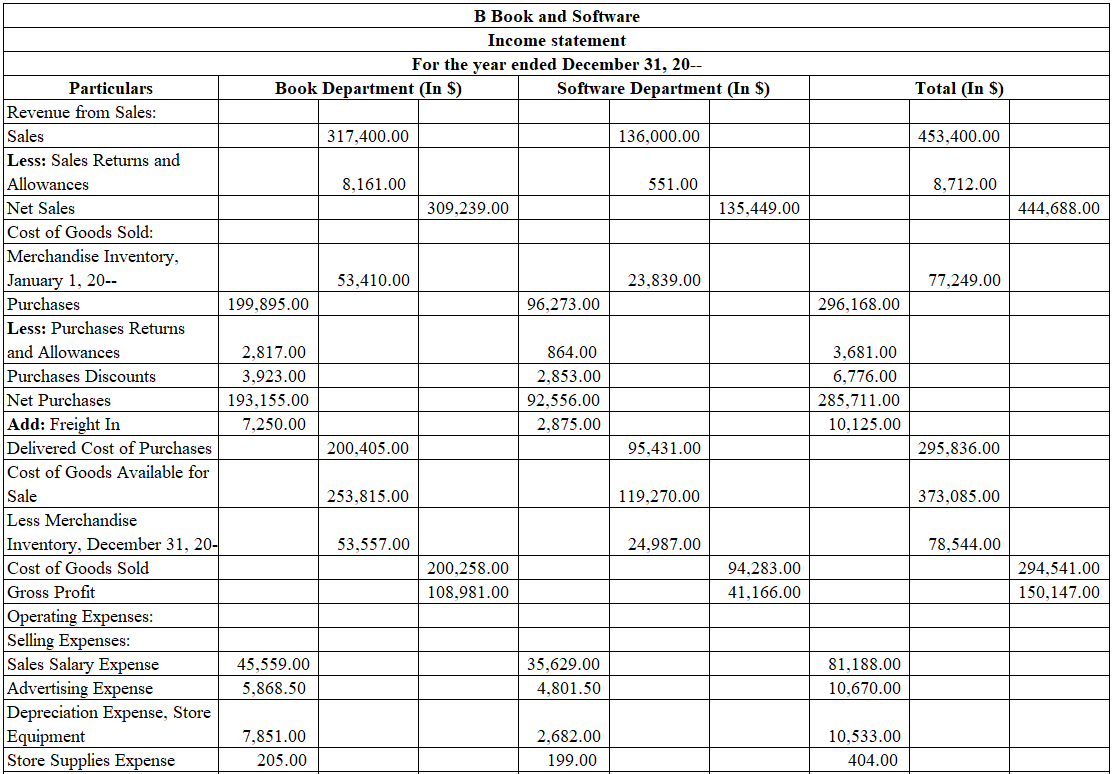

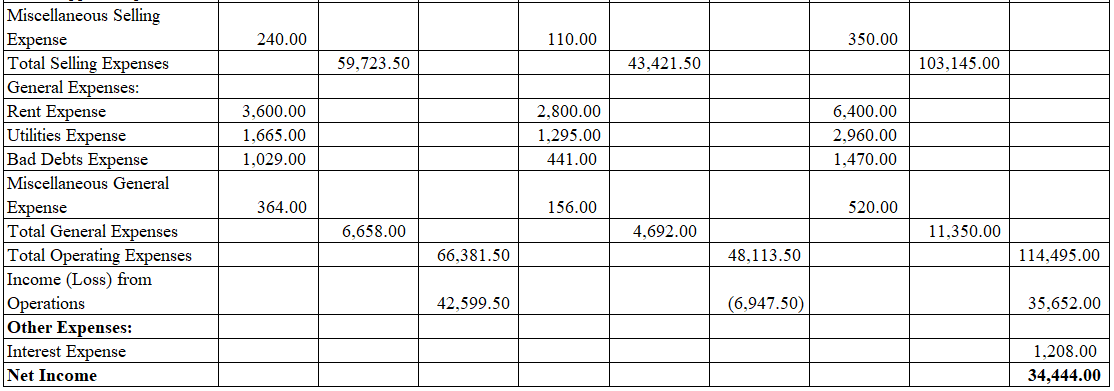

Prepare an income statement for B Book and Software by department, and non-departmentalized (total) income statement for the year ended December 31, 20--.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for B Book and Software by department, and non-departmentalized (total) income statement for the year ended December 31, 20--.

Table (1)

Thus, the income statement of B Book and Software for the year ended December 31, 20—reports income from operations of $42,599.50 for Book Department, and loss from operations of $6,947.50 for Software Department, and total net income of $34,444.00.

Want to see more full solutions like this?

Chapter E Solutions

Bundle: College Accounting: A Career Approach (with QuickBooks Online), Loose-leaf Version, 13th + LMS Integrated CengageNOWV2, 1 term (6 months) Printed Access

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Intermediate Accounting (2nd Edition)

Financial Accounting, Student Value Edition (5th Edition)

Operations Management

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Essentials of MIS (13th Edition)

- Zendta Corporation, a firm with no net debt, reports cash flow from operations of $5,120 million in its cash flow statement after adding $1,750 million in accruals to earnings. It reported cash investments in operations of $3,025 million. What were Zendta Corporation's free cash flow and earnings for the period?arrow_forwardHow will net income be affected for this financial accounting question?arrow_forwardIf Nixon Corporation had a net income of $420,000 in 2018 and it experienced a 19.8% increase in net income for 2019, what is its net income for 2019?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,