Concept explainers

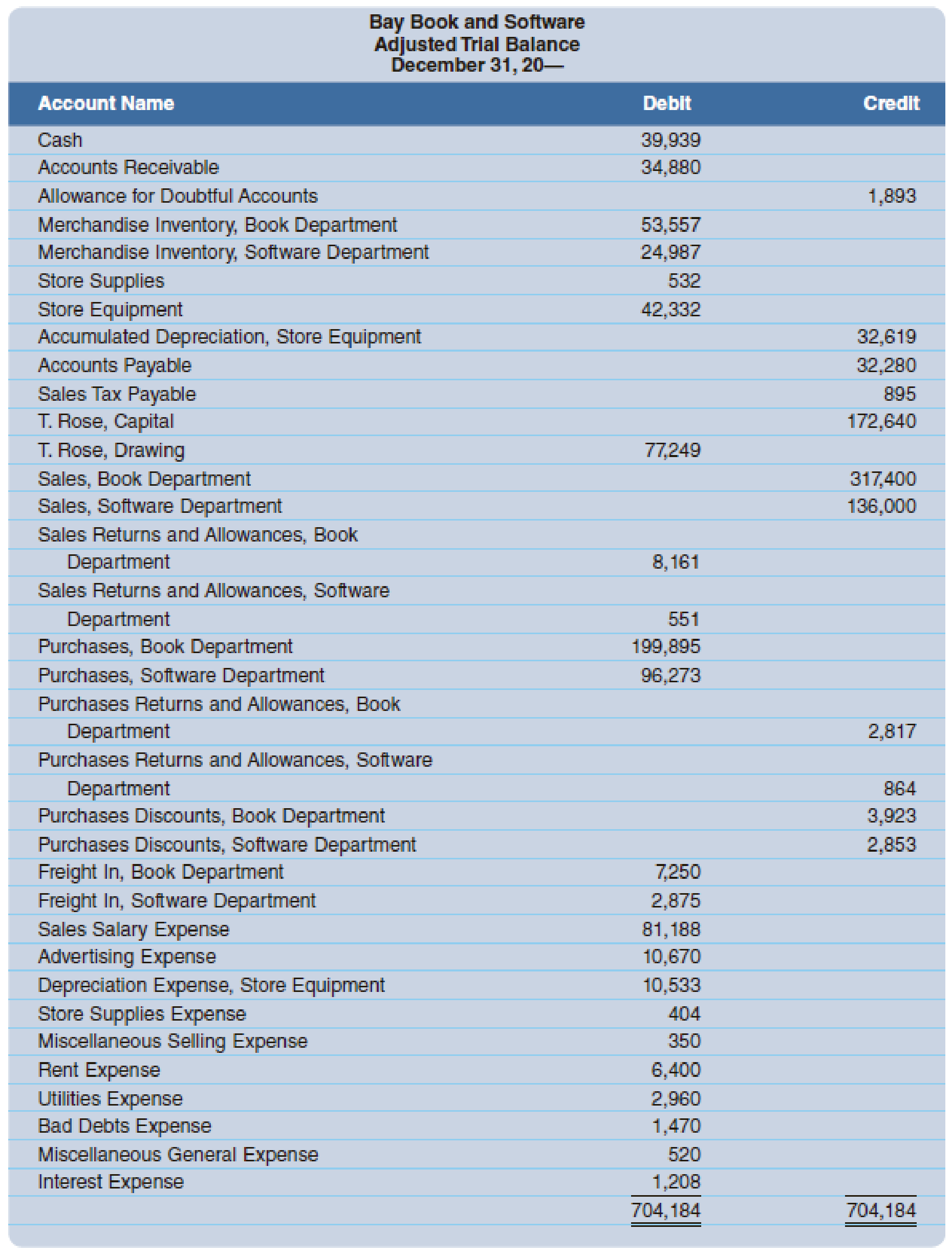

Bay Book and Software has two sales departments: Book and Software. After recording and posting all adjustments, including the adjustments for merchandise inventory, the accountant prepared the adjusted

Merchandise inventories at the beginning of the year were as follows: Book Department, $53,410; Software Department, $23,839. The bases (and sources of figures) for apportioning expenses to the two departments are as follows (rounded to the nearest dollar):

- Sales Salary Expense (payroll register): Book Department, $45,559; Software Department, $35,629

- Advertising Expense (newspaper column inches): Book Department, 550 inches; Software Department, 450 inches

- Depreciation Expense, Store Equipment (property and equipment ledger): Book Department, $7,851; Software Department, $2,682

- Store Supplies Expense (requisitions): Book Department, $205; Software Department, $199

- Miscellaneous Selling Expense (volume of gross sales): Book Department, $240; Software Department, $110

- Rent Expense and Utilities Expense (floor space): Book Department, 9,000 square feet; Software Department, 7,000 square feet

Bad Debts Expense (volume of gross sales): Book Department, $1,029; Software Department, $441- Miscellaneous General Expense (volume of gross sales): Book Department, $364; Software Department, $156

Required

Prepare an income statement by department to show income from operations, as well as a nondepartmentalized income statement (using the Total columns) to show net income for the entire company.

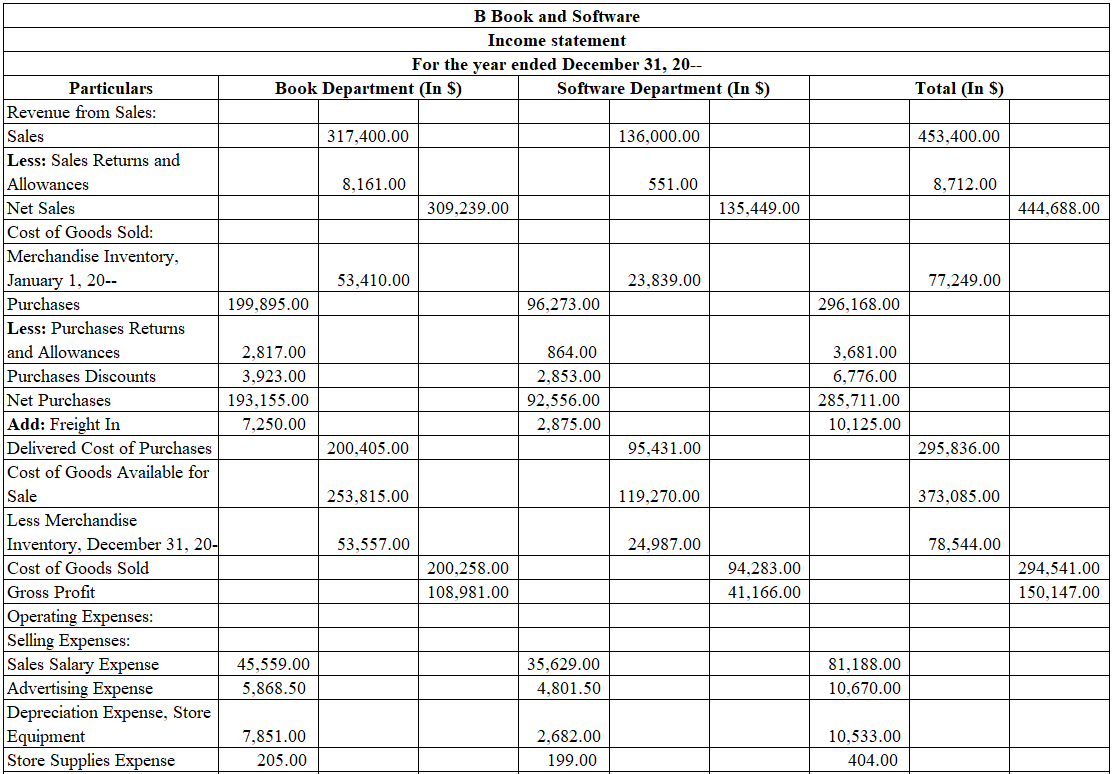

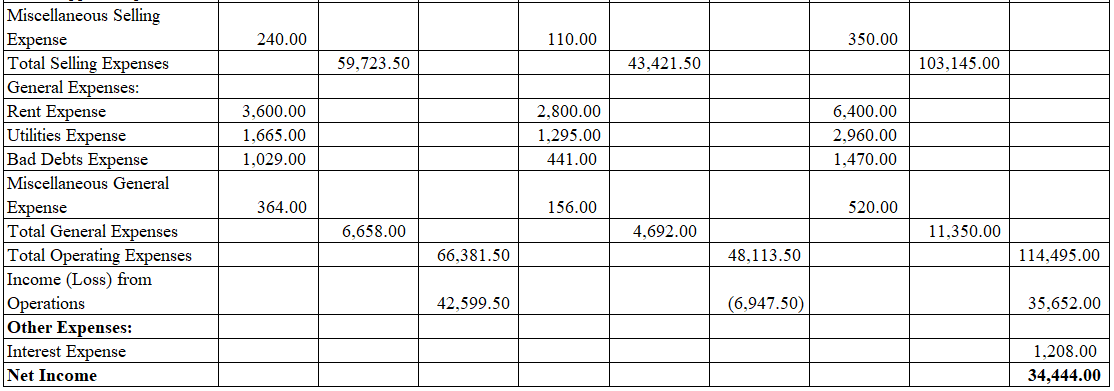

Prepare an income statement for B Book and Software by department, and non-departmentalized (total) income statement for the year ended December 31, 20--.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for B Book and Software by department, and non-departmentalized (total) income statement for the year ended December 31, 20--.

Table (1)

Thus, the income statement of B Book and Software for the year ended December 31, 20—reports income from operations of $42,599.50 for Book Department, and loss from operations of $6,947.50 for Software Department, and total net income of $34,444.00.

Want to see more full solutions like this?

Chapter E Solutions

College Accounting: A Career Approach (with Quickbooks Online), Loose-leaf Version

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Intermediate Accounting (2nd Edition)

Financial Accounting, Student Value Edition (5th Edition)

Operations Management

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Essentials of MIS (13th Edition)

- L.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7. In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question: Now assume that 5% of the L.L. Bean boots are returned by customers for various reasons. L. Bean has a 100% refund policy for returns, no matter what the reason. What would the journal entry be to accrue L.L. Bean's sales returns for this one pair of boots?arrow_forwardThe following data were taken from the records of Splish Brothers Company for the fiscal year ended June 30, 2025. Raw Materials Inventory 7/1/24 $58,100 Accounts Receivable $28,000 Raw Materials Inventory 6/30/25 46,600 Factory Insurance 4,800 Finished Goods Inventory 7/1/24 Finished Goods Inventory 6/30/25 99,700 Factory Machinery Depreciation 17,100 21,900 Factory Utilities 29,400 Work in Process Inventory 7/1/24 21,200 Office Utilities Expense 9,350 Work in Process Inventory 6/30/25 29,400 Sales Revenue 560,500 Direct Labor 147,550 Sales Discounts 4,700 Indirect Labor 25,360 Factory Manager's Salary 63,400 Factory Property Taxes 9,910 Factory Repairs 2,500 Raw Materials Purchases 97,300 Cash 39,200 SPLISH BROTHERS COMPANY Income Statement (Partial) $arrow_forwardNo AIarrow_forward

- L.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7.In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question: Assume that a pair of 8" Bean Boots are ordered on December 3, 2015. The order price is $109. The sales tax rate in the state in which the boots are order is 7%. L.L. Bean ships the boots on January 29, 2016. Assume same-day shipping for the sake of simplicity. On what day would L.L. Bean recognize the…arrow_forwardFinancial accounting questionarrow_forward2 Questionarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,