Concept explainers

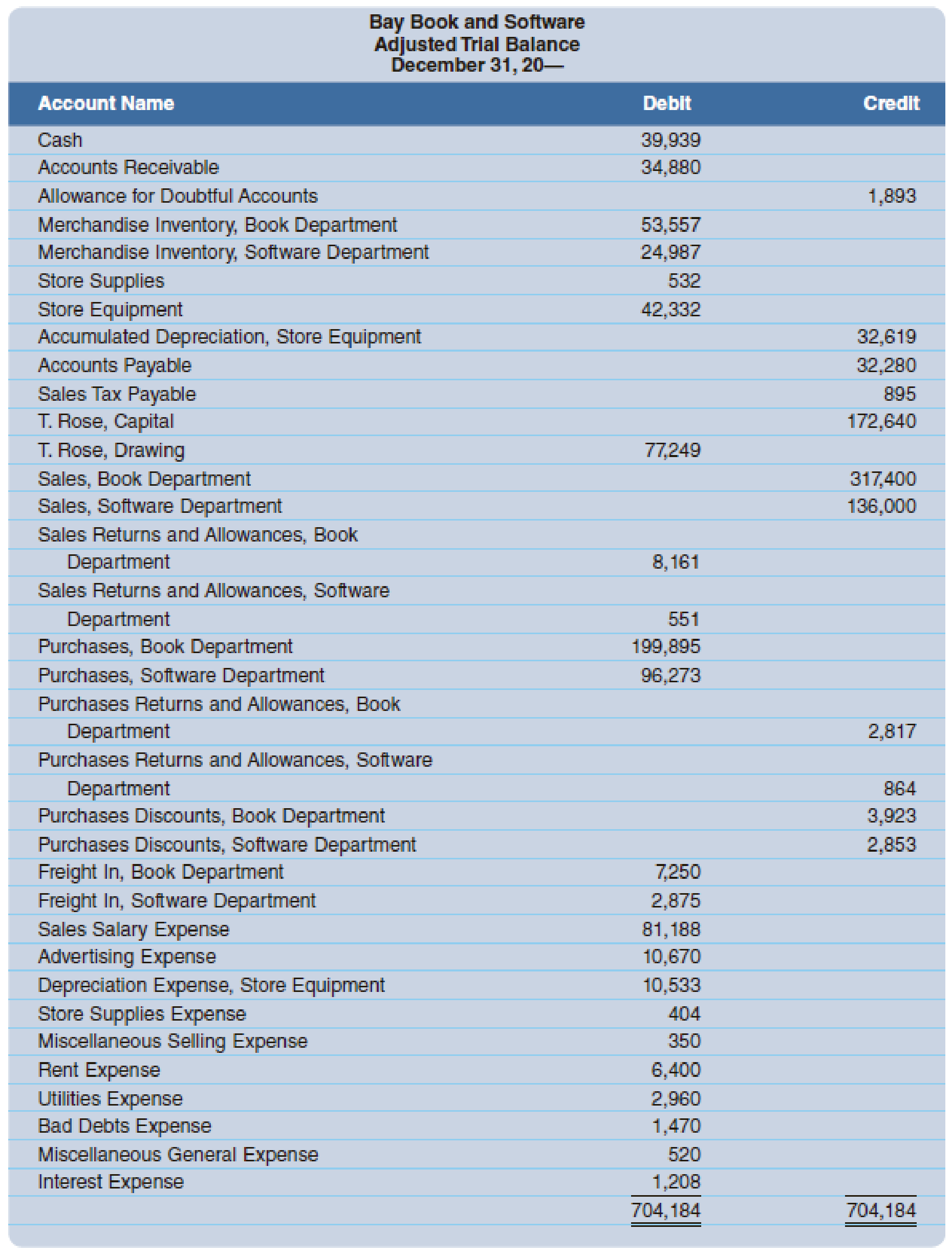

Bay Book and Software has two sales departments: Book and Software. After recording and posting all adjustments, including the adjustments for merchandise inventory, the accountant prepared the adjusted

Merchandise inventories at the beginning of the year were as follows: Book Department, $53,410; Software Department, $23,839. The bases (and sources of figures) for apportioning expenses to the two departments are as follows (rounded to the nearest dollar):

- Sales Salary Expense (payroll register): Book Department, $45,559; Software Department, $35,629

- Advertising Expense (newspaper column inches): Book Department, 550 inches; Software Department, 450 inches

Depreciation Expense, Store Equipment (property and equipment ledger): Book Department, $7,851; Software Department, $2,682- Store Supplies Expense (requisitions): Book Department, $205; Software Department, $199

- Miscellaneous Selling Expense (volume of gross sales): Book Department, $240; Software Department, $110

- Rent Expense and Utilities Expense (floor space): Book Department, 9,000 square feet; Software Department, 7,000 square feet

Bad Debts Expense (volume of gross sales): Book Department, $1,029; Software Department, $441- Miscellaneous General Expense (volume of gross sales): Book Department, $364; Software Department, $156

Required

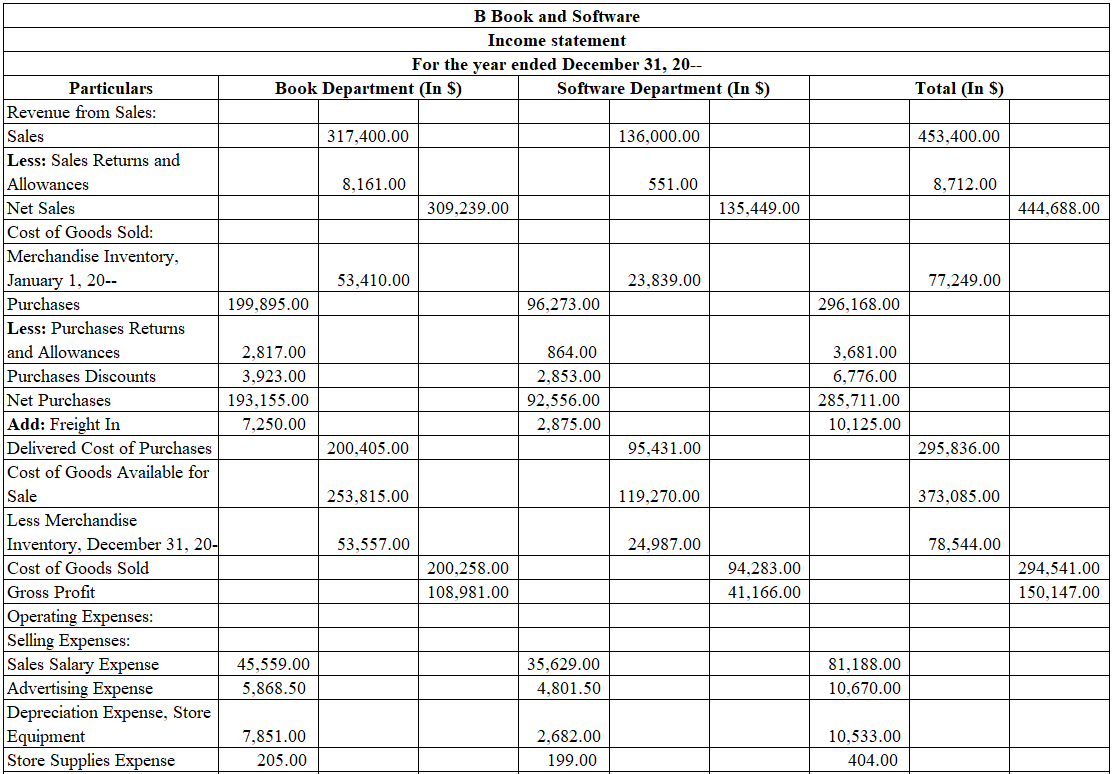

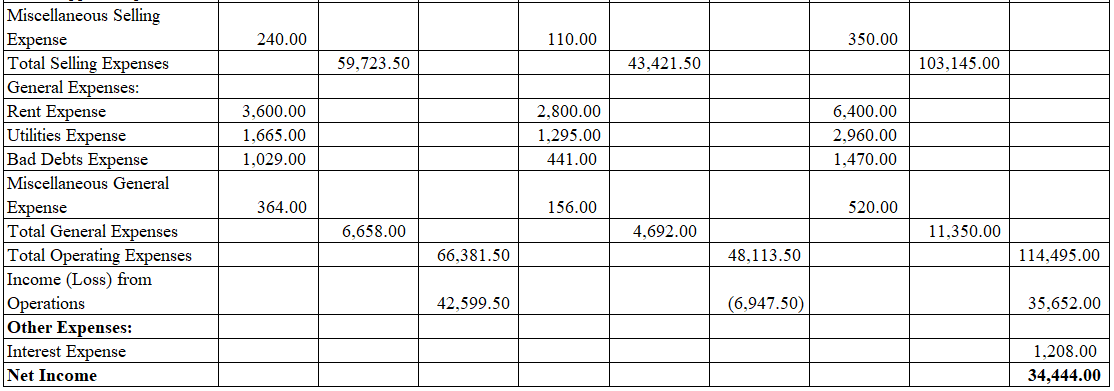

Prepare an income statement by department to show income from operations, as well as a nondepartmentalized income statement (using the Total columns) to show net income for the entire company.

Prepare an income statement for B Book and Software by department, and non-departmentalized (total) income statement for the year ended December 31, 20--.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for B Book and Software by department, and non-departmentalized (total) income statement for the year ended December 31, 20--.

Table (1)

Thus, the income statement of B Book and Software for the year ended December 31, 20—reports income from operations of $42,599.50 for Book Department, and loss from operations of $6,947.50 for Software Department, and total net income of $34,444.00.

Want to see more full solutions like this?

Chapter E Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Intermediate Accounting (2nd Edition)

Financial Accounting, Student Value Edition (5th Edition)

Operations Management

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Essentials of MIS (13th Edition)

- Richard has the following potential liabilities: William, a former employee, has sued Richard for $880,000. Richard contacted his attorney, and the case is believed to be frivolous. Carter sued Richard for an undisclosed amount for a class action lawsuit. Richard thinks it's frivolous, but his attorneys indicate a loss is probable for $88,000. Charles sued Richard because he slipped outside of Richard's store. The claim is $264,000 and Richard is certain he will lose the case but believes Charles will settle. The attorneys agree and based on conversations with Charles's attorneys, have stated that it is remote the claim will be settled for $255,200. Charles's attorneys indicated he would be willing to accept either cash of $242,000 or shares of Richard's closely-held common stock currently valued at $233,200. Richard would prefer not to settle in cash. Richard is suing William for $264,000 because William is in violation of a non-compete agreement he has with Richard. Richard is…arrow_forwardNeed answer the financial accounting question not use aiarrow_forwardHow much were SMS's liabilities on these general accounting question?arrow_forward

- I cannot figure out the account of "Goodwill" or "APIC from Pushdown Accounting." I thought APIC should be $285,000, but it didn't work for some reason. And I didn't know we had goodwill, but we do, and I can't figure out how to get the correct answer. I tried $350,000 for APIC, but that also doesn't work, and I am at a loss of what to do next. Please explain as clearly as possible how to do Goodwill and the APIC from Pushdown Accounting. Thanks so much! :)arrow_forwardNonearrow_forwardHii tutor please given answer general Accounting questionarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,