Managerial Accounting

6th Edition

ISBN: 9781259726972

Author: John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter D, Problem 5PSA

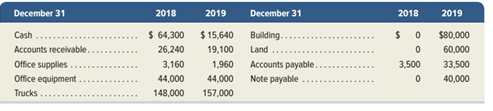

The accounting records of Nettle Distribution show the following assets and liabilities as of December 31,

. Required

- Prepare balance sheets for the business as of December 31,2018 and 2019. Hint: Report only total equity on the

balance sheet and remember that total equity equals the difference between assets and liabilities. - Compute net income for 2019 by comparing total equity amounts for these two years and using the following information: During 2019, the owner invested $35,000 additional cash in the business (in exchange for common stock) and the company paid a $19,000 cash dividend.

- Compute the 2019 year-end debt ratio (in percent and rounded to one decimal).

Problem D-5A

Computing net income from equity analysis, preparing a balance sheet and computing the debt ratio

C2 A1 A2 P3

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Daley Industries wishes to develop a single predetermined overhead rate. The company's expected annual fixed overhead is $420,000, and its variable overhead cost per machine hour is $3.25. The company's relevant range is from 200,000 to 650,000 machine hours. Daley expects to operate at 520,000 machine hours for the coming year. The plant's theoretical capacity is 850,000 machine hours. The predetermined overhead rate per machine hour should be: a. $3.85 b. $4.06 c. $3.75 d. $4.25

Need accounting question

What is the total manufacturing costs charged to work in process during November

Chapter D Solutions

Managerial Accounting

Ch. D - Prob. 1DQCh. D - Prob. 2DQCh. D - Prob. 3DQCh. D - Prob. 4DQCh. D - Are debits or credits typically listed first in...Ch. D - Should a transaction be recorded first in a...Ch. D - Prob. 7DQCh. D - Why does the reeordkeeper prepare a trial balance?Ch. D - Prob. 9DQCh. D - Prob. 10DQ

Ch. D - Prob. 11DQCh. D - Prob. 12DQCh. D - Prob. 13DQCh. D - Define (a) assets, (b) liabilities, and (c) equityCh. D - Prob. 15DQCh. D - Review the Apple balance sheet Appendix A....Ch. D - Review the Google balance sheet in Appendix A....Ch. D - Prob. 18DQCh. D - Identify the items from the following list that...Ch. D - Prob. 2QSCh. D - Prob. 3QSCh. D - Identify the normal balance (debit or credit) for...Ch. D - Prob. 5QSCh. D - Prob. 6QSCh. D - Prob. 7QSCh. D - A trial balance has total debits of $20,000 and...Ch. D - Prob. 9QSCh. D - Prob. 10QSCh. D - Prob. 11QSCh. D - Prob. 12QSCh. D - Prob. 13QSCh. D - Prob. 14QSCh. D - Prob. 15QSCh. D - Order the following steps in the accounting...Ch. D - Prob. 2ECh. D - Enter the number for the item that best completes...Ch. D - For each of the following, (1) identify the type...Ch. D - Prob. 5ECh. D - Prob. 6ECh. D - Prepare general journal entries for the following...Ch. D - Prob. 8ECh. D - Prob. 9ECh. D - Prob. 10ECh. D - Prob. 11ECh. D - 1. Prepare general journal entries for the...Ch. D - Prob. 13ECh. D - Prob. 14ECh. D - A corporation had the following assets and...Ch. D - Carmen Camry operates a consulting firm called...Ch. D - Prob. 17ECh. D - Prob. 18ECh. D - Prob. 19ECh. D - Prob. 20ECh. D - You are told the column totals in a trial balance...Ch. D - Exercise D-22 Calculating and interprets the debt...Ch. D - Prob. 23ECh. D - Prob. 1PSACh. D - Prob. 2PSACh. D - Denzel Brooks opened a web consulting business...Ch. D - Prob. 4PSACh. D - The accounting records of Nettle Distribution show...Ch. D - Prob. 6PSACh. D - Prob. 7PSACh. D - Prob. 1PSBCh. D - Prob. 2PSBCh. D - Prob. 3PSBCh. D - Prob. 4PSBCh. D - Prob. 5PSBCh. D - Prob. 6PSBCh. D - Prob. 7PSBCh. D - Prob. 1SPCh. D - Prob. 2SPCh. D - Prob. 3SPCh. D - Prob. 1GLPCh. D - Prob. 2GLPCh. D - Prob. 3GLPCh. D - Prob. 4GLPCh. D - Prob. 5GLPCh. D - Prob. 6GLPCh. D - Prob. 7GLPCh. D - Using transactions from the following assignments...Ch. D - Prob. 1AACh. D - Prob. 2AACh. D - Prob. 3AACh. D - Prob. 1BTNCh. D - Prob. 2BTNCh. D - Prob. 3BTNCh. D - The expanded accounting equation consists of...Ch. D - Prob. 5BTNCh. D - Prob. 6BTNCh. D - Prob. 7BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which accounting concept supports recording bad debt expense before accounts are actually uncollectible? a) Full disclosure principle b) Matching principle c) Going concern concept d) Materiality concept need answerarrow_forwardCan you explain the correct approach to solve this financial accounting question?arrow_forwardsubject=general accountingarrow_forward

- Rose Equipment Corporation (LEC) paid $6,800 for direct materials and $11,500 for production workers' wages. Lease payments and utilities on the production facilities amounted to $7,400, while general, selling, and administrative expenses totaled $4,200. The company produced 7,500 units and sold 5,900 units at a price of $7.75 per unit. What was LEC's net income for the first year in operation? Need answerarrow_forwardSolve with explanation and accountingarrow_forward6 PTSarrow_forward

- Daniil Consulting is a consulting firm. The firm expects to have $64,500 in indirect costs during the year and bill customers for 8,600 hours. The cost of direct labor is $85 per hour.1. Calculate the predetermined overhead allocation rate for Daniil Consulting. 2. Daniil completed a consulting job for Sarah Miller and billed the customer for 22 hours. What was the total cost of the consulting? 3. If Daniil wants to earn a profit equal to 80% of the cost of a job, how much should the company charge Ms. Miller?arrow_forwardSales uncollected equals how many days?arrow_forwardSolve my problemarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License