Managerial Accounting

6th Edition

ISBN: 9781259726972

Author: John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter D, Problem 16E

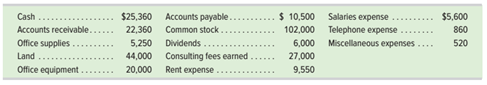

Carmen Camry operates a consulting firm called Help Today, which began operations on August 1. On August 31, the company’s records show the following selected accounts and amounts for the month of August. Use this information to prepare an August income statement for the business

Exercise D-16

Preparing an income statement C3 P3

Check Net income, $10,470

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025.

1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business.

2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful.

3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years.

4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029.

5.) Oriole incurred $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…

Reffering to fair value of an asset, division, or organization, What exactly is fair value and how is it assessed?

The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025.

1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business.

2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful.

3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years.

4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred

5.) $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…

Chapter D Solutions

Managerial Accounting

Ch. D - Prob. 1DQCh. D - Prob. 2DQCh. D - Prob. 3DQCh. D - Prob. 4DQCh. D - Are debits or credits typically listed first in...Ch. D - Should a transaction be recorded first in a...Ch. D - Prob. 7DQCh. D - Why does the reeordkeeper prepare a trial balance?Ch. D - Prob. 9DQCh. D - Prob. 10DQ

Ch. D - Prob. 11DQCh. D - Prob. 12DQCh. D - Prob. 13DQCh. D - Define (a) assets, (b) liabilities, and (c) equityCh. D - Prob. 15DQCh. D - Review the Apple balance sheet Appendix A....Ch. D - Review the Google balance sheet in Appendix A....Ch. D - Prob. 18DQCh. D - Identify the items from the following list that...Ch. D - Prob. 2QSCh. D - Prob. 3QSCh. D - Identify the normal balance (debit or credit) for...Ch. D - Prob. 5QSCh. D - Prob. 6QSCh. D - Prob. 7QSCh. D - A trial balance has total debits of $20,000 and...Ch. D - Prob. 9QSCh. D - Prob. 10QSCh. D - Prob. 11QSCh. D - Prob. 12QSCh. D - Prob. 13QSCh. D - Prob. 14QSCh. D - Prob. 15QSCh. D - Order the following steps in the accounting...Ch. D - Prob. 2ECh. D - Enter the number for the item that best completes...Ch. D - For each of the following, (1) identify the type...Ch. D - Prob. 5ECh. D - Prob. 6ECh. D - Prepare general journal entries for the following...Ch. D - Prob. 8ECh. D - Prob. 9ECh. D - Prob. 10ECh. D - Prob. 11ECh. D - 1. Prepare general journal entries for the...Ch. D - Prob. 13ECh. D - Prob. 14ECh. D - A corporation had the following assets and...Ch. D - Carmen Camry operates a consulting firm called...Ch. D - Prob. 17ECh. D - Prob. 18ECh. D - Prob. 19ECh. D - Prob. 20ECh. D - You are told the column totals in a trial balance...Ch. D - Exercise D-22 Calculating and interprets the debt...Ch. D - Prob. 23ECh. D - Prob. 1PSACh. D - Prob. 2PSACh. D - Denzel Brooks opened a web consulting business...Ch. D - Prob. 4PSACh. D - The accounting records of Nettle Distribution show...Ch. D - Prob. 6PSACh. D - Prob. 7PSACh. D - Prob. 1PSBCh. D - Prob. 2PSBCh. D - Prob. 3PSBCh. D - Prob. 4PSBCh. D - Prob. 5PSBCh. D - Prob. 6PSBCh. D - Prob. 7PSBCh. D - Prob. 1SPCh. D - Prob. 2SPCh. D - Prob. 3SPCh. D - Prob. 1GLPCh. D - Prob. 2GLPCh. D - Prob. 3GLPCh. D - Prob. 4GLPCh. D - Prob. 5GLPCh. D - Prob. 6GLPCh. D - Prob. 7GLPCh. D - Using transactions from the following assignments...Ch. D - Prob. 1AACh. D - Prob. 2AACh. D - Prob. 3AACh. D - Prob. 1BTNCh. D - Prob. 2BTNCh. D - Prob. 3BTNCh. D - The expanded accounting equation consists of...Ch. D - Prob. 5BTNCh. D - Prob. 6BTNCh. D - Prob. 7BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License