Intro Stats, Books a la Carte Edition (5th Edition)

5th Edition

ISBN: 9780134210285

Author: Richard D. De Veaux, Paul Velleman, David E. Bock

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter CR, Problem 7E

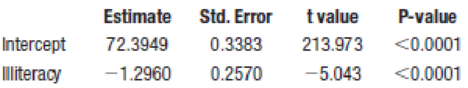

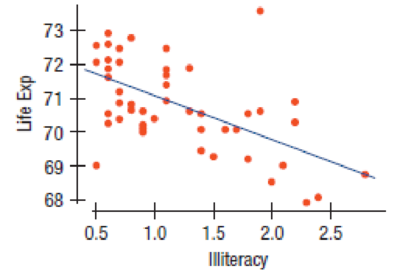

Life expectancy and literacy Consider the relationship between the life expectancy (in years) and the illiteracy rate (per hundred people) in the 50 U.S. states plus Washington, DC. A linear model is run and the output is presented here:

Coefficients:

Residual standard deviation: 1.097 on 48 degrees of freedom Multiple R-squared: 0.3463,

- a) Colorado has an illiteracy rate of 0.70. What is its predicted life expectancy?

- b) Based on the analysis, which of the following can you conclude about this relationship?

- i. Reducing illiteracy will increase life expectancy.

- ii. Reducing illiteracy will reduce life expectancy.

- iii. If you move to a state that spends less money on teachers, your life expectancy will go down, on average, due to lurking variables.

- iv. Higher levels of illiteracy are associated with generally lower life expectancies.

- v. States with lower life expectancies generally have lower illiteracy rates.

- vi. None of the above

- c) What is the

correlation between life expectancy and illiteracy? - d) Tennessee’s illiteracy rate is about 1 SD above the

mean for all states. What do you predict its life expectancy to be?- i. About 1.296 SDs below the mean life expectancy.

- ii. About 1 SD below the mean life expectancy.

- iii. About 1 SD above the mean life expectancy.

- iv. About 0.59 SD below the mean life expectancy.

- v. None of the above

- e) High school graduation rate has a correlation of 0.60 with life expectancy. A simple regression of life expectancy on high school graduation rate shows a positive slope with a very low P-value. If you add high school graduation rate as a predictor to the regression of life expectancy on illiteracy, and fit a multiple regression on high school graduation and Illiteracy, which of the following is true?

- i. The R2 of this model is at least as high as the R2 of either single predictor model.

- ii. The slope of the high school graduation rate is positive.

- iii. The slope of the high school graduation rate is negative.

- iv. The slope of the high school graduation rate is statistically significant.

- i. None of the above

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

«

CENGAGE MINDTAP

Quiz: Chapter 38

Assignment: Quiz: Chapter 38

ips

Questions ra1kw08h_ch38.15m

13.

14.

15.

O

Which sentence has modifiers in the correct place?

O a. When called, she for a medical emergency responds quickly.

b. Without giving away too much of the plot, Helena described the heroine's actions in the film.

O c. Nearly the snakebite victim died before the proper antitoxin was injected.

. O

O

16

16.

O

17.

18.

O

19.

O

20

20.

21

21.

22.

22

DS

23.

23

24.

25.

O

O

O

Questions ra1kw08h_ch36.14m

12.

13.

14.

15.

16.

Ӧ

17.

18.

19.

OS

20.

Two separate sentences need

Oa. two separate subjects.

Ob. two dependent clauses.

c. one shared subject.

Customers experiencing technical difficulty with their Internet cable service may call an 800 number for technical support. It takes the technician between 30 seconds and 11 minutes to resolve the problem. The distribution of this support time follows the uniform distribution.

Required:

a. What are the values for a and b in minutes?

Note: Do not round your intermediate calculations. Round your answers to 1 decimal place.

b-1. What is the mean time to resolve the problem?

b-2. What is the standard deviation of the time?

c. What percent of the problems take more than 5 minutes to resolve?

d. Suppose we wish to find the middle 50% of the problem-solving times. What are the end points of these two times?

Chapter CR Solutions

Intro Stats, Books a la Carte Edition (5th Edition)

Ch. CR - Speed and density The following data relate...Ch. CR - Hospital variables A random sample of 1000...Ch. CR - Lake source cooling Since 2000, Cornell University...Ch. CR - Life expectancy and literacy Consider the...Ch. CR - Hotel maids A Harvard psychologist recruited 75...Ch. CR - Now lets consider only the maids who were...Ch. CR - Prob. 10ECh. CR - Prob. 11ECh. CR - But maybe the BMIs of all the participants changed...Ch. CR - For each of the following descriptions, select the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Similar questions

- Exercise 6-6 (Algo) (LO6-3) The director of admissions at Kinzua University in Nova Scotia estimated the distribution of student admissions for the fall semester on the basis of past experience. Admissions Probability 1,100 0.5 1,400 0.4 1,300 0.1 Click here for the Excel Data File Required: What is the expected number of admissions for the fall semester? Compute the variance and the standard deviation of the number of admissions. Note: Round your standard deviation to 2 decimal places.arrow_forward1. Find the mean of the x-values (x-bar) and the mean of the y-values (y-bar) and write/label each here: 2. Label the second row in the table using proper notation; then, complete the table. In the fifth and sixth columns, show the 'products' of what you're multiplying, as well as the answers. X y x minus x-bar y minus y-bar (x minus x-bar)(y minus y-bar) (x minus x-bar)^2 xy 16 20 34 4-2 5 2 3. Write the sums that represents Sxx and Sxy in the table, at the bottom of their respective columns. 4. Find the slope of the Regression line: bi = (simplify your answer) 5. Find the y-intercept of the Regression line, and then write the equation of the Regression line. Show your work. Then, BOX your final answer. Express your line as "y-hat equals...arrow_forwardApply STATA commands & submit the output for each question only when indicated below i. Generate the log of birthweight and family income of children. Name these new variables Ibwght & Ifaminc. Include the output of this code. ii. Apply the command sum with the detail option to the variable faminc. Note: you should find the 25th percentile value, the 50th percentile and the 75th percentile value of faminc from the output - you will need it to answer the next question Include the output of this code. iii. iv. Use the output from part ii of this question to Generate a variable called "high_faminc" that takes a value 1 if faminc is less than or equal to the 25th percentile, it takes the value 2 if faminc is greater than 25th percentile but less than or equal to the 50th percentile, it takes the value 3 if faminc is greater than 50th percentile but less than or equal to the 75th percentile, it takes the value 4 if faminc is greater than the 75th percentile. Include the outcome of this code…arrow_forward

- solve this on paperarrow_forwardApply STATA commands & submit the output for each question only when indicated below i. Apply the command egen to create a variable called "wyd" which is the rowtotal function on variables bwght & faminc. ii. Apply the list command for the first 10 observations to show that the code in part i worked. Include the outcome of this code iii. Apply the egen command to create a new variable called "bwghtsum" using the sum function on variable bwght by the variable high_faminc (Note: need to apply the bysort' statement) iv. Apply the "by high_faminc" statement to find the V. descriptive statistics of bwght and bwghtsum Include the output of this code. Why is there a difference between the standard deviations of bwght and bwghtsum from part iv of this question?arrow_forwardAccording to a health information website, the distribution of adults’ diastolic blood pressure (in millimeters of mercury, mmHg) can be modeled by a normal distribution with mean 70 mmHg and standard deviation 20 mmHg. b. Above what diastolic pressure would classify someone in the highest 1% of blood pressures? Show all calculations used.arrow_forward

- Write STATA codes which will generate the outcomes in the questions & submit the output for each question only when indicated below i. ii. iii. iv. V. Write a code which will allow STATA to go to your favorite folder to access your files. Load the birthweight1.dta dataset from your favorite folder and save it under a different filename to protect data integrity. Call the new dataset babywt.dta (make sure to use the replace option). Verify that it contains 2,998 observations and 8 variables. Include the output of this code. Are there missing observations for variable(s) for the variables called bwght, faminc, cigs? How would you know? (You may use more than one code to show your answer(s)) Include the output of your code (s). Write the definitions of these variables: bwght, faminc, male, white, motheduc,cigs; which of these variables are categorical? [Hint: use the labels of the variables & the browse command] Who is this dataset about? Who can use this dataset to answer what kind of…arrow_forwardApply STATA commands & submit the output for each question only when indicated below İ. ii. iii. iv. V. Apply the command summarize on variables bwght and faminc. What is the average birthweight of babies and family income of the respondents? Include the output of this code. Apply the tab command on the variable called male. How many of the babies and what share of babies are male? Include the output of this code. Find the summary statistics (i.e. use the sum command) of the variables bwght and faminc if the babies are white. Include the output of this code. Find the summary statistics (i.e. use the sum command) of the variables bwght and faminc if the babies are male but not white. Include the output of this code. Using your answers to previous subparts of this question: What is the difference between the average birthweight of a baby who is male and a baby who is male but not white? What can you say anything about the difference in family income of the babies that are male and male…arrow_forwardA public health researcher is studying the impacts of nudge marketing techniques on shoppers vegetablesarrow_forward

- The director of admissions at Kinzua University in Nova Scotia estimated the distribution of student admissions for the fall semester on the basis of past experience. Admissions Probability 1,100 0.5 1,400 0.4 1,300 0.1 Click here for the Excel Data File Required: What is the expected number of admissions for the fall semester? Compute the variance and the standard deviation of the number of admissions. Note: Round your standard deviation to 2 decimal places.arrow_forwardA pollster randomly selected four of 10 available people. Required: How many different groups of 4 are possible? What is the probability that a person is a member of a group? Note: Round your answer to 3 decimal places.arrow_forwardWind Mountain is an archaeological study area located in southwestern New Mexico. Potsherds are broken pieces of prehistoric Native American clay vessels. One type of painted ceramic vessel is called Mimbres classic black-on-white. At three different sites the number of such sherds was counted in local dwelling excavations. Test given. Site I Site II Site III 63 19 60 43 34 21 23 49 51 48 11 15 16 46 26 20 31 Find .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning

Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897...

Algebra

ISBN:9780079039897

Author:Carter

Publisher:McGraw Hill

College Algebra (MindTap Course List)

Algebra

ISBN:9781305652231

Author:R. David Gustafson, Jeff Hughes

Publisher:Cengage Learning

Big Ideas Math A Bridge To Success Algebra 1: Stu...

Algebra

ISBN:9781680331141

Author:HOUGHTON MIFFLIN HARCOURT

Publisher:Houghton Mifflin Harcourt

Linear Algebra: A Modern Introduction

Algebra

ISBN:9781285463247

Author:David Poole

Publisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...

Algebra

ISBN:9781337111348

Author:Bruce Crauder, Benny Evans, Alan Noell

Publisher:Cengage Learning

Correlation Vs Regression: Difference Between them with definition & Comparison Chart; Author: Key Differences;https://www.youtube.com/watch?v=Ou2QGSJVd0U;License: Standard YouTube License, CC-BY

Correlation and Regression: Concepts with Illustrative examples; Author: LEARN & APPLY : Lean and Six Sigma;https://www.youtube.com/watch?v=xTpHD5WLuoA;License: Standard YouTube License, CC-BY