Concept explainers

Use the information presented in Problem C-1 to solve this problem.

Required

Find the cost of the ending inventory by the last-in, first-out method.

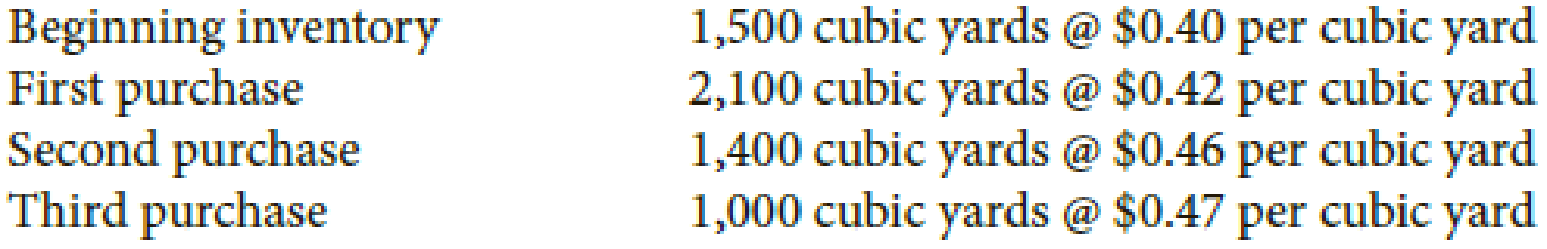

PROBLEM C-1 Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows:

Required

Find the cost of 1,200 cubic yards in the ending inventory by the weighted-average-cost method. Carry average cost per cubic yard to four decimals.

Check Figure

Cost of ending inventory, $480

Want to see the full answer?

Check out a sample textbook solution

Chapter C Solutions

Cengagenowv2, 1 Term Printed Access Card For Scott's College Accounting: A Career Approach, 13th

Additional Business Textbook Solutions

Essentials of MIS (13th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

PRIN.OF CORPORATE FINANCE

Principles of Microeconomics (MindTap Course List)

FUNDAMENTALS OF CORPORATE FINANCE

Marketing: An Introduction (13th Edition)

- provide correct solutionsarrow_forwardgeneral accountarrow_forwardBedrock Company reported a December 31 ending inventory balance of $412,000. The following additional information is also available: -The ending inventory balance of $412,000 included $72,000 of consigned inventory for which Bedrock was the consignor. -The ending inventory balance of $412,000 included $22,000 of office supplies that were stored in the warehouse and were to be used by the company's supervisors and managers during the coming year. Based on this information, the correct balance for ending inventory on December 31 is: A) $362,000 B) $390,000 C) $412,000 D) $318,000 E) $340,000arrow_forward

- need answer in this questionsarrow_forwardKenzi Kayaking, a manufacturer of kayaks, began operations this year. During this first year, the company produced 1,000 kayaks and sold 750. at a price of $1,000 each. At this first year-end, the company reported the following income statement information using absorption costing. Sales (750 $1,000) $750,000 Cost of goods sold (750 $450) 337,500 Gross margin 412,500 Selling and administrative expenses 240,000 Net income $172,500 Additional Information: a. Production cost per kayak totals $450, which consists of $350 in variable production cost and $100 in fixed production cost the latter amount is based on $100,000 of fixed production costs allocated to the 1,000 kayaks produced. b. The $240,000 in selling and administrative expense consists of $95,000 that is variable and $145,000 that is fixed. Required: Prepare an income statement for the current year under variable costing.arrow_forwardDon't use ai given answer accounting questionsarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning