Concept explainers

Use the information presented in Problem C-1 to solve this problem.

Required

Find the cost of the ending inventory by the last-in, first-out method.

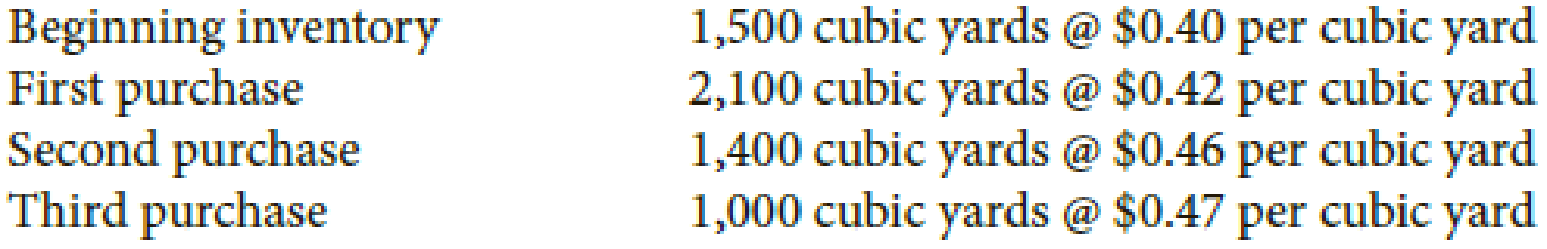

PROBLEM C-1 Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows:

Required

Find the cost of 1,200 cubic yards in the ending inventory by the weighted-average-cost method. Carry average cost per cubic yard to four decimals.

Check Figure

Cost of ending inventory, $480

Want to see the full answer?

Check out a sample textbook solution

Chapter C Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Essentials of MIS (13th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

PRIN.OF CORPORATE FINANCE

Principles of Microeconomics (MindTap Course List)

FUNDAMENTALS OF CORPORATE FINANCE

Marketing: An Introduction (13th Edition)

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning