Concept explainers

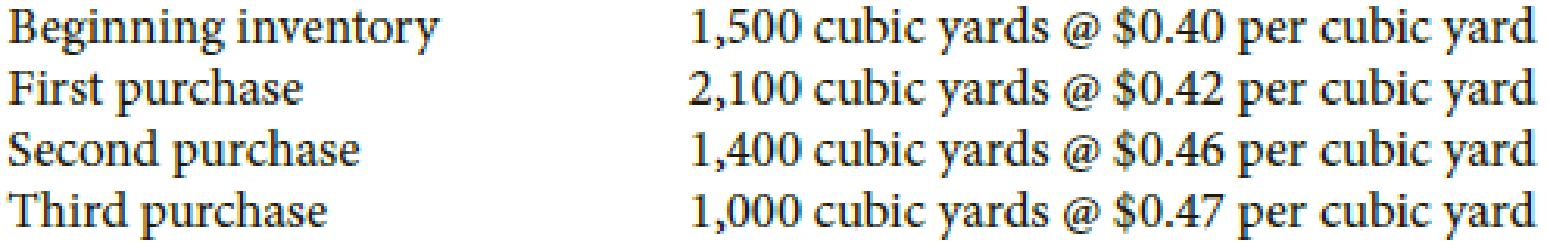

Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows:

Required

Find the cost of 1,200 cubic yards in the ending inventory by the weighted-average-cost method. Carry average cost per cubic yard to four decimals.

Check Figure

Cost of ending inventory, $519.24

Compute the cost of ending inventory using weighted-average-cost method.

Explanation of Solution

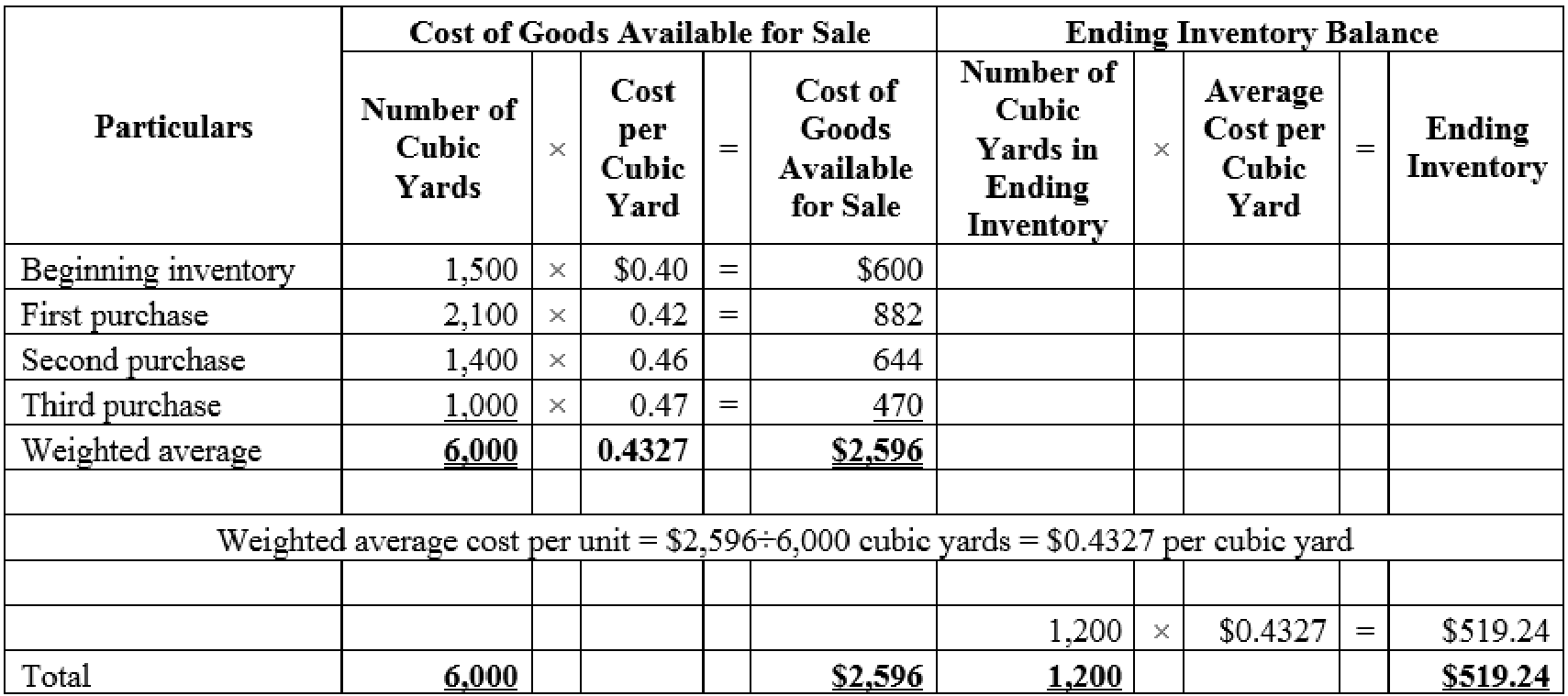

Weighted-average cost method: Under average cost method, company calculates a new average after every purchase. It is determined by dividing the cost of goods available for sale by the units on hand.

Compute the cost of ending inventory of 1,200 cubic yards using weighted-average-cost method.

Table (1)

Thus, the cost of 1,200 cubic yards using weighted-average-cost is $519.24.

Want to see more full solutions like this?

Chapter C Solutions

EBK COLLEGE ACCOUNTING: A CAREER APPROA

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Essentials of MIS (13th Edition)

Fundamentals of Management (10th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- Financial Accountingarrow_forwardMason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $184,500 salary working full time for Angels Corporation. Angels Corporation reported $418,000 of taxable business income for the year. Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $184,500 (all salary from Angels Corporation). Mason claims $59,000 in itemized deductions. Answer the following questions for Mason. c. b. Assuming the business income allocated to Mason is income from a specified service trade or business, except that Angels Corporation reported $168,000 of taxable business income for the year. What is Mason's deduction for qualified business income? Ignore the wage-based limitation when computing the deduction.arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,