Managerial Accounting

6th Edition

ISBN: 9781259726972

Author: John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter C, Problem 11E

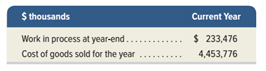

Use the information below for Tesla to answer the requirements.

1. Compute days’ sales in work in process inventory for the current year. Round to the nearest day.

2. If the company’s work in process inventory were 5% lower, by how many days would days’ sales in work in process inventory be reduced? Round to the nearest day.

3. If the company’s cost of goods sold were 12% higher, by how many days would days’ sales in work in process inventory be reduced? Round to the nearest day.

Exercise C-11

Days’ sales in work in process inventory

A2

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide the solution to this general accounting question with accurate financial calculations.

Can you solve this general accounting question with accurate accounting calculations?

Can you explain this financial accounting question using accurate calculation methods?

Chapter C Solutions

Managerial Accounting

Ch. C - Prob. 1DQCh. C - How does push production differ from pull...Ch. C - Prob. 3DQCh. C - Prob. 4DQCh. C - Prob. 5DQCh. C - Prob. 6DQCh. C - Prob. 7DQCh. C - Prob. 8DQCh. C - Prob. 9DQCh. C - Prob. 10DQ

Ch. C - Prob. 11DQCh. C - Prob. 12DQCh. C - Can management of a company like Samsung use cycle...Ch. C - Identify each of the following as applying more to...Ch. C - Identify each of the following as applying more to...Ch. C - Prob. 3QSCh. C - Use lean accounting to prepare journal entries for...Ch. C - Prob. 5QSCh. C - Prob. 6QSCh. C - Prob. 7QSCh. C - Prob. 8QSCh. C - Prob. 9QSCh. C - Prob. 10QSCh. C - Prob. 11QSCh. C - A company reports ending accounts payable of...Ch. C - Prob. 13QSCh. C - Identify each of the following production...Ch. C - Prob. 2ECh. C - Prob. 3ECh. C - Prob. 4ECh. C - Prob. 5ECh. C - Prob. 6ECh. C - Prob. 7ECh. C - A manufacturer makes T-shirts in several...Ch. C - Prob. 9ECh. C - Prob. 10ECh. C - Use the information below for Tesla to answer the...Ch. C - Prob. 12ECh. C - Prob. 13ECh. C - Prob. 14ECh. C - Robo-Lawn is a lean manufacturer of robotic lawn...Ch. C - Prob. 2PCh. C - Prob. 3P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain the correct approach for solving this general accounting question.arrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License