Fundamentals of Statistics, Books a la Carte Edition Plus MyLab Statistics with Pearson eText -- Access Card Package (5th Edition)

5th Edition

ISBN: 9780134763699

Author: Michael Sullivan III

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter B.2, Problem 16AYU

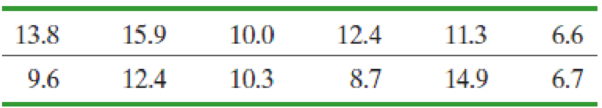

Investment Risk Investors not only desire a high return on their money, but they would also like the rate of return to be stable from year to year. An investment manager invests with the goal of reducing volatility (year-to-year fluctuations in the rate of return). The following data represent the rate of return (in percent) for his mutual fund for the past 12 years.

- (a) Verify that the data are

normally distributed by constructing a normalprobability plot. - (b) Determine the sample standard deviation.

- (c) Construct a 95% confidence interval for the population standard deviation of the rate of return.

- (d) The investment manager wants to have a population standard deviation for the rate of return below 6%. Does the confidence interval validate this desire?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

2 (VaR and ES) Suppose X1

are independent. Prove that

~

Unif[-0.5, 0.5] and X2

VaRa (X1X2) < VaRa(X1) + VaRa (X2).

~

Unif[-0.5, 0.5]

8 (Correlation and Diversification)

Assume we have two stocks, A and B, show that a particular combination

of the two stocks produce a risk-free portfolio when the correlation between

the return of A and B is -1.

9 (Portfolio allocation)

Suppose R₁ and R2 are returns of 2 assets and with expected return and

variance respectively r₁ and 72 and variance-covariance σ2, 0%½ and σ12. Find

−∞ ≤ w ≤ ∞ such that the portfolio wR₁ + (1 - w) R₂ has the smallest

risk.

Chapter B.2 Solutions

Fundamentals of Statistics, Books a la Carte Edition Plus MyLab Statistics with Pearson eText -- Access Card Package (5th Edition)

Ch. B.2 - True or False: The chi-square distribution is...Ch. B.2 - Prob. 2AYUCh. B.2 - Prob. 3AYUCh. B.2 - Prob. 4AYUCh. B.2 - Prob. 5AYUCh. B.2 - Prob. 6AYUCh. B.2 - In Problems 58, find the critical values 1/22 and...Ch. B.2 - Prob. 8AYUCh. B.2 - Prob. 9AYUCh. B.2 - A simple random sample of size n is drawn from a...

Ch. B.2 - NW 11. pH of Rain The following data represent the...Ch. B.2 - Travel Taxes Travelers pay taxes for flying, car...Ch. B.2 - Crash Test Results The following data represent...Ch. B.2 - Crawling Babies The following data represent the...Ch. B.2 - Peanuts A jar of peanuts is supposed to have 16...Ch. B.2 - Investment Risk Investors not only desire a high...Ch. B.2 - Critical Values Sir R. A. Fisher, a famous...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Similar questions

- 7 (Multivariate random variable) Suppose X, €1, €2, €3 are IID N(0, 1) and Y2 Y₁ = 0.2 0.8X + €1, Y₂ = 0.3 +0.7X+ €2, Y3 = 0.2 + 0.9X + €3. = (In models like this, X is called the common factors of Y₁, Y₂, Y3.) Y = (Y1, Y2, Y3). (a) Find E(Y) and cov(Y). (b) What can you observe from cov(Y). Writearrow_forward1 (VaR and ES) Suppose X ~ f(x) with 1+x, if 0> x > −1 f(x) = 1−x if 1 x > 0 Find VaRo.05 (X) and ES0.05 (X).arrow_forwardJoy is making Christmas gifts. She has 6 1/12 feet of yarn and will need 4 1/4 to complete our project. How much yarn will she have left over compute this solution in two different ways arrow_forward

- Solve for X. Explain each step. 2^2x • 2^-4=8arrow_forwardOne hundred people were surveyed, and one question pertained to their educational background. The results of this question and their genders are given in the following table. Female (F) Male (F′) Total College degree (D) 30 20 50 No college degree (D′) 30 20 50 Total 60 40 100 If a person is selected at random from those surveyed, find the probability of each of the following events.1. The person is female or has a college degree. Answer: equation editor Equation Editor 2. The person is male or does not have a college degree. Answer: equation editor Equation Editor 3. The person is female or does not have a college degree.arrow_forwardneed help with part barrow_forward

- Suppose you know that Bob's test score is above the mean, but he doesn't remember by how much. At least how many students must score lower than Bob?arrow_forwardIf a baby's weight is at the median, what's her percentile?arrow_forwardAt the same restaurant as in Question 19 with the same normal distribution, what's the chance of it taking no more than 15 minutes to get service?arrow_forward

- Clint, obviously not in college, sleeps an average of 8 hours per night with a standard deviation of 15 minutes. What's the chance of him sleeping between 7.5 and 8.5 hours on any given night? 0-(7-0) 200 91109s and doiw $20 (8-0) mol 8520 slang $199 galbrog seam side pide & D (newid se od poyesvig as PELEO PER AFTE editiw noudab temand van Czarrow_forwardTimes to complete a statistics exam have a normal distribution with a mean of 40 minutes and standard deviation of 6 minutes. Deshawn's time comes in at the 90th percentile. What percentage of the students are still working on their exams when Deshawn leaves?arrow_forwardSuppose that the weights of cereal boxes have a normal distribution with a mean of 20 ounces and standard deviation of half an ounce. A box that has a standard score of o weighs how much? syed by ilog ni 21arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Trigonometry (MindTap Course List)TrigonometryISBN:9781337278461Author:Ron LarsonPublisher:Cengage Learning

Trigonometry (MindTap Course List)TrigonometryISBN:9781337278461Author:Ron LarsonPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Trigonometry (MindTap Course List)

Trigonometry

ISBN:9781337278461

Author:Ron Larson

Publisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...

Algebra

ISBN:9781337111348

Author:Bruce Crauder, Benny Evans, Alan Noell

Publisher:Cengage Learning

Mod-01 Lec-01 Discrete probability distributions (Part 1); Author: nptelhrd;https://www.youtube.com/watch?v=6x1pL9Yov1k;License: Standard YouTube License, CC-BY

Discrete Probability Distributions; Author: Learn Something;https://www.youtube.com/watch?v=m9U4UelWLFs;License: Standard YouTube License, CC-BY

Probability Distribution Functions (PMF, PDF, CDF); Author: zedstatistics;https://www.youtube.com/watch?v=YXLVjCKVP7U;License: Standard YouTube License, CC-BY

Discrete Distributions: Binomial, Poisson and Hypergeometric | Statistics for Data Science; Author: Dr. Bharatendra Rai;https://www.youtube.com/watch?v=lHhyy4JMigg;License: Standard Youtube License