Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter B, Problem 29BP

Using all journals, posting, and balancing the ledgers

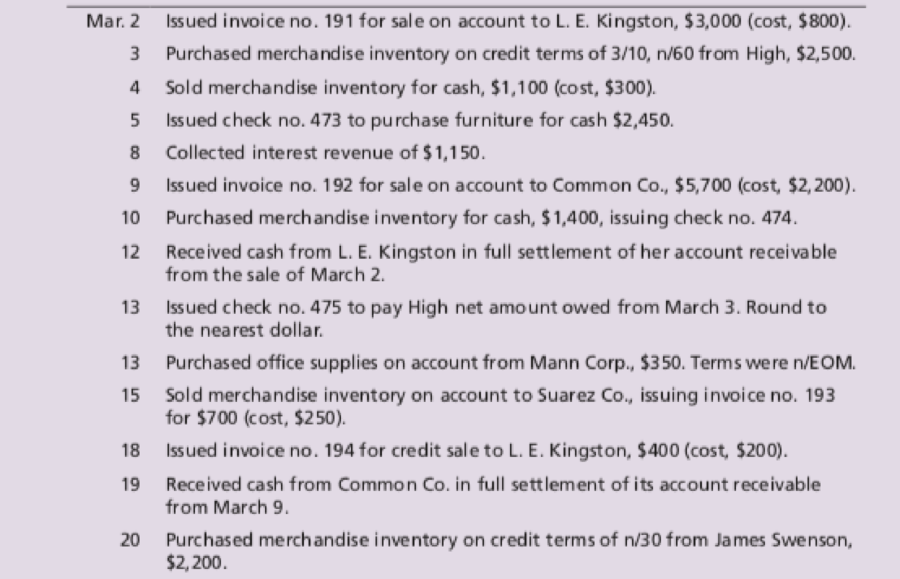

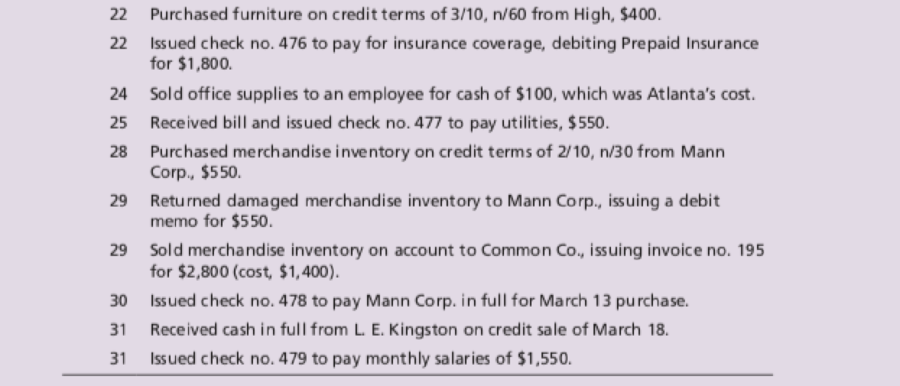

Atlanta Computer Security uses the perpetual inventory system and makes all credit sales on terms of n/30. During March, Atlanta completed these transactions:

Requirements

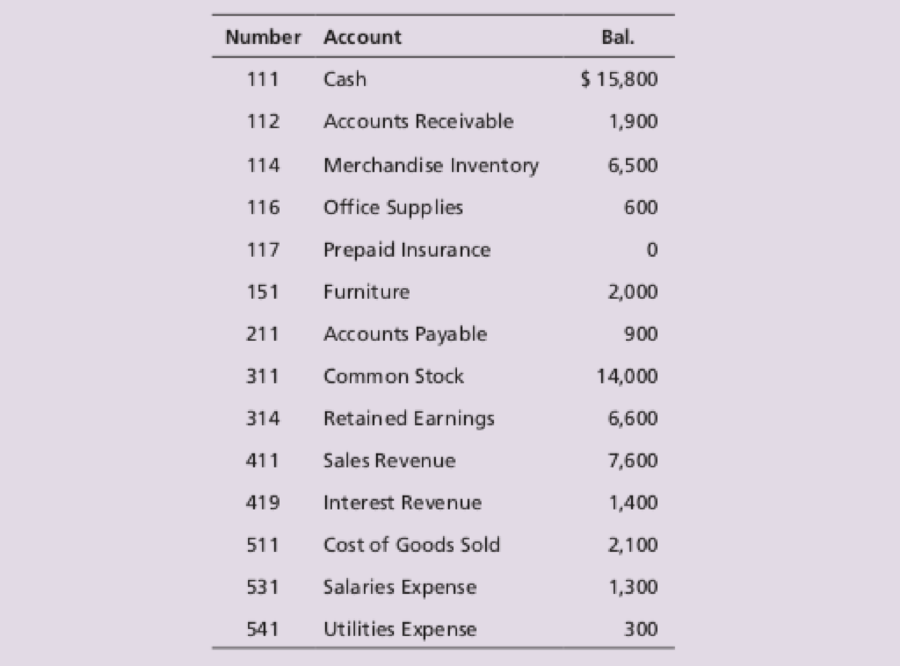

- 1. Open four-column general ledger accounts using Atlanta Computer Security’s account numbers and balances as of March 1, 2018, that follow. All accounts have normal balances.

- 2. Open four-column accounts in the subsidiary ledgers with beginning balances as of March 1, if any.

Accounts receivable subsidiary ledger: Arrundel Co., $1,900; Common Co., $0; L. E. Kingston, $0; and Suarez, $0. Accounts payable subsidiary ledger: High, $0; Mann Corp, $0; James Swenson, $0; and Young Co., $900. - 3. Enter the transactions in a sales journal (page 8), a cash receipts journal (page 3, omit Sales Discounts Forfeited column), a purchases journal (page 6), a cash payments journal (page 9), and a general journal (page 4), as appropriate.

- 4. Post daily to the accounts receivable subsidiary ledger and to the accounts payable subsidiary ledger.

- 5. Total each column of the special journals. Show that total debits equal total credits in each special journal. On March 31, post to the general ledger.

- 6. Prepare a

trial balance as of March 31, 2018, to verify the equality of the general ledger. Balance the total of the customer account ending balances in the accounts receivable subsidiary ledger against Accounts Receivable in the general ledger. Do the same for the accounts payable subsidiary ledger and Accounts Payable in the general ledger.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Need help with this financial accounting question please solve

variable cost per machine hours?

need this subjects solutions

Chapter B Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. B - Match the benefit of an effective accounting...Ch. B - Prob. 2TICh. B - Prob. 3TICh. B - Prob. 4TICh. B - Prob. 5TICh. B - Prob. 6TICh. B - Prob. 7TICh. B - Prob. 8TICh. B - Prob. 1QCCh. B - Prob. 2QC

Ch. B - Prob. 3QCCh. B - Prob. 4QCCh. B - Prob. 5QCCh. B - Prob. 6QCCh. B - Prob. 7QCCh. B - When using a manual accounting information system,...Ch. B - Prob. 9QCCh. B - Prob. 1RQCh. B - Prob. 2RQCh. B - Prob. 3RQCh. B - Prob. 4RQCh. B - What is the purpose of a subsidiary ledger?Ch. B - Prob. 6RQCh. B - List the four special journals often used in a...Ch. B - Explain the posting process of the sales journal.Ch. B - Prob. 9RQCh. B - What are the columns that are typically used in...Ch. B - Explain the posting process of the cash payments...Ch. B - When is the general journal used in a manual...Ch. B - Prob. 13RQCh. B - Prob. 14RQCh. B - Prob. 15RQCh. B - How is QuickBooks organized?Ch. B - How would a business record a sale of services on...Ch. B - How would a business record a bill received in...Ch. B - Prob. 1SECh. B - Prob. 2SECh. B - Identifying special journals Use the following...Ch. B - Prob. 4SECh. B - Prob. 5SECh. B - Prob. 6SECh. B - Prob. 7SECh. B - Prob. 8SECh. B - Prob. 9SECh. B - Prob. 10SECh. B - Prob. 11SECh. B - Prob. 12SECh. B - Prob. 13SECh. B - Prob. 14ECh. B - Prob. 15ECh. B - Prob. 16ECh. B - Prob. 17ECh. B - Identifying transactions in the accounts...Ch. B - Prob. 19ECh. B - Prob. 20ECh. B - Prob. 21ECh. B - Prob. 22ECh. B - Prob. 23ECh. B - Prob. 24APCh. B - Prob. 25APCh. B - Using all journals, posting, and balancing the...Ch. B - Prob. 27BPCh. B - Using the purchases, cash payments, and general...Ch. B - Using all journals, posting, and balancing the...Ch. B - Prob. 30PCh. B - Prob. 31PCh. B - Prob. 1COMPCh. B - Prob. 1TIATCCh. B - Prob. 1DCCh. B - Prob. 1FCCh. B - Prob. 1CA

Additional Business Textbook Solutions

Find more solutions based on key concepts

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY