Financial Accounting

3rd Edition

ISBN: 9780133791129

Author: Jane L. Reimers

Publisher: Pearson Higher Ed

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter B, Problem 24EA

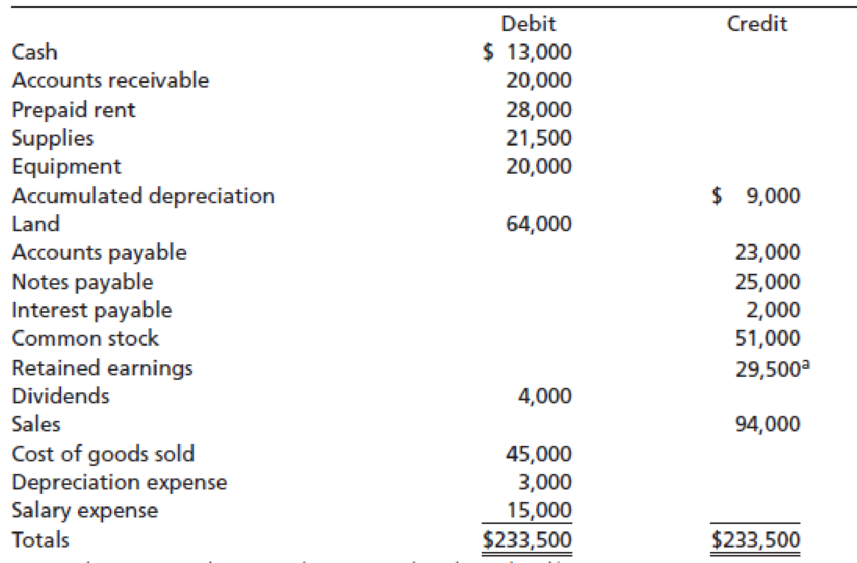

Record closing entries and compute net income.

(LO 4). Given the following adjusted

Brett’s Bait & Tackle, Inc.

Adjusted Trial Balance

June 30, 2011

a

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the effective of this transaction on these financial accounting question?

Need help with this general accounting question

Compute the total cost of work in process for the year on these general accounting question

Chapter B Solutions

Financial Accounting

Ch. B - Indicate whether each of the following accounts...Ch. B - Prob. 2YTCh. B - Prob. 1QCh. B - Prob. 2QCh. B - Prob. 3QCh. B - Prob. 4QCh. B - Prob. 5QCh. B - Prob. 6QCh. B - Prob. 7QCh. B - Prob. 8Q

Ch. B - Prob. 9QCh. B - Prob. 1MCQCh. B - Prob. 2MCQCh. B - Prob. 3MCQCh. B - Prob. 4MCQCh. B - Prob. 5MCQCh. B - Prob. 6MCQCh. B - Prob. 7MCQCh. B - Prob. 8MCQCh. B - Prob. 9MCQCh. B - Prob. 10MCQCh. B - Prob. 1SEACh. B - Prob. 2SEACh. B - Prob. 3SEACh. B - Prob. 4SEACh. B - Prob. 5SEACh. B - Prob. 6SEACh. B - Prob. 7SEACh. B - Prob. 8SEACh. B - Prob. 9SEACh. B - Prob. 10SEBCh. B - Prob. 11SEBCh. B - Prob. 12SEBCh. B - Prob. 13SEBCh. B - Prob. 14SEBCh. B - Prob. 15SEBCh. B - Prob. 16SEBCh. B - Prob. 17SEBCh. B - Prob. 18SEBCh. B - Prob. 19EACh. B - Prob. 20EACh. B - Record transactions to T-accounts and prepare an...Ch. B - Prob. 22EACh. B - Prob. 23EACh. B - Record closing entries and compute net income. (LO...Ch. B - Record journal entries, record adjusting entries,...Ch. B - Record journal entries, post to T-accounts, and...Ch. B - Prob. 27EBCh. B - Prob. 28EBCh. B - Prob. 29EBCh. B - Prob. 30EBCh. B - Prob. 31EBCh. B - Prob. 32EBCh. B - Prob. 33EBCh. B - Prob. 34EBCh. B - Prepare a trial balance and financial statements....Ch. B - Record journal entries, post to T-accounts, and...Ch. B - Prepare closing entries and financial statements....Ch. B - Record adjusting journal entries, post to...Ch. B - Prob. 39PACh. B - Prob. 40PACh. B - Prob. 41PACh. B - Prob. 42PACh. B - Prob. 43PBCh. B - Prob. 44PBCh. B - Prob. 45PBCh. B - Prob. 46PBCh. B - Prob. 47PBCh. B - Prob. 48PBCh. B - Prob. 49PBCh. B - Prob. 50PBCh. B - Prob. 51FSACh. B - Prob. 52CTP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine the cost per equivalent unit of conversion on these general accounting questionarrow_forwardCarla Vista Corporation had a projected benefit obligation of $2,890,000 and plan assets of $3,097,000 at January 1, 2025. Carla Vista also had a net actuarial loss of $437,680 in accumulated OCI at January 1, 2025. The average remaining service period of Carla Vista's employees is 7.9 years. Compute Carla Vista's minimum amortization of the actuarial loss. Minimum amortization of the actuarial lossarrow_forwardChapter 15 Homework i 10 0.83 points Saved Help Save & Exit Submit Check my work QS 15-8 (Algo) Computing predetermined overhead rates LO P3 A company estimates the following manufacturing costs at the beginning of the period: direct labor, $520,000; direct materials, $216,000; and factory overhead, $141,000. Required: eBook 1. Compute its predetermined overhead rate as a percent of direct labor. 2. Compute its predetermined overhead rate as a percent of direct materials. Ask Complete this question by entering your answers in the tabs below. Print Required 1 Required 2 References Mc Graw Hill Compute its predetermined overhead rate as a percent of direct labor. Overhead Rate Numerator: 1 Denominator: = Overhead Rate = Overhead Rate = 0arrow_forward

- hello teacher please solve questions general accountingarrow_forwardCampbell Soup Company reported pension expense of $94 million and contributed $81.5 million to the pension fund. Prepare Campbell's journal entry to record pension expense and funding, assuming campbell has no OCI amounts.arrow_forwardProvide accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY