Managerial Accounting: Tools for Business Decision Making 7e Binder Ready Version + WileyPLUS Registration Card

7th Edition

ISBN: 9781119036449

Author: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Publisher: Wiley (WileyPLUS Products)

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter A, Problem A.2BE

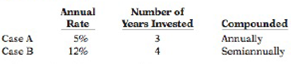

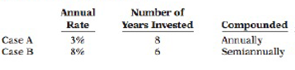

Kor each of the following cases, indicate (a) what interest rate columns and (b) what number of periods you would refer to in looking up the future value factor.

(1) In Table 1 (future value of 1):

(2) In Table 2 (future value of an annuity of 1):

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the fixed asset turnover

ACP Manufacturing has budgeted a total overhead cost of $850,000 and budgeted machine hours of 85,000 for the upcoming period. During the actual period, the total overhead incurred was $865,000, and actual machine hours used were 90,000. Find the applied overhead for the period and determine whether the overhead is overapplied or underapplied. Show your step-by-step solution.

You are buying a house and will borrow $205,000 on a 30-year fixed rate mortgage with monthly payments to finance the purchase. Your loan officer has offered you a mortgage with an APR of 4.35%. Alternatively, she tells you that you can “buy down” the interest rate to 4.15% if you pay points up front on the loan. A point on a loan is 1% (one percentage point) of the loan value. You believe that you will live in the house for only eight years before selling the house and buying another house. This means that in eight years, you will pay off the remaining balance of the original mortgage. What is the maximum number of points that you would be willing to pay now? (Do not round intermediate calculations. Round your answer to 3 decimal places, e.g., 32.162.)

Chapter A Solutions

Managerial Accounting: Tools for Business Decision Making 7e Binder Ready Version + WileyPLUS Registration Card

Ch. A - Prob. A.1BECh. A - Kor each of the following cases, indicate (a) what...Ch. A - Liam Company signed a lease for an office building...Ch. A - Prob. A.4BECh. A - Prob. A.5BECh. A - Prob. A.6BECh. A - For each of the following cases, indicate (a) what...Ch. A - Prob. A.8BECh. A - Prob. A.9BECh. A - Prob. A.10BE

Ch. A - Prob. A.11BECh. A - Prob. A.12BECh. A - Dempsey Railroad Co. is about to issue 400,000 of...Ch. A - Prob. A.14BECh. A - Neymar Taco Company receives a 75,000, 6-year note...Ch. A - Prob. A.16BECh. A - Frazier Company issues a 10%, 5-year mortgage note...Ch. A - Prob. A.18BECh. A - Prob. A.19BECh. A - Prob. A.20BECh. A - Prob. A.21BECh. A - Prob. A.22BECh. A - Prob. A.23BECh. A - Prob. A.24BECh. A - Prob. A.25BECh. A - As the purchaser of a new house, Carrie Underwood...Ch. A - Using a financial calculator, solve for the...Ch. A - Using a financial calculator, provide a solution...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The investment turnover isarrow_forwardCrane top uses the periodic inventory system. For the current month, the beginning inventory consisted of 486 units that cost $66 each. During the month, the company made two purchases: 720 units at $69 each and 355 units at $71 each. Crane also sold 1200 units during the month. Using the FIFO method, what is the amount of cost of goods sold for the month?arrow_forwardFinancial Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Internal Rate of Return (IRR); Author: The Finance Storyteller;https://www.youtube.com/watch?v=aS8XHZ6NM3U;License: Standard Youtube License