Concept explainers

1.

Indicate the method used to account the investment in D common stock and F bonds, and explain.

1.

Explanation of Solution

Available-for-sale (AFS) securities: The category of passive investments which are held as idle funds to serve the future operating and strategic purposes, are referred to as available-for-sale securities. The percentage of passive investments in debt or equity will be less than 20%.

Fair value method: The method of accounting the investments in short-term debt, and short-term and long-term equity securities, with an ownership of less than 20% of the outstanding stock of the investee, is referred to as fair value method.

Method used to account investment in stock of Corporation D: Since the investor company, Company OG purchased 14.74%

Method used to account investment in bonds of Corporation F: Since the bonds are not intended to hold till maturity, they are considered as short-term, and hence, fair value method is used.

2.

a.

Journalize the purchase of investment in available-for-sale securities’ transaction for the years 2016 and 2017.

2.

a.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in

stockholders’ equity accounts. - Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

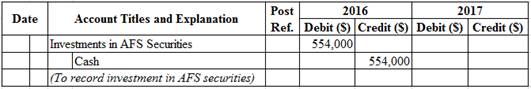

Prepare journal entry for purchase of investment in AFS.

Table (1)

Note: No purchases were made in 2017.

Description:

- Investments in AFS Securities is an asset account. Since stock investments are purchased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Notes:

Compute cost of investment in AFS securities.

Step 1: Compute cost of investment in stock.

Step 2: Compute cost of investment in AFS securities.

Note: Refer to Equation (1) for value and computation of cost of investment in stock.

b.

Journalize the entry for income reported by investee companies for the years 2016 and 2017.

b.

Explanation of Solution

The income reported by Corporations D and F are not recorded by Company OG because the type of investment is passive, and not of significant influence. So, for the two years 2016 and 2017, Company OG will not record any entry for the net income of the investee.

c.

Journalize the entry for receipt of dividend and interest revenue for the years 2016 and 2017.

c.

Explanation of Solution

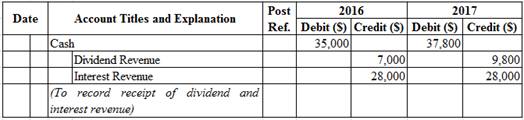

Prepare journal entry for cash dividend received and interest received.

Table (2)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Dividend Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of dividend received in 2016.

Compute amount of dividend received in 2017.

d.

Journalize the

d.

Explanation of Solution

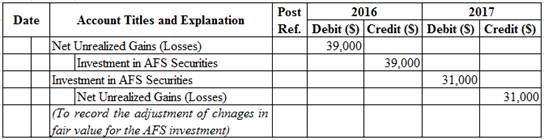

Prepare journal entry for adjusting the cost of AFS securities to the fair market value, as on December 31, 2016, and 2017.

Table (3)

Description:

2016:

- Net Unrealized Gains (Losses) is an adjustment account used to report gain or loss on adjusting cost of investment at fair market value. Since loss has occurred and losses decrease stockholders’ equity value, a decrease in stockholders’ equity value is debited. This loss is reported as component of Other Comprehensive Income (OCI) on the Statement of Comprehensive Income.

- Investments in AFS Securities is an asset account. The account is credited because the market price was decreased, and eventually the asset value decreased.

2017:

- Investments in AFS Securities is an asset account. The account is debited because the market price was increased, and eventually the asset value increased.

- Net Unrealized Gains (Losses) is an adjustment account used to report gain or loss on adjusting cost of investment at fair market value. Since gain has occurred and gains increase stockholders’ equity value, an increase in stockholders’ equity value is credited. This gain is reported as component of Other Comprehensive Income (OCI) on the Statement of Comprehensive Income.

Working Notes:

Determine the unrealized gain or loss on investment on December 31, 2016.

Step 1: Compute the fair value of investment on December 31, 2016.

Step 2: Compute total fair value of investment in AFS securities on December 31, 2016.

Note: Refer to Equation (2) for value and computation of fair value of investment in stock.

Step 3: Compute unrealized gain or loss on investment in AFS securities.

Note: Refer to Equations (1) and (3) for both the values.

Determine the unrealized gain or loss on investment on December 31, 2017.

Step 1: Compute the fair value of investment on December 31, 2017.

Step 2: Compute total fair value of investment in AFS securities on December 31, 2017.

Note: Refer to Equation (2) for value and computation of fair value of investment in stock.

Step 3: Compute unrealized gain or loss on investment in AFS securities.

Note: Refer to Equations (3) and (5) for both the values.

3.

a.

Show the reporting of long-term assets related to AFS investments, on the

3.

a.

Explanation of Solution

Reporting of long-term assets on balance sheet:

| Company OG | ||

| Balance Sheet | ||

| December 31 | ||

| Assets: | 2016 | 2017 |

| Long-term assets: | ||

| Investment in Available-For-Sale-Securities | 515,000 | 546,000 |

Table (4)

b.

Show the reporting of net unrealized gains (losses) related to AFS investments, on the stockholders’ equity section of Company OG, on December 31, 2016 and 2017.

b.

Explanation of Solution

Reporting of net unrealized gains (losses) on statement of stockholders’ equity:

| Company OG | ||

| Statement of Stockholders’ Equity | ||

| December 31 | ||

| 2016 | 2017 | |

| Stockholders’ Equity: | ||

| Common Stock | XXX | |

| | XXX | |

| Accumulated other comprehensive income: | ||

| Net unrealized gains (losses) | (39,000) | (8,000) |

Table (5)

c.

Show the revenue related to AFS investments, reported on the income statement of Company OG, for the years ended December 31, 2016 and 2017.

c.

Explanation of Solution

Income statement presentation:

| Company OG | ||

| Income Statement (Partial) | ||

| For the Year Ended December 31 | ||

| Other Revenue: | 2016 | 2017 |

| Interest revenue | $28,000 | $28,000 |

| Dividend revenue | 7,000 | 9,800 |

Table (6)

Want to see more full solutions like this?

Chapter A Solutions

Financial Accounting

- Which feature distinguishes nominal accounts from real accounts in closing entries? Options: (i) Temporary nature requiring closure (ii) Balance sheet presentation (iii) Permanent balances carried forward (iv) Contra account status financial Accounting problemarrow_forwardProvide correct solution accountingarrow_forwardWhat is its degree of opereting leverage? General accountingarrow_forward

- General accountingarrow_forwardWhich feature distinguishes nominal accounts from real accounts in closing entries? Options: (i) Temporary nature requiring closure (ii) Balance sheet presentation (iii) Permanent balances carried forward (iv) Contra account statusarrow_forwardNeed help this questionarrow_forward

- Organization/Industry Rank Employer Survey Student Survey Career Service Director Survey Average Pay Deloitte & Touche/accounting 1 1 8 1 55 Ernst & Young/accounting 2 6 3 6 50 PricewaterhouseCoopers/accounting 3 22 5 2 50 KPMG/accounting 4 17 11 5 50 U.S. State Department/government 5 12 2 24 60 Goldman Sachs/investment banking 6 3 13 16 60 Teach for America/non-profit; government 7 24 6 7 35 Target/retail 8 19 18 3 45 JPMorgan/investment banking 9 13 12 17 60 IBM/technology 10 11 17 13 60 Accenture/consulting 11 5 38 15 60 General Mills/consumer products 12 3 33 28 60 Abbott Laboratories/health 13 2 44 36 55 Walt Disney/hospitality 14 60 1 8 40 Enterprise Rent-A-Car/transportation 15 28 51 4 35 General Electric/manufacturing 16 19 16 9 55 Phillip Morris/consumer products 17 8 50 19 55 Microsoft/technology 18 28 9 34 75 Prudential/insurance 19 9 55 37 50 Intel/technology 20 14 23 63 60 Aflac/insurance 21 9 55 62 50 Verizon…arrow_forwardProvide correct solution accountingarrow_forwardWhat is the gross marginarrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning