Derivatives; interest rate swap; fixed rate debt; fair value change unrelated to hedged risk

(This is a variation of E A–2, modified to consider fair value change unrelated to hedged risk.)

LLB Industries borrowed $200,000 from Trust Bank by issuing a two-year, 10% note, with interest payable quarterly. LLB entered into a two-year interest rate swap agreement on January 1, 2018, and designated the swap as a fair value hedge. Its intent was to hedge the risk that general interest rates will decline, causing the fair value of its debt to increase. The agreement called for the company to receive payment based on a 10% fixed interest rate on a notional amount of $200,000 and to pay interest based on a floating interest rate.

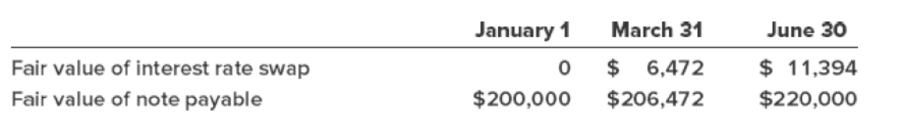

Floating (LIBOR) settlement rates were 10% at January 1, 8% at March 31, and 6% at June 30, 2018. The fair values of the swap are quotes obtained from a derivatives dealer. Those quotes and the fair values of the note are as indicated below. The additional rise in the fair value of the note (higher than that of the swap) on June 30 was due to investors’ perceptions that the creditworthiness of LLB was improving.

Required:

- 1. Calculate the net cash settlement at June 30, 2018.

- 2. Prepare the

journal entries on June 30, 2018, to record the interest and necessary adjustments for changes in fair value.

Want to see the full answer?

Check out a sample textbook solution

Chapter A Solutions

INTERMEDIATE ACCOUNTING (LL) W/CONNECT

- Please explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forwardI am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forward

- I am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

- No chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forwardI need help Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forward