Concept explainers

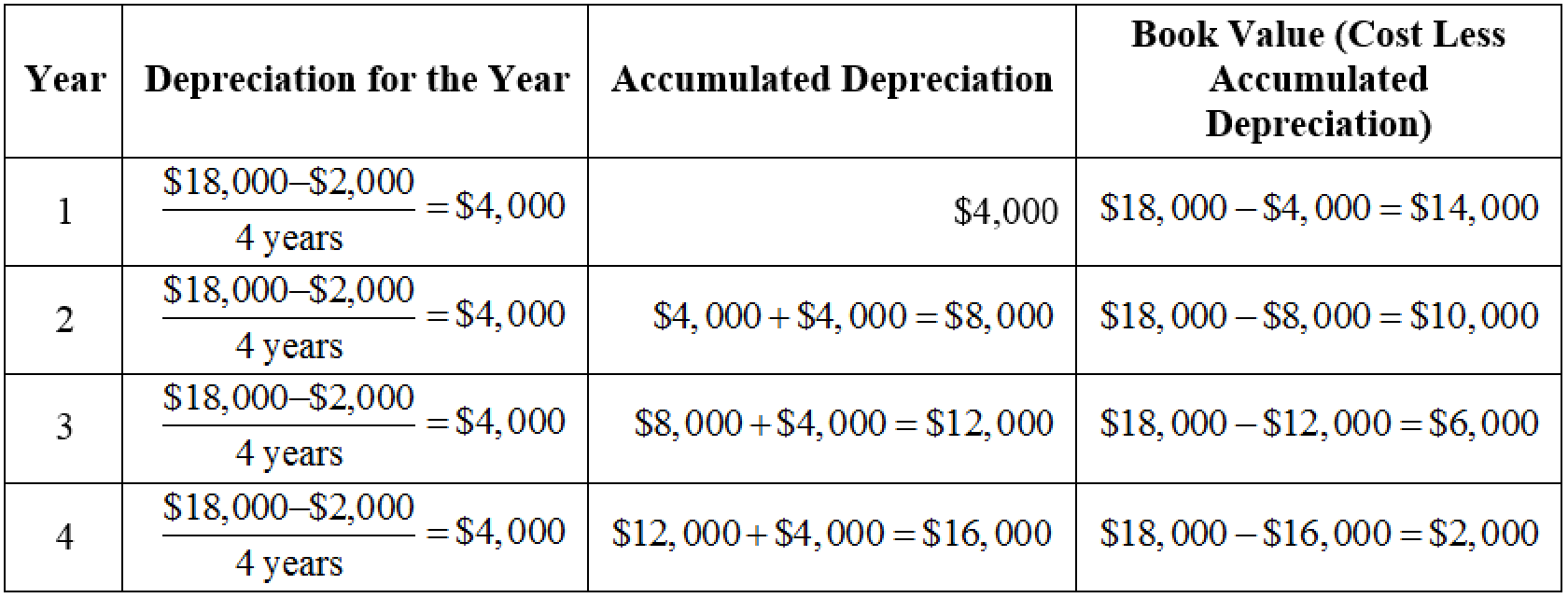

A delivery van was bought for $18,000. The estimated life of the van is four years. The trade-in value at the end of four years is estimated to be $2,000.

Required

Prepare a

Check Figure

Year 1 depreciation, $4,000

Prepare depreciation schedule for the four year estimated useful life of the delivery van under straight-line depreciation method.

Explanation of Solution

Straight-line method: The depreciation method which assumes that the consumption of economic benefits of long-term asset could be distributed equally throughout the useful life of the asset, is referred to as straight-line method.

Formula for straight-line depreciation method:

Prepare depreciation schedule for the four year estimated useful life of the delivery van under straight-line depreciation method, if cost of the asset is $18,000 and trade-in value is $2,000.

Table (1)

Want to see more full solutions like this?

Chapter A Solutions

Cengagenowv2, 1 Term Printed Access Card For Scott's College Accounting: A Career Approach, 13th

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Marketing: An Introduction (13th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Fundamentals of Management (10th Edition)

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning