FUNDAME.OF COST ACCT. W/CONNECT

6th Edition

ISBN: 9781264508341

Author: LANEN

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter A, Problem 14E

Present Value Analysis in Nonprofit Organizations

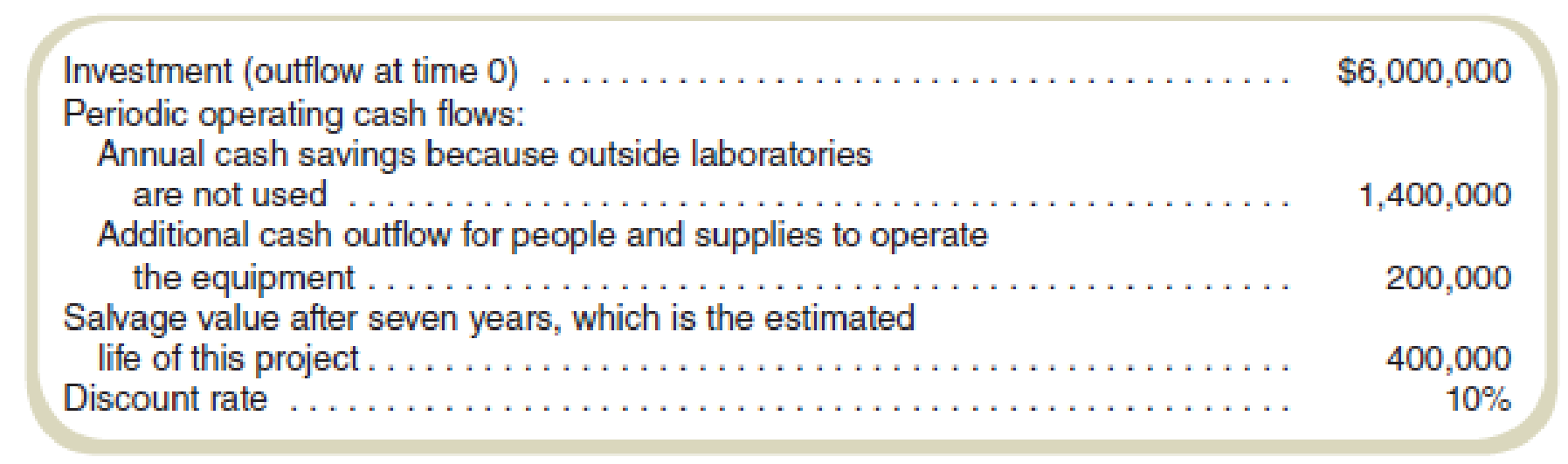

The Johnson Research Organization, a nonprofit organization that does not pay taxes, is considering buying laboratory equipment with an estimated life of seven years so it will not have to use outsiders’ laboratories for certain types of work. The following are all of the

Required

Calculate the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

provide correct answer general accounting

Windsor Manufacturing planned to use $90 of material per unit but actually used $88 of material per unit. The company planned to produce 1,500 units but actually produced 1,200 units. What is the sales-volume variance? provide answer

need help this questions

Chapter A Solutions

FUNDAME.OF COST ACCT. W/CONNECT

Ch. A - What are the two most important factors an...Ch. A - Prob. 2RQCh. A - Prob. 3RQCh. A - Prob. 4RQCh. A - Prob. 5RQCh. A - Prob. 6CADQCh. A - What are the four types of cash flows related to a...Ch. A - Is depreciation included in the computation of net...Ch. A - The total tax deduction for depreciation is the...Ch. A - Prob. 10CADQ

Ch. A - In Chapter 14, we discussed performance...Ch. A - Present Value of Cash Flows Star City is...Ch. A - Prob. 13ECh. A - Present Value Analysis in Nonprofit Organizations...Ch. A - Prob. 15ECh. A - What is the net present value of the investment...Ch. A - Prob. 17PCh. A - Sensitivity Analysis in Capital Investment...Ch. A - Compute Net Present Value Dungan Corporation is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License